Dark side of Disinflation

What’s happening

Over the last few weeks, the US equity markets rallied on the narrative of disinflation, which is intensifying, not only in the US but also in other developed markets. The news is undoubtedly positive (for now), and the Fed and other central banks would be breathing a sigh of relief as their monetary policy tightening actions are finally showing results. However, last week with the earnings of Tesla disappointing, we got a taste of the dark side of disinflation.

By the numbers

Inflation Data

The below charts from UBS show the intensity of disinflation since 3Q of last year in major Developed Markets (DM). The economists at UBS also expect that this trend will continue into 2024.

However, if we look at Fed’s preferred gauge, Personal Consumption Expenditure (PCE) Price Index, we see that more work needs to be done on the persistent “Core service ex-housing” category. So far, we have not seen a major dent as the category is still growing consistently at over 5.5% y/y.

US Treasury Market Performance

The treasury market rally, driven by a decrease in bond yields since the July 6th CPI print, which indicated a two-year low in inflation, experienced a pause this week. The temporary halt came as initial jobless claims (as shown in the second graph below) dropped back below 230k during the week of the July payrolls survey. This notably low number served as a reminder to investors that the labor market remains tight. Consequently, concerns about potential hawkish risks at the upcoming Fed meeting resurfaced.

Equity Market Performance

The below chart shows that since early June, Russell 2000 and S&P 500 joined the Nasdaq index in reaching new YTD highs. These indices benefited from the disinflationary narrative, which combined with stable to up-ticking economic data has led to increased confidence in the soft landing scenarios for the US economy.

Meanwhile, Nasdaq has benefitted primarily from the AI frenzy, and the disinflationary intensification is arguably positive for the “tech proxy“ Nasdaq index given the longer duration of the index.

However, the price action in major indices took a breather after disappointing earnings reported primarily from tech giants.

Why and how will disinflation be negative for companies?

Last week, Tesla reported declining auto gross margins in the second quarter as the “automaker” decreased the prices of its cars to compete with its rivals. TSLA reported margins of 18.2%, below analyst expectations of 18.8%. Tesla's operating margin also fell below 10% to 9.6%, which is nearly 5% — 493 basis points, to be precise — below what it was a year ago. Arguably, the stock gained more than 130% in 2023, so a 10% hit to its stock price post-earnings is not a big deal.

However, the reason for price cuts is not only intensifying competition in the Electric Vehicles (EV) space but also due to input costs going down and supply chain bottlenecks easing. Ford announced that it will cut prices of its popular F-150 lighting pickups by $10,000, just after cutting prices of its Mach-E, a couple of months ago. According to Reuters, Ford's price drops come after the company was able to "cut prices following improvements in scale and battery raw material costs."

Appliance maker Electrolux’s stock price tracked its worst day since 2011 after Europe's biggest home appliances maker swung to a loss in the second quarter as cash-strapped shoppers opted for cheaper products and demand from residential property builders slowed. The company mentioned that promotional activity was high during the last quarter due to lower consumer demand. The company noted that lower prices contributed somewhat positively to earnings, but it expects prices to be lower in 3Q.

The consumer demand weakness was also highlighted by the Swiss owner of Cartier, Richement. The luxury goods maker drove the sector lower amid concerns that demand in the US and China, two of the biggest markets for the industry, is starting to sputter. Last week, Burberry Group Plc said the low end of the luxury market in the US softened. China is a major market for luxury brands, and the economic data reported last week was underwhelming (retail sales, Q2 GDP). Equity markets have been struggling in that part of the world since the authorities have not taken any dramatic action on stimulus measures.

Amex also reported the weakest spending growth on its credit cards since the first quarter of 2021 in its latest earnings report on Friday. The CFO noted a tough comparison to recent quarters as travel (airlines or hotel stays) and entertainment spending came down, while consumers are spending more on dining.

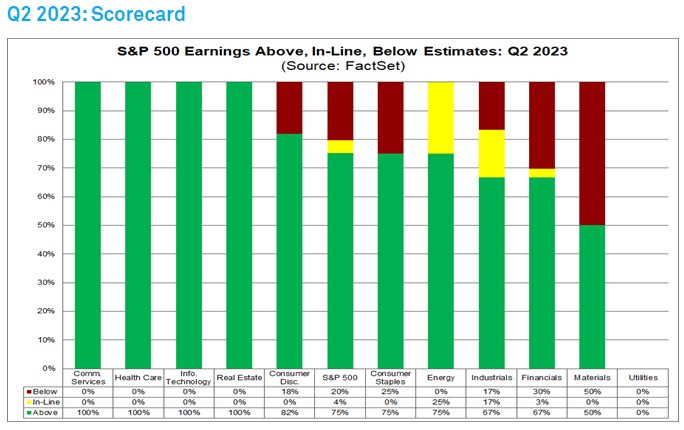

Earnings so far

According to Factset, overall, 18% of the companies in the S&P 500 have reported actual results for Q2 2023 to date. Of these companies, 75% have reported actual EPS above estimates, which is below the 5-year average of 77% but above the 10-year average of 73%. In aggregate, companies are reporting earnings that are 6.4% above estimates, which is below the 5-year average of 8.4% but equal to the 10-year average of 6.4%.

Bottom-line

Overall, the market narrative of disinflation with a combination of decent economic data is driving the price action. However, as noted above the disinflationary forces if it intensifies further could be a major headwind for corporates especially in this high interest rate environment. The Fed is expected to raise rates by 25bps next week, however, if Chair Powell’s presser leans hawkish it would not be positive for risk assets. Given the tightness in labor markets and minimal progress on Core PCE ex-housing, the chances of a hawkish outcome are non-zero. Apart from the FOMC, going into next week, we have 40% of the S&P reporting earnings, along with the ECB, and BOJ. Any major surprises on the earnings front or central banks could lead to renewed volatility.