Will the rally in stocks continue?

The big news this week was the CPI, which met expectations and suggests dovish implications for Fed policy. April's core CPI rose +0.3% M/M and +3.6% Y/Y, decelerating by 20bp from March. Headline CPI was slightly softer at +0.3% M/M and +3.4% Y/Y, with shelter and gasoline contributing over 70% of the increase.

The good news is that oil and gasoline prices are already falling, so we should see an improvement in the headline CPI numbers next month.

Investors are striking gold in most every market - WSJ

From Tokyo to New York, Stock Markets Are on a Record-Hitting Spree Around the World - BBG

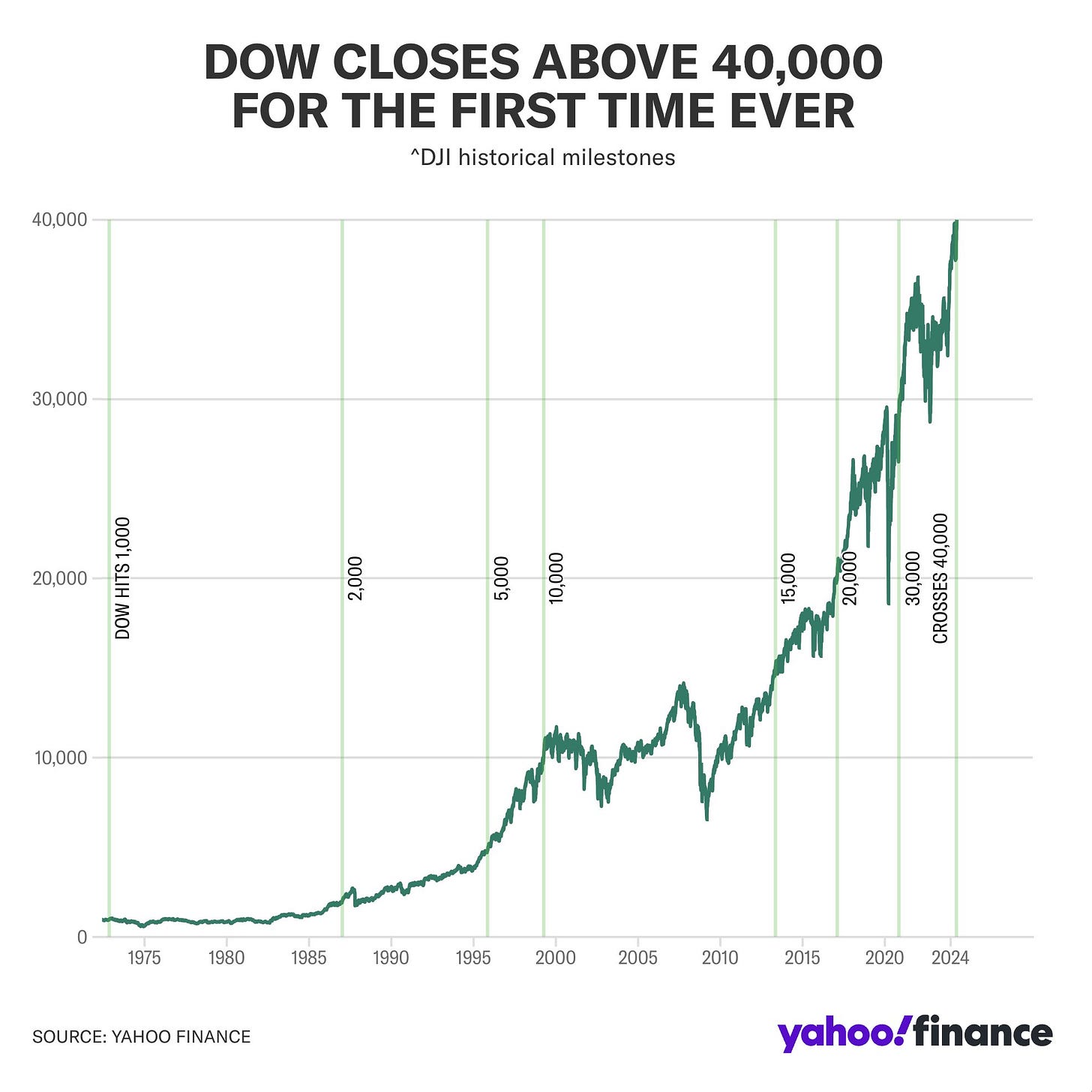

After hitting a low of 4,963pts on April 19th, the S&P 500 has rallied to ~5,300pts - a whopping 6.7% gain in less than a month. It’s not only stocks but everything is going up - gold, bitcoin, a, junk bonds, etc. Now the question is whether this rally will continue to extend or could a nice round number - DOW 40k - on a useless index and the above articles from WSJ/BBG be something of a contrarian sentiment cue?

To answer that question, let’s revisit the reasons for this rally and explore the catalysts that could extend it.

Why are stocks going up?

The slump in April, due to higher rates and geopolitical tensions, led to extremely negative sentiment and fear, which typically follows a period of improved sentiment as investors step in to buy risk assets at favorable levels.

Favorable data on inflation and the last US jobs report sent Treasury yields sharply lower, boosting stocks as lower rates are good for valuations.

The market was focused on the disinflation stalling narrative, so hints of resumed disinflation led to some fears abating.

On the back of #2 and #3, the Fed officials have been dovish, setting a high bar for resuming rate hikes. The market reflects this, with the odds of a rate cut in September at 84%, compared to 46% on April 17th.

Reduced geopolitical tensions with Iran/Israel stepping back, while the Israel/Gaza situation remains unchanged but has been digested by the market for months.

Q1 earnings were decent, with growth moderating but companies still meeting EPS expectations and increasing shareholder returns through aggressive buybacks.

AI events/announcements (Open AI, Google I/O) have been seen favorably so far.

What could halt this rally? or is this unstoppable for now?

Recently, some top voices in the investment world have signaled caution.

Besides Druckenmiller, 13F filings showed David Tepper slashed his holdings in Amazon, Microsoft, and Meta Platforms. David Bonderman's Wildcat Capital Management sold Meta stock, bringing his position to $23.7 million. Michael Platt's BlueCrest Capital Management dumped Nvidia and Amazon.

It wasn't just high-profile fund managers selling tech stocks. Insiders were, too...

So far, the economy and the markets have been painting a 'Goldilocks' picture with growth moderating and the disinflation phase resuming. So why are these guys so worried?