Navigating the Surge in US Treasury Yields: Causes and Consequences

Long term interest rates are on the move

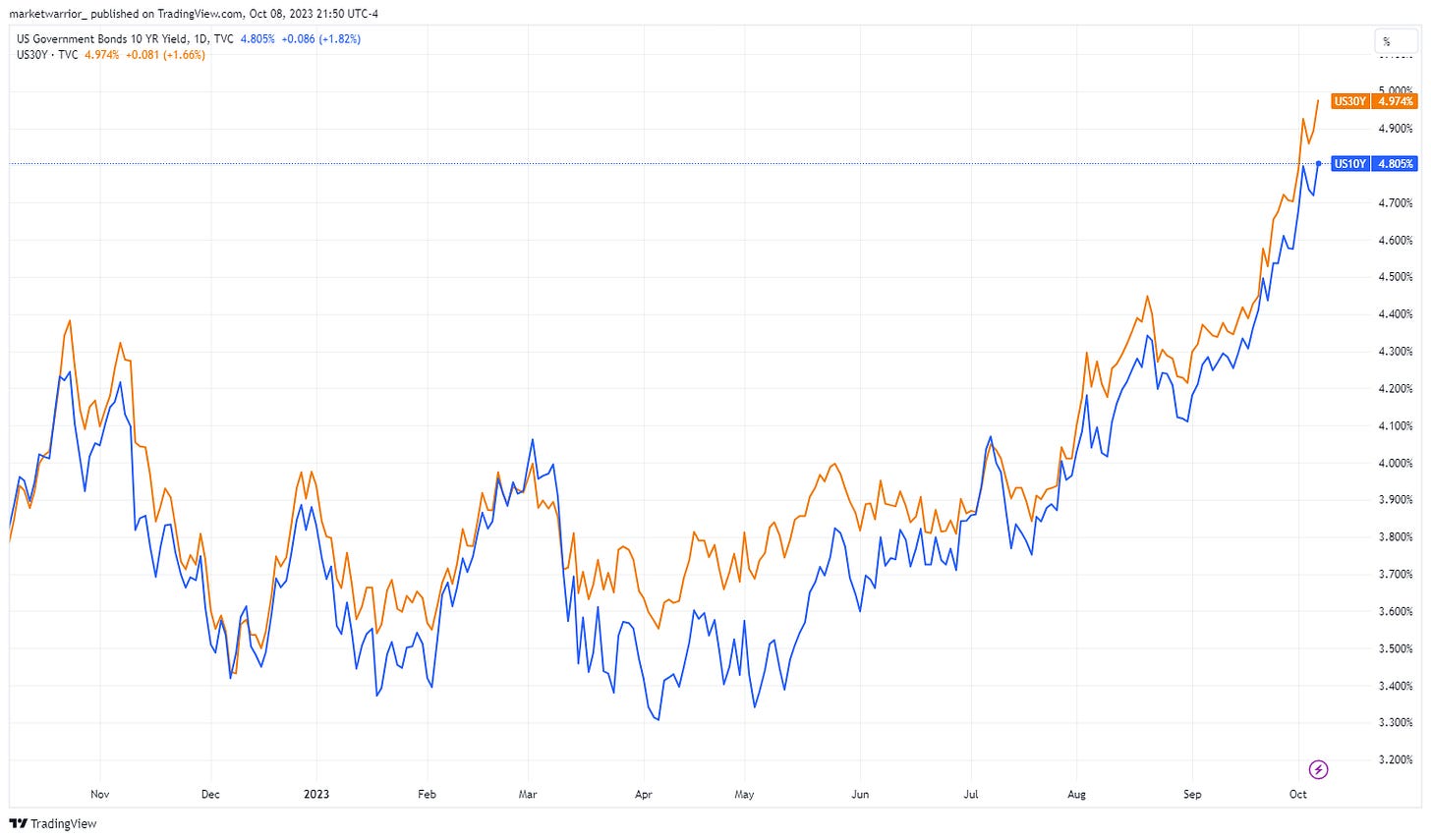

The 10Y and 30Y US Treasuries yields have moved higher by 150bps and 139bps respectively in the last six months. Since March 2023, the Federal Reserve has raised the overnight Fed Fund rates by 75bps to the 5.25-5.50% range, mainly impacting the short-term funding markets. The move in 10Y and 30Y Treasuries implies that borrowing costs have risen not only in the short-term funding markets but also in long-term funding markets.

Why are the 10Y and 30Y Treasury yields going higher?

We covered this topic in our last post, but in summary:

Supply/Demand Imbalance - The Treasury Department has to refinance existing debt, and its biggest customer, the Fed, is no longer buying these bonds with Quantitative Tightening going on in the background.

