Weekly Market Recap (Mar 1st)

Diamond hands are back?

The rally in risk assets continued on the first day of March with the S&P 500 and Nasdaq indices making fresh all-time-highs. The S&P 500 index closed at 5,137pts, slightly above the 5,100pts median forecast of 40 strategists polled by Reuters in mid-Feb. Now that doesn’t mean that the markets can’t go any higher –the optimism over AI, goldilocks economic data, and anticipated easing by the Central Banks are some of the reasons why this rally can keep going on. And in response, we will see strategists raise their year-end targets to account for the fresh optimism.

In terms of catalysts for the market to pullback, a softer jobs print or pricing out of the remaining 90bps of Fed Funding cuts on the back of inflation reaccelerating could do the job, so the next few weeks will be important to see which way the market is going to head.

US Labor Market – signs of softening?

The US jobs data for February will be released on Feb 8th, and consensus expectations are for the economy to show an additional 200k in jobs compared to 353k in January. However, the continuing jobless claims 4-week average is hovering around 1.9m – the highest since 2022, so could this be an early indicator of the softening in labor market?

Will the Fed cut in 2024 as expected?

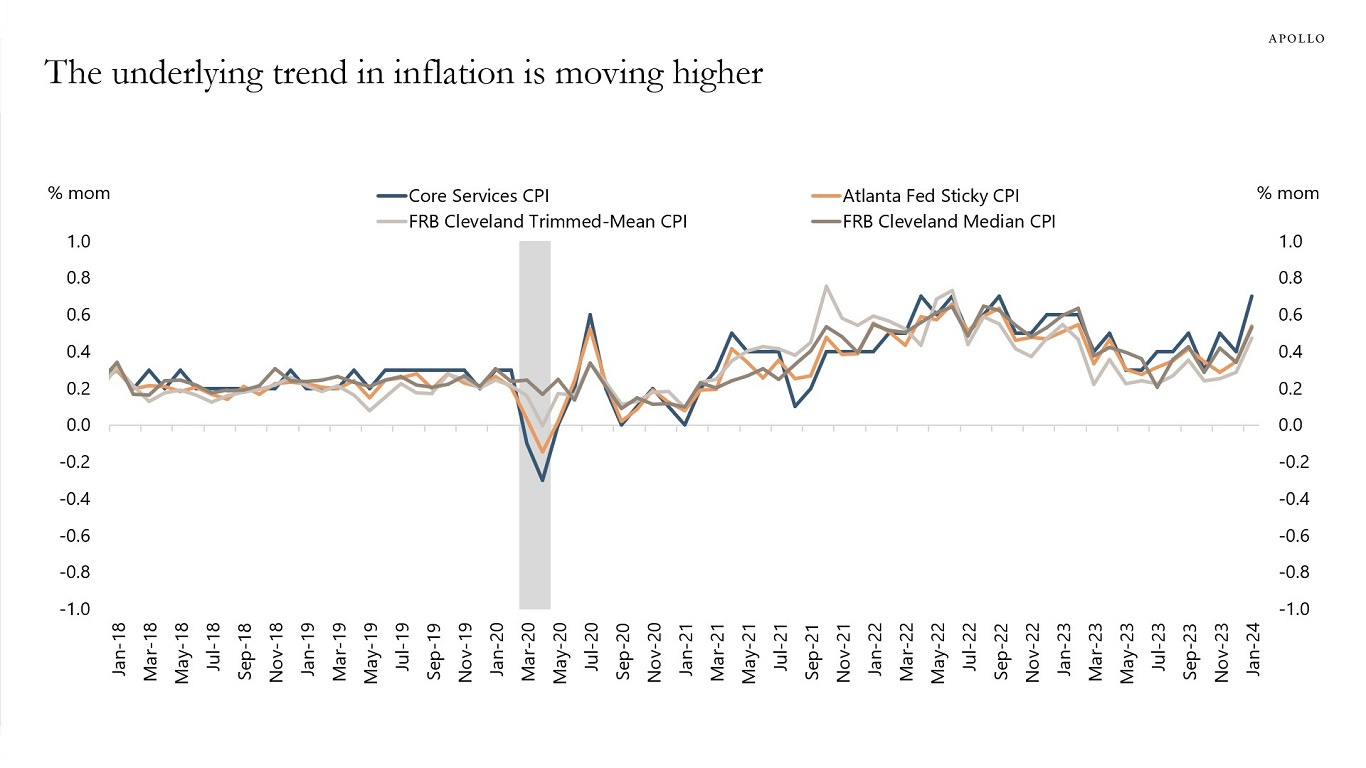

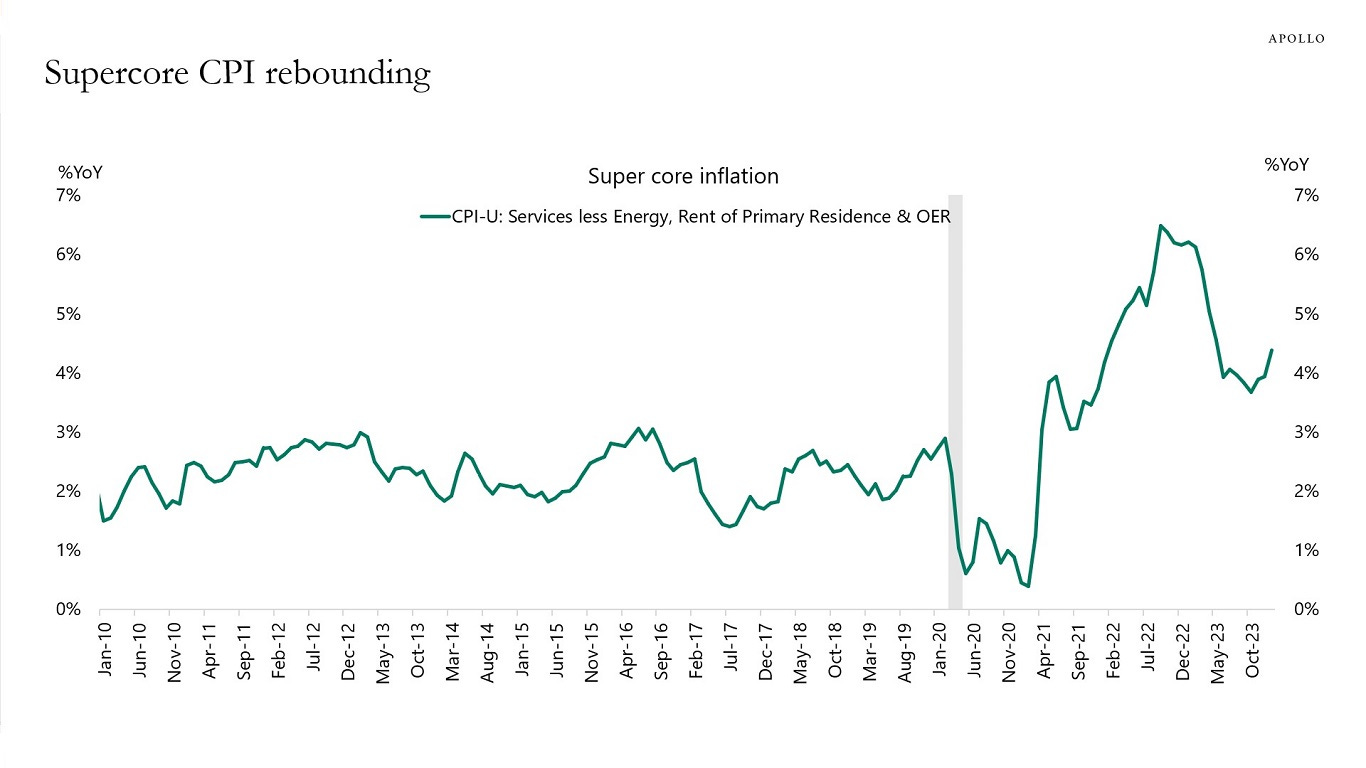

Renewed economist, Torsten Slok’s latest note to clients indicated that the Fed will spend 2024 fighting inflation, which will prevent the Federal Reserve from cutting rates. His argument is based on two factors:

Fed’s December pivot towards easier monetary policy in December 2023 has given an additional tailwind to the economy, financial/capital markets, and financial conditions. “All that is likely to continue to be supporting growth in consumer spending, in capex spending, in hiring for most likely the better part of this year.” Sloak said.

The market has declared victory over inflation, whereas it appears that inflation is becoming a problem again. Slok’s comments come after the Thursday release of the Fed’s preferred inflation metric, the core personal consumption expenditures price index, showed an increase of 0.4% in January, the fastest pace in nearly a year.

