Trending again: Goldilocks data

Best weekly gain for stocks since March 2020

The past week was a big one for financial markets as we saw broad markets reverse all the weakness in October. October was a weak month, with geopolitical tensions rising amid the turmoil in Middle East, strong US data and further rises in long-term borrowing costs.

In equities, the S&P 500 and NASDAQ indices rose by 5.8% and 6.6%, respectively over last week. For context, the last weekly gain that was bigger was in March 2020, driven by bazooka-like policy easing during the pandemic.

So what triggered the strong price action?

Positioning – Market was positioned too short and below events led to a strong reversal as short-sellers rushed to cover their positions.

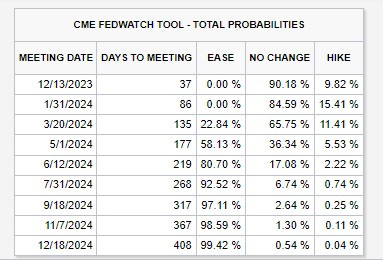

Peak in Fed Fund Rates – The FOMC on Nov 1st kept the rates steady as widely expected, however, they also gave a signal that the rate hiking cycle is mostly finished. A key part of the Fed’s message last week was that tighter financial conditions had provided a useful substitute for further rate hikes. Accordingly, the market is once again pricing the first rate cut by June 2024.

Quarterly Refunding Announcement

Ahead of the Fed, the main story driving markets was the Treasury refunding announcement, which triggered a major rally for Treasuries (yields down). That was because they only announced sales of $112bn of longer-term securities (vs. $114bn expected), and the increase in the issuance of 10yr and 30yr Treasuries was smaller than the increases in August. In a nutshell, less supply in longer tenors than market expectations. Given all the focus on rising fiscal deficit, this announcement was seen as a relief.

Goldilocks data supporting a soft-landing narrative:

US labor market weakness:

US continuing jobless claims had risen for a 6th consecutive week

Non-farm Payrolls report - The US economy added 150k jobs in October, less than the 180k consensus expected. Average hourly earnings advanced just 0.21%MoM in October, softer than the 0.3%MoM expected. Average hours worked fell to 34.3 from 34.4 meaning monthly aggregate earnings were flat – the weakest reading since February 2021.

JOLTS data report was an exception as it showed a tighter labor market than expected - job openings were up to a 4-month high of 9.553m (vs. 9.4m expected), which meant that the ratio of job openings per unemployed individuals was still above its pre-pandemic levels at 1.50.

United Auto Workers (UAW) news - Union strike resolution was also positive for risk assets, but added wage pressures which would make Fed’s job harder on bringing inflation down.

US ISM manufacturing release fell to 46.7 in October (vs. 49.0 expected), which ended a run of three consecutive gains, whilst the new orders subcomponent also fell to a 5-month low of 45.5 (vs. 49.8 expected).

Atlanta Fed’s GDPNow estimates growth rate of 1.2% for Q4 compared to 4.9% in 3Q of 2023.

Seasonality

The median return for S&P 500 during November is +1.50% going back to 1928. NASDAQ is higher in 10 out of the last 11 November's.

While above data seems positive in the near-term, we are not out of the woods and need to be cognizant of the below:

Geopolitical tensions – although they seem to be contained, any escalation or involvement of Iran in the current crisis would be a big negative.

Earnings – Third quarter earnings have been mixed-to-decent with 81% of the companies in the S&P 500 reported so far. Looking ahead, analysts expect (year-over-year) earnings growth of 3.9% for Q4 2023, which is below the estimate of 8.1% on September 30. For CY 2023, analysts predict (year-over-year) earnings growth of 0.6%, which is below the estimate of 0.8% on September 30. For CY 2024, analysts are calling for (year-over-year) earnings growth of 11.9%, which is below the estimate of 12.2% on September 30.

Financial conditions – The Fed held the rates steady since the tighter financial conditions are doing some of Fed’s work, however, a sharp rally in risk assets and treasuries as we saw last week led to looser financial conditions. Taking that into account, the Fed might walk back their dovish stance especially if inflation data picks up again.

Risks ahead:

This week is set to be a quieter macro week (no big data releases), so the focus will be on Fed Chair Powell’s panel discussion at IMF on Nov 9th (2PM EST)