Thoughts ahead of the FOMC

Is the Fed done?

Given the action-packed week, I decided to do one more piece before the FOMC decision tomorrow. Things feel slightly different compared to Sunday when my last post came out. Since then, we have received two major economic data reports. The Fed will use the data from these reports to decide on the policy.

I realize that some readers might not be familiar with FOMC policy meetings, so I made a FAQ section with the help of ChatGPT to get you up to speed.

How I am looking at tomorrow’s event

The market is pricing an 87% probability of a 25bp hike to bring rates range to 5.00-5.25%, so the Fed is widely expected to go through with it unless they know something which we don’t

A more critical question is if they will opt to signal a pause or preserve the option for further rate hikes. The wording of the forward guidance in the statement will tell us more about it. The WSJ article What a Fed Debate 17 Years Ago Reveals About Its Rate Deliberations Now led me to research how the Fed tweaked its language in the policy statement as it made its final increase in that series in June 2006.

i. May 2006: The Committee judges that some further policy firming may yet be needed to address inflation risks but emphasizes that the extent and timing of any such firming will depend importantly on the evolution of the economic outlook as implied by incoming information. In any event, the Committee will respond to changes in economic prospects as needed to support the attainment of its objectives.

ii. June 2006: The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information. In any event, the Committee will respond to changes in economic prospects as needed to support the attainment of its objectives.

iii. August 2006: Nonetheless, the Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

The key guidance in the FOMC statement now reads:

The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

Based on the above, I will carefully examine the bolded statement to see if and how it is tweaked.

Will Powell push back on rate cuts priced into the markets?

I’ll wait to see if he re-emphasizes the possibility of further increases and the Committee’s commitment to keep rates restrictive for some time.

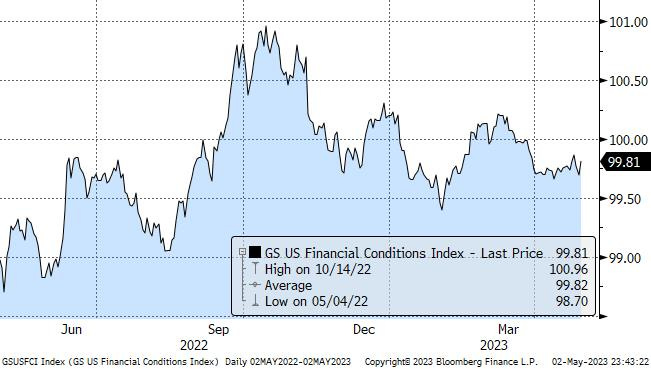

Credit conditions

The FOMC will have the Senior Loan Officer Opinion Survey (SLOOS) data, and Powell will likely provide a preview of it during the presser. He might make a reference to the severity of tightening of credit conditions from the regional banking crisis which started in March, but the committee would likely want to see some confirming evidence of an impact on economic activity in the data before sending a stronger signal that they are on hold. Note that as per DB, a one standard deviation tightening of C&I bank lending conditions was approximately equal to two to three 25bp rate hikes after accounting for spillovers to broader financial conditions. FWIW, based on the weekly Fed reports, there is no sign of a sharp drying up of credit in aggregate bank data for the week of April 19th. Even deposits are stable at small and large banks.

Regional banking crisis/stress

The presser will probably start with a statement giving us assurance on the US banking system’s resiliency, despite KRE (regional banking ETF) falling 6% today and FRC failing over the weekend.

Labor market

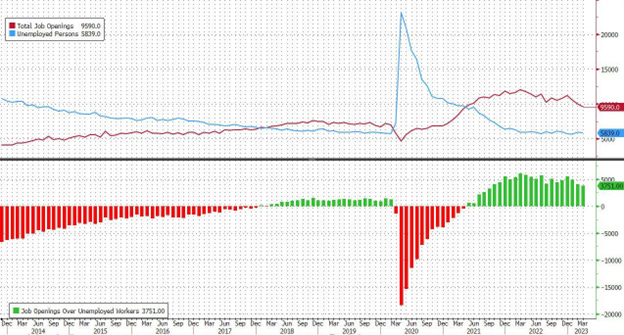

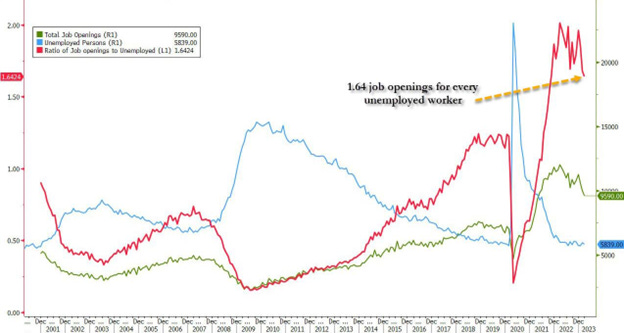

Powell will probably refer to today’s JOLTS report and how the labor market is less tight today compared to last year. Powell’s pet metric shows that there are 1.64 job openings for every unemployed worker, down from 1.67 last month and over 2 at the record high in March 2022. Needless to say, this number still has ways to drop to revert to its pre-covid levels around 1.20, but the trend is now clearly lower.

Inflation

Given that the latest March core PCE release showed a three-month annualized growth rate of 4.9%, the Committee is highly likely to continue to characterize inflation as "elevated". Nonshelter core services inflation (which is more closely tied to wage growth) has remained elevated as well. But he might also point that ECI wage data showed a modest acceleration in Q1, but with the job market softening, we expect this to come down.

My view

Overall, I see a high probability of the Fed indicating a pause, but I wouldn’t be completely surprised to see a hawkish scenario playing out given the inflationary pressures and “stability” after FRC was resolved in a pretty efficient manner. Note that several key data releases before the June FOMC meeting would give the Fed some color on how to proceed – including two employment and CPI reports as well as high-frequency data on consumer spending and banking/credit conditions.