A take on market direction from here

Dovish pivot speculation grows

It was another great week for risk assets as equities and credit rallied on the back of a soft- US CPI print which more or less implied that the Fed should be done with its hiking cycle and peak in US rates is likely in. The markets also digested an OK retail sales number and a bunch of negative economic data such as higher weekly jobless claims, weak industrial production, and a miss in the NAHB housing market index - all signs of a soft landing.

Stocks rally on soft landing hopes WSJ

Observations from this week:

CPI

The Core CPI (ex-gas and food) was not as strong as market participants expected it to be as the whisper number was close to 0.4% MoM and economists were expecting 0.3% MoM, but we got 0.23% MoM. This meant a huge surprise for the markets and risk assets behaved like kids in a candy store - 2yr Treasury yields were down by a massive —19.9bps on the day.

The slowdown in core CPI continued in October despite a bit less deflation in core goods. Shelter costs cooled as has long been anticipated 12-month change Core goods: +0.02% (vs, -0.03% in Sept) Housing: +6.7% (vs. 7.1%) Core services ex-housing: +3.8% (vs. 3.8%)

Zooming out and comparing the relationship between headline CPI and money supply (M2) with an 18-month lead is perhaps pointing to further disinflation coming down the line. Note that in the below case, the assumption is that there is an 18-month gap between the changes in M2 and the subsequent changes in CPI.

Commentary from Walmart on that front was also interesting: “In the US, we maybe managing through a period of deflation in the months to come”

Before we get too excited about lower prices, it might be a good time to read about the Dark side of Disinflation written earlier in the year.

Daly (voter next year) said the Fed should not proclaim 'mission accomplished' on inflation prematurely FT

Nick Timiraos- The first rule of “mission accomplished” is you do not say “mission accomplished.” But things are unquestionably looking a lot better than they were six months ago.

The global fight against inflation has turned a corner, opening the door for rate cuts next year WSJ

This Thanksgiving looks a lot more reasonably priced compared to recent ones WSJ

Jobless claims

Initial claims data released this week spiked up to their highest since August, at 231k (vs. 220k expected), whilst the continuing claims hit their highest since late-2021, at 1.865m (vs. 1.843m expected).

Although this data was seen as goldilocks as it is further evidence of a slowdown in the economy, we would need to see a stabilization in measures like the continuing jobless claims and the unemployment rate, as the former is now at its highest since late-2021, and the latter is now at its highest level since January 2022.

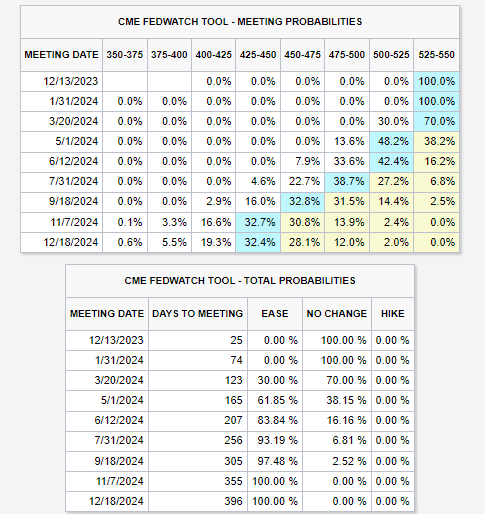

Fed Fund Futures pricing

Given the soft inflation print and the slowdown in growth, the market moved aggressively in pricing in cuts as early as May 2024 and expects the Fed to deliver 75bps worth of cuts by the end of 2024 bringing the policy rate to the 450-475bps range from 525-550bps range today. This could be a problem as the Fed might not meet the market’s expectation of such steep cuts by the end of 2024.

With respect to rate cuts, the Fed can’t afford to wait until inflation is all the way back at 2% or the labor market is showing signs of dramatic weakness — by then the economy would likely already be in recession, which the central bank wants to avoid. Policymakers will want to be somewhat proactive, so they would possibly pencil in rate cuts for next year if they expect growth to slow down, but how much is the million-dollar question?

