USA, baby!

"Never bet against America” - Warren Buffett

Positioning continued to drive the price action this week. It seems like the market was too one-sided (by one-sided, I mean most investors crowding or following the same trade) since the SVB collapse, and we are continuing to see the moves reverse post SVB. Overall, I think there was a bet against the US economy, which has not played out (yet). The combination of strong spending, a robust US jobs market, diminishing bank concerns, along with persistent inflation, has led to investors fading the "recession" narrative.

Debt Ceiling Update

No deal has been reached yet, but it looks like lawmakers are continuing to make progress to avoid a default. The good news is that we now have until June 5th, as Treasury Secretary Yellen estimates that the U.S. could be unable to pay all of its bills on time if Congress has not raised the debt ceiling by that date.

Republicans and Democrats are circling a deal that would raise the debt limit for two years, while also setting caps on some federal spending. However, President Biden and House Speaker Kevin McCarthy (R., Calif.) have not completed the agreement, which could take several days to wind its way through Congress.

Good article on implications of not raising the debt ceiling on time - What happens if the debt ceiling is not raised? (WSJ)

Short USD and Long US Treasuries

The banking crisis, fears of a recession, and expectations of the Fed easing led to investors betting against the greenback since March 10th. This led the USD to weaken against most major currencies. However, with recent data coming in better than expected, regional bank situations stabilizing, and hawkish Fed remarks, the USD has started strengthening.

Furthermore, the reopening theme in China and better-than-expected growth in Europe also led to investors betting against the greenback. However, this trend has reversed more recently, as it seems like China's reopening growth has faded quickly and growth in Europe is slowing down faster than expected (Germany is in a technical recession).

USD Index

The next big test for the USD index will be surpassing 104.6, which was the level right before the SVB collapse.

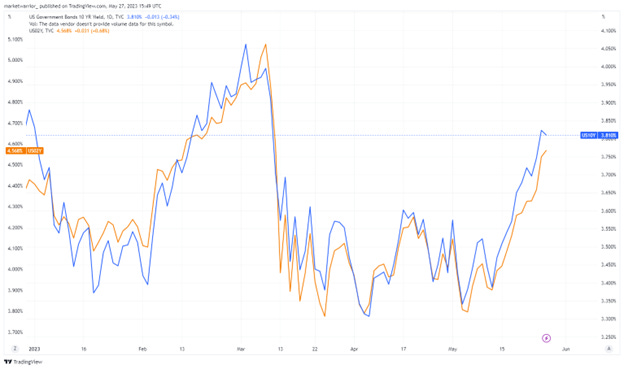

US 2Y and 10Y Treasuries

The 2Y Treasury yields had fallen significantly post SVB as the market expected the Fed to be done with their rate hikes and start cutting rates to support the economy. Fears of contagion were high at the time, as US regional bank stocks kept selling off and deposit outflows were severe.

The longer-dated 10Y Treasury yields fell as it was expected that growth would slow down significantly, potentially leading to a recession and declining inflation.

However, since then, we have seen in the most recent economic data that growth continues to be resilient, thanks to the US consumer, and core inflation remains sticky. Additionally, the weekly jobless claims data has been revised, following Massachusetts fraud clean-up, and it appears that the job market still remains robust.

Data this week

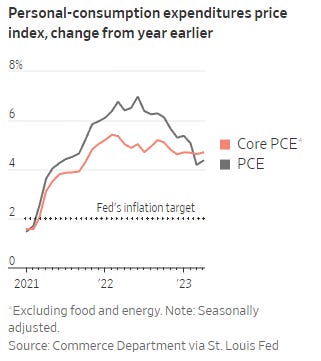

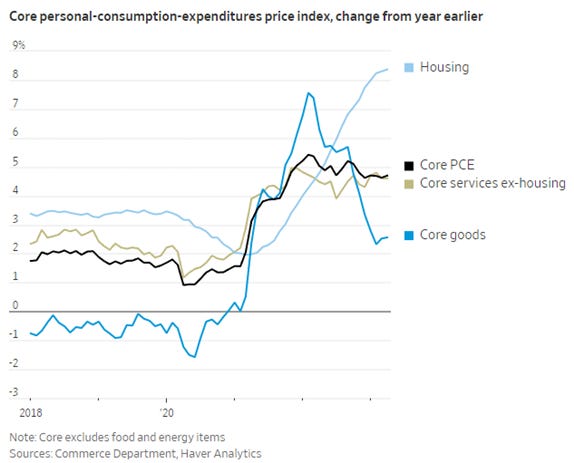

The US Core Personal Consumption Expenditure (PCE) showed that core inflation is not slowing but rather remains near 5%, which is not good news for the Fed, as their preferred indicator is far off from the target of 2%.