On the back of the PCE release, multiple Fed officials encouraged observers to ignore January inflation data as “noise.” However, the data for February to be released in the coming weeks will tell us whether the recent data was flattered by seasonals or if there was a real signal there. Moreover, a continued rally in risk assets should push upward pressure on inflation, causing rate cuts to be priced out.

Everything Rally - are Diamond hands back?

This week we saw both S&P 500 and NASDAQ reach fresh highs along with gold. Meanwhile, Bitcoin is $7k off its all-time high of $69k.

This feels similar to 2021 for a couple of reasons:

Bitcoin’s rise above $60k on “scarcity” while meme coins ( Dogecoin, Shiba Inu, and Pepe) rally in sympathy.

Demand for call options is surging. Appetite among retail traders for bullish call options is near early-2022 levels, per JPMorgan Chase & Co. citing data on flows from options customers with fewer than 10 contracts. Just head over to Reddit wallstreetbets to see all the action. Although we haven’t reached GME insanity, the performance of stocks on the back of call options can’t be ignored.

Retail favorite stonks like Carvana and Beyond Meat rose 76% and 61%, respectively in February - burning short sellers along the way.

As per Bloomberg, last July, when similar risk-taking behavior emerged among day traders, the S&P 500 peaked later in the month before falling into a 10% correction.

Gold Shinning Again?

Gold aka “boomer bitcoin" has been lagging behind other macro asset classes since it made its last high of $2075/oz in 2020. It closed at $2,083/oz on Friday, so let’s see if this rally will continue.

Overall, while markets are celebrating near-term recession risks receding, the risk that central banks will have to hold rates higher for longer, or potentially even deliver further hikes, may be rising.

Next Week’s Events

March 4/5th - China Government Summit

March 5th - US ISM Services

March 6th - US ADP Employment, Bank of Canada decision

March 7th - ECB Interest Rate Decision; US jobless claims; Powell testimony to Congress

March 8th - US Nonfarm payrolls (jobs report)