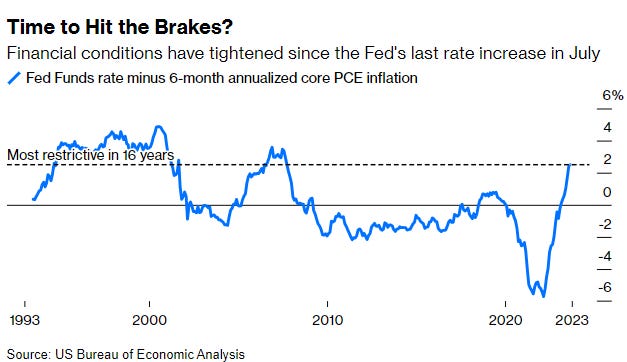

One way to look at it is “How restrictive is the Fed today” ie How high is the Fed Funds rate above the inflation rate? Powell noted that this rate aka real rate is at 2% which is “sufficiently restrictive.”

Using a six-month annualized measure of the Fed’s inflation gauge shows that monetary policy is more restrictive than it has been in 16 years and, importantly, has become tighter since July, even without further rate increases, because inflation has eased.

As price pressures continue to abate — the Fed projects more softening in 2024 — policy will get tighter and tighter if no rate cuts ensue. By lowering rates somewhat the Fed can match some of the decline in inflation while hopefully being just moderately restrictive rather than “significantly restrictive.” This is arguably what the Fed did in 2019 when it lowered rates by 75 basis points even though the economy was not in recession.

U.S. Retail Sales Fall for First Time Since March as Holiday Season Approaches WSJ

Oil production cuts

The slump in oil prices continued this week as investors digested further negative news from China and geopolitics premium continued to be priced out as the Middle East conflict is expected to remain contained. However, Brent crude prices were bid up ~4% after news that Saudi Arabia might prolong oil production cuts into next year and an additional Opec+ cut of up to 1mn b/d could be on the table in response to falling prices and rising anger over the Israel-Hamas war. FT

China: Home prices fell the most (-0.38% MoM) in eight years during October BBG Mainland China's attempt at replicating Hong Kong marred by half-empty towers and barely-used roadways RTRS

Geopolitics: Iran's supreme leader delivered a clear message to the head of Hamas when they met in Tehran in early November, according to three senior officials: You gave us no warning of your Oct. 7 attack on Israel and we will not enter the war on your behalf. RTRS

Russell 2000 Outperformance this week

Russell 2000 was the clear outperformer this week with a 6% gain vs. S&P 500 and NASDAQ - both up 2.5-2.6%. The outperformance can probably be explained as investors looked at these indices' YTD returns and realized that valuation could be an issue after NASDAQ’s 46% rise this year. Even the S&P 500 is up 18% compared to a 9.5% annualized historic return. Russell 2000 is only up 2.7% this year and is ~10% below the YTD highs, and 35% from all-time highs.

Where to from here for Stocks?

After moving higher in the past 3 weeks, can this grind continue into year-end? This seems tougher to answer every week, but just looking at some recent developments, the path to year-end is probably higher…

Seasonality- S&P has mostly followed the standard intra-year pattern, so if sustained there is incremental upside from here

Source: Friday SpeedRun

Buybacks - Post-earnings companies continue their buyback plans, which provide another strong bid until late December.

Shutdown risk averted again - The Senate has passed a stop-gap spending bill to keep the government funded and avert a shutdown at the end of the week. The two-step plan extends funding until January 19 for priorities including military construction, veterans affairs, transportation, housing and the Energy Department. The rest of the government — anything not covered by the first step — would be funded until February 2.

Inflation cooling - Inflation is falling faster than expected across advanced economies, marking a turning point in central banks’ two-year battle against surging prices. WSJ

US Growth is pretty good considering restrictive Fed policy and cooling inflation. The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 2.0 percent on November 17.

US Consumer is doing fine as we saw in the latest retail sales data despite pandemic savings running out and student loan payments restarting

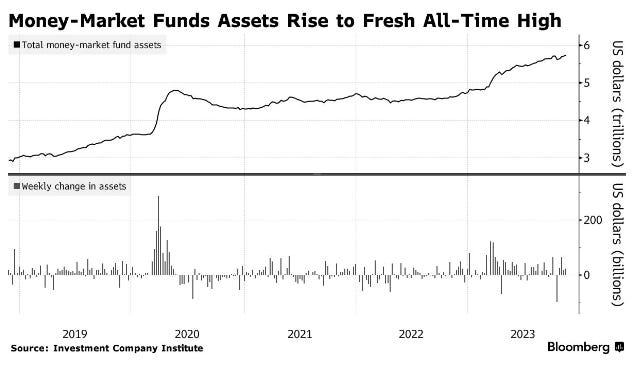

Investors sentiment is changing and the money parked in Treasuries or Money-Market Funds could find a home in risk assets.

Biden-Xi summit was a positive first step in normalizing relationship with China. NYT