Resiliency of the US Economy - The initial stage of the move was driven by the repricing of Economic growth. In March 2023, the US banking sector experienced a regional bank crisis after SVB and a few other banking institutions failed. There was an expectation that the regional banking crisis would spread and there would be a sharp slowdown in economic activity prompting a decline in bond yields (lower growth = lower bond yields). Clearly, that has not happened and the US economy has proven to be more resilient and a soft landing has become a consensus expectation. Recent economic data has fueled this narrative with the Non-farm payrolls surprising to the upside.

Potential US Credit Rating Downgrade due to government shutdown fears/dysfunction in the Congress

Rise in Oil Prices - up 23% since March 2023

Investor positioning - Investors expecting a fall in yields are possibly closing out their money-losing positions adding more pressure to the upside

What are the implications of these higher rates?

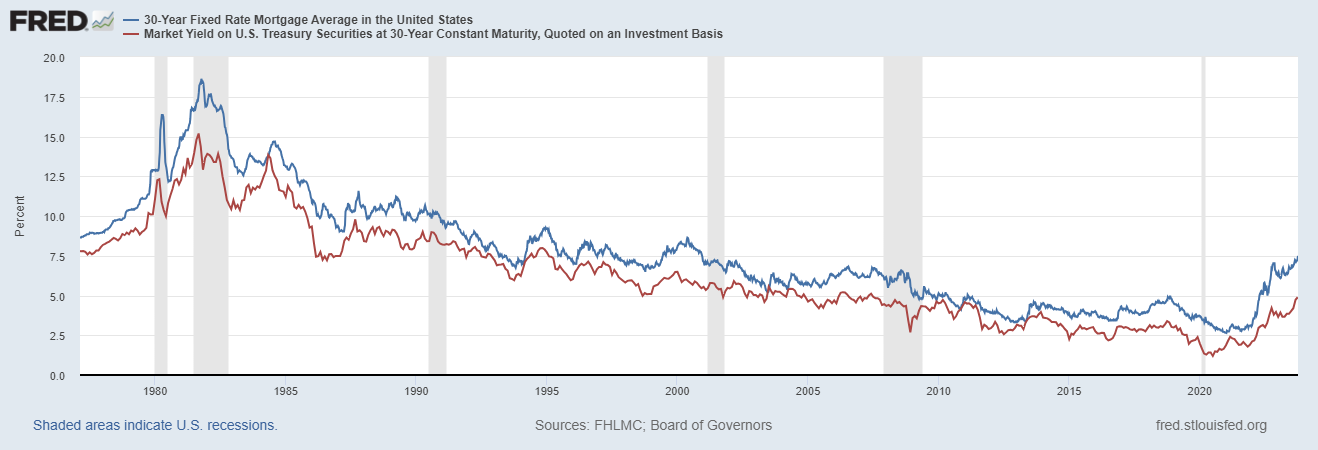

Higher mortgage rates - as we can see over the long term, the 30Y mortgage rates track the 30Y Treasury yields pretty closely, so the affordability of home buyers is impacted.

Higher funding costs for corporates, munis, and governments - Similar to consumers, all entities relying on debt to finance also face higher funding costs. Yields at these levels on a sustained basis increase the nominal cost of capital for even the safest borrowers. The cost of capital will be well above nominal income and earnings growth. That is not sustainable for an extended period. Further, higher funding costs for corporates could lead to bankruptcies and restructuring of debt.

Headwinds to growth - Typically funding rates above the growth rates of an economy can lead to a slowdown or even a recession. So far, the US economy for Q3 is tracking 3.7% GDP growth, however, growth would slow down meaningfully which would lead to labor market cooling (job losses).

Unknown unknowns - The world financial system is in many ways based on Treasuries, which is a USD 33 trillion market, and they play a critical role as the main collateral for many leveraged positions of various market participants. Rising yields, and thus falling Treasury values, can quickly lead to problems for these collateralized borrowers. This was essentially the root cause of the bank stress in March that brought down Silicon Valley Bank. Such hidden risks are often hard to identify in advance, even if they seem obvious in hindsight.

Impact on stock markets - The recent 8% decline in the S&P 500 can be attributed to rising interest rates, driven partly by concerns over inflation and the Federal Reserve's actions. However, the outlook for stocks may improve as rates stabilize, and corporate profits are expected to rebound due to factors like pent-up demand and ongoing investments in various sectors. On the other hand, geopolitical tensions (as seen this weekend), concerns on the growth front, or a more restrictive Fed might result in further pressure on stocks.