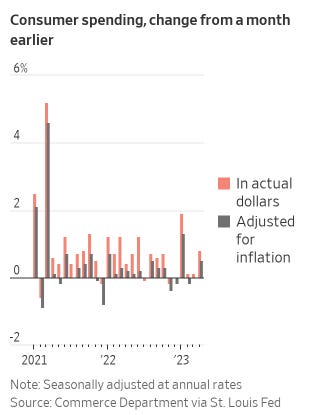

Personal spending accelerated a whopping 0.8% MoM in April, up from a slightly revised 0.1% prior. Even real personal spending (adjusted for inflation) firmed by 0.5% over the month after being flat before.

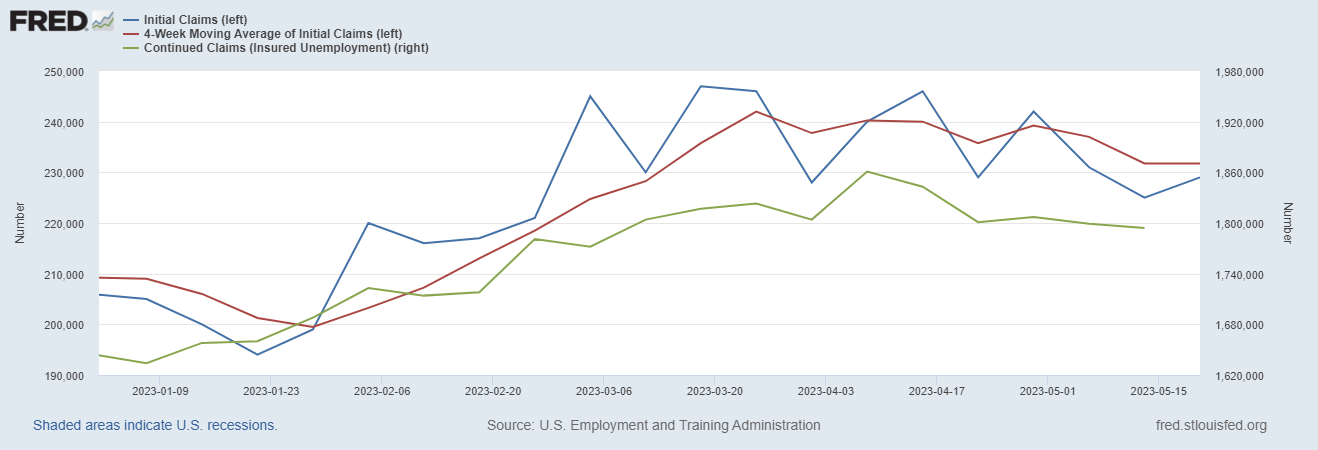

The rise in initial jobless claims above 240k now looks almost entirely due to fraud in Massachusetts. Continuing jobless claims have plateaued but at relatively low levels.

