Bullish case for the US stocks

Stocks rise despite Powell's pushback and a poor 30-year auction

The equity markets continued to rise this week with S&P 500 and NASDAQ up 9/10 days and 10/11 days, respectively. The one-day losses that occurred on Thursday (Nov 9th) were due to a disastrous 30-year Treasury bond auction and “hawkish” Powell. However, the poor sentiment quickly reversed as the S&P 500 and NASDAQ finished 1.6% and 2.1% higher on Friday (Nov 10th).

Six observations from this week

S&P 500 Price Action

Friday’s manic rally sent the S&P 500 index above its 100-day moving average (blue line below), this was a key level from a technicals perspective, however, let’s see if this was just a false breakout or if the rally will extend.

Looking at last week’s stock performance heatmap, it is clear that 6 of the ‘Magnificent 7’ stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) contributed most of the gains, which is not healthy..

On Friday (Nov 10th), participation in the rally was broad-based, which is positive for the overall market.

Oil move

As fears of the Israel-Hamas conflict spreading continued to abate, Brent crude has erased all the gains seen since the geopolitical premium was priced out. The fall below the 200-day moving average is notable, and could also imply growing fears of a slowdown in the global economy.

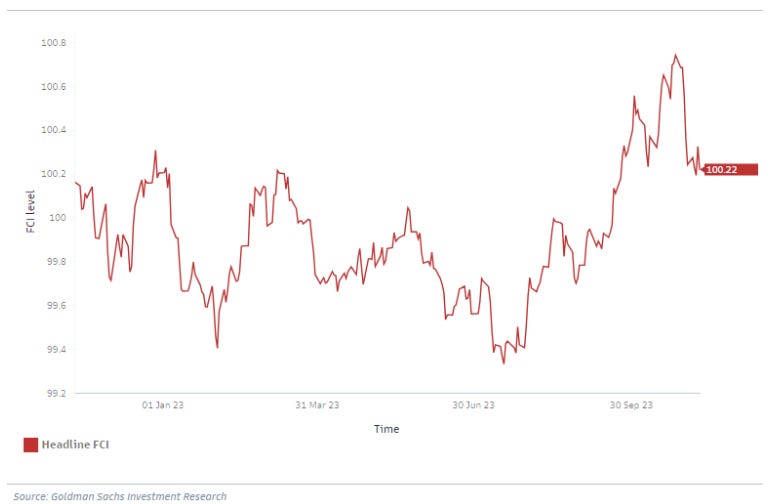

Powell hawkish again?

Powell in his opening remarks warned against getting too complacent and the Fed would hike again if data supported it. He echoed his comments from the FOMC presser on good news on growth and inflation but also warned of a possible head fake in the inflation trend. Most market participants expected a hawkish tone (compared to the FOMC presser) as the market has moved quickly to price rate cuts for next year, which the “Fed is not even thinking about.” The loosening of financial conditions due to a rally in equities and bonds also made the Fed uncomfortable.

30-Year bond auction

This was one of the main reasons why we saw stocks puke on Thursday. Regular readers will recollect that the market has been worried about the US fiscal situation due to a sharp rise in debt levels. So this auction gave fuel to the worries as there was far less demand from investors for $24bn in 30-year Treasury bonds than the market expected. The 30-year auction stopped at a high yield of 4.769%, 5.3bps above the indicated pre-sale level. Only one other 30-year auction in the last decade has had a tail (term implying weaker than expected) around these levels. In the aftermath, yields on 30-year notes jumped to 4.83% before reversing to close the week at 4.76%.

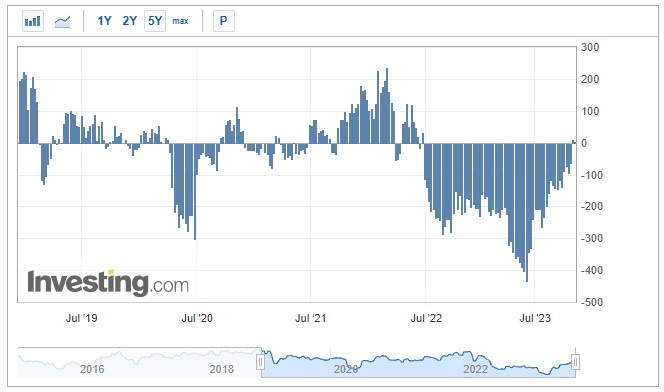

Recession probability hits highest levels after SLOOS report

The Fed’s senior loan officer opinion survey (SLOOS) can give you a glimpse into credit conditions each quarter – that is, how willing banks are to lend, and how keen businesses and households are to borrow. Strong credit creation typically fuels economic growth (and the reverse leads to a slowdown in growth). So the survey can give you an early look at the economy’s direction and sometimes a warning about potential pitfalls in its path.

The October report released last week showed that U.S. banking lending standards have tightened across the board to levels seen when recessions are imminent or already happening, said the DB Research report.

The chart shows that as almost 30% of banks tighten their standards on small firm C&I loans, the probability of a U.S. recession in the next 0 to 12 months jumps to almost 90%.

Full report along with charts can be accessed here.

US credit rating at risk again!

Late Friday, Moody’s lowered its outlook for the US credit rating from stable to negative. Note that Moody’s is the only rating agency that still has the US as AAA rated (Fitch and S&P previously stripped the US of AAA), so a cut to AA would not be surprising at this juncture.

Amid higher interest rates, without measures to reduce spending or boost revenue, fiscal deficits will likely “remain very large, significantly weakening debt affordability,” Moody’s said.

“Interest rates have shifted materially and structurally higher,” William Foster, a senior credit officer at Moody’s, said in an interview. “This is the new environment for rates. Our expectation is that these higher rates and deficits around 6% of GDP for the next several years, and possibly higher, means that debt affordability will continue to pressure the US.”

Can stocks continue to move higher for the rest of the year?

Although it feels like we have rallied quite a bit in the last 10 trading sessions and the market could take a breather, risk/reward from the below factors and seasonality (touched last week) are favorable in the near term. So, yes we could see another move higher.

Positioning

Positioning remains close to neutral, so we could see more investors chase the market especially if the price action continues.. and this could act as a strong tailwind until year-end.

Sentiment

Sentiment is seeing a shift among investors as most have been bearish since inflation was proven to be ‘non-transitory.’ See below from a JPM weekly survey.

Inflation reports

This week we saw the preliminary results of the University of Michigan survey:

Consumer sentiment fell again - 60.4 for November vs. median forecast 63.7, prior 63.8

1-year inflation expectations (preliminary) 4.4% for November vs. median forecast 4.0%, prior 4.2%

5-10-year inflation expectations (preliminary) 3.2% for November vs. GS 2.9%, median forecast 3.0%, prior 3.0%

The rise in 1-year inflation expectations is presumably driven by concern about the war in the Middle East (ie higher gas price expectations). However, it was impressive that the market ignored that. As pointed out by Vital Knowledge, the risk/reward into the CPI on Tuesday is very bullish even if we get an inline number.

See below for consensus expectations and previous numbers