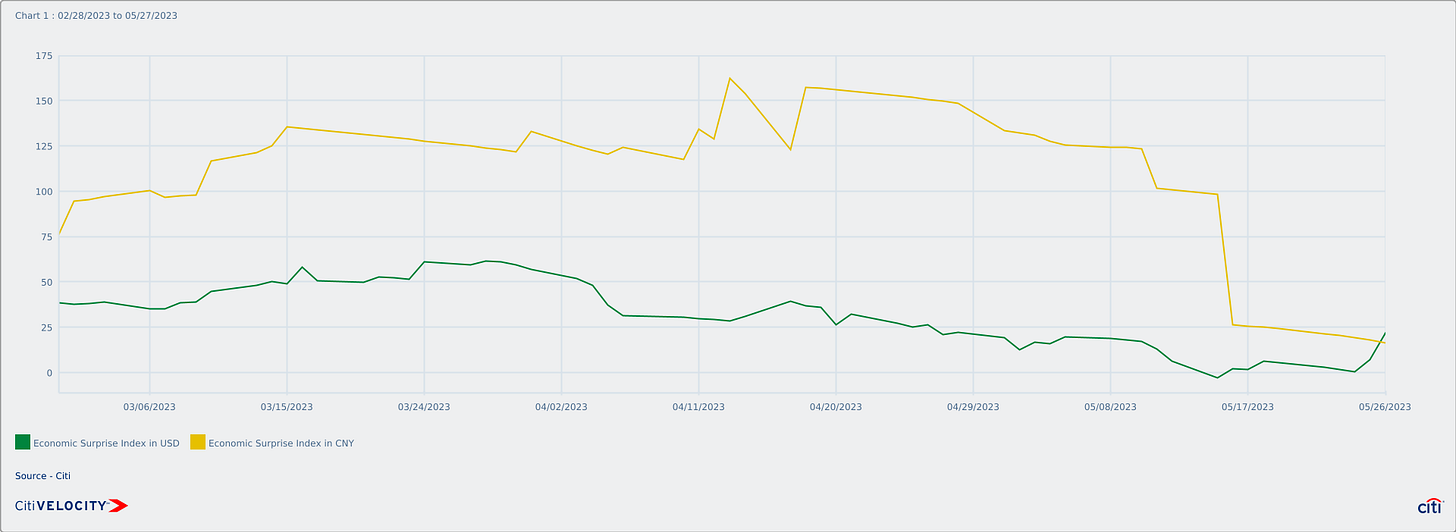

Citi US Economic Surprise Index

The Citi Economic Surprise Index measures how economic data compares to what experts predicted. It looks at important economic information like employment and growth. If the data is better than expected, the index goes up. If it's worse, the index goes down. A positive index means things are generally going well, while a negative index suggests problems. As we can see from the below graph that data in May for the US (green line) started improving after seeing a slump in April. Although, a single month is not enough to forecast a trend, but trend starts with a single month. On the other hand, the yellow line represents Chinese data, which as you can see has fallen pretty significantly.

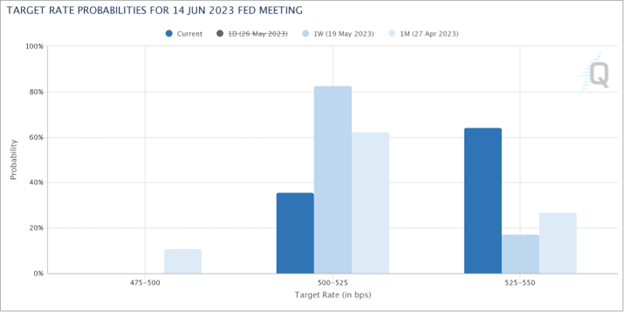

Fed hike probabilities

Current Fed target range is 500-525bps, as you can see from the below graph, the probability of Fed raising the target rate range has increased to 64.2% compared to 17.3% last week.

Long Gold

Long gold was another popular trade since the SVB collapse as fears of recession, a weaker USD, and declining treasury yields had all supported the moved. However, with all of the above reversing, gold has also lost some of its shine!

Equities

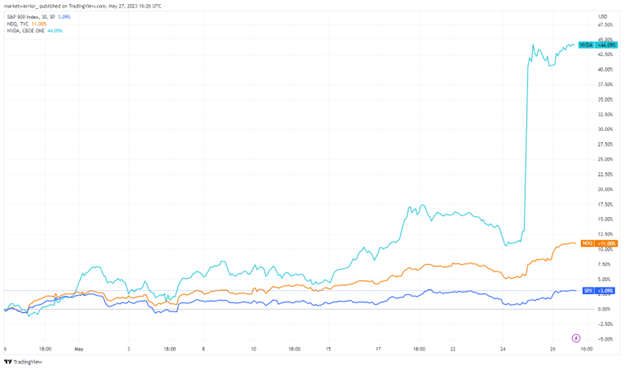

In equities, the melt up continued in the last week as it seems like the ‘AI narrative’ is fueling new life into stonks. Further, the optimism around the debt ceiling talks is also boosting sentiment, which a few weeks back, equity markets didn’t even care about. Although, inflation remains a concern for the Fed, and the hawkish tone from the officials is being priced into the Treasury and Fed Fund Futures market, equities are probably paying more attention to the ‘cautious tone’ from Fed speakers who are arguing for a pause. However, Fed officials have suggested they are now practicing “extreme” data dependence and “maximum” optionality. Fed forecasts from March envisioned headwinds from tighter bank credit, lagged effects of rate hikes and fading fiscal policy slowing the economy and cooling inflation. That has not happened.

I want to continue to highlight that a small number of big stocks are driving the major indices higher. See below for the overall index performance and a heatmap for the same period which shows individual stock performance.

1 Month Equities Performance Heatmap

Next Week

Monday is a holiday, so it will be a short week for US markets

Debt ceiling

JOLTS Job Openings data on Wednesday

ADP, Jobless claims, ISM Manufacturing and Construction Spending on Thursday

Jobs (Non Farm Payrolls) report on Friday

Interesting Articles of the week

Solar power due to overtake oil production investment for first time -IEA

America’s Math Coach Is Teaching Fifth-Graders to Outsmart AI

A Paralyzed Man Can Walk Naturally Again With Brain and Spine Implants