Markets react to developing Middle East conflict

Markets will spend a fair amount of time in the early part of this week trying to understand the implications of the most serious cross-border attack on Israel in decades early on Saturday morning. It's a reminder that geopolitical risk is elevated at the moment with the Ukraine conflict, the US/China tensions, and now those resurfacing in the Middle East. How Saudi Arabia, Iran, and the US get drawn into this will be key.

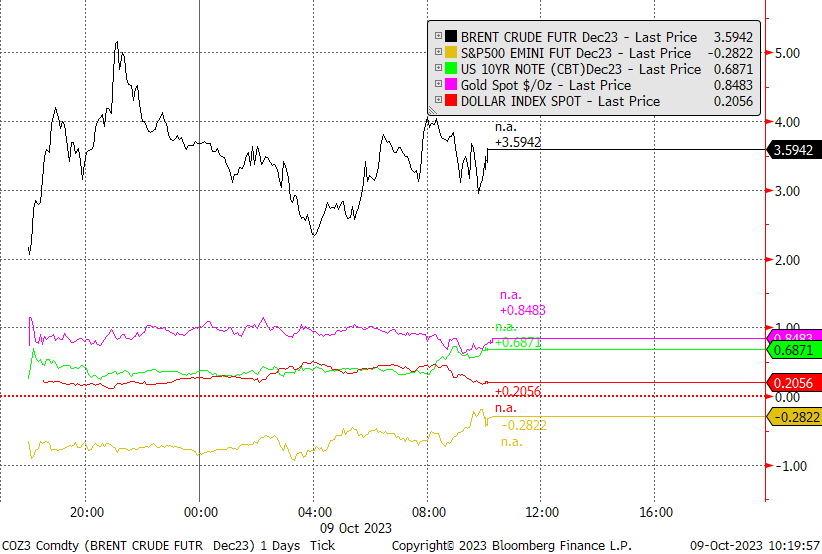

After unprecedented events over the weekend, we’re watching the reaction of various assets:

Oil – So far this morning Brent oil is +3.59%, having been around +5% a little earlier in the session. To put this in some context it was down over -11% last week. We are watching reports about the influence of Iran and its involvement, as the worst-case scenario would be the conflict expanding to draw other nations. Despite US sanctions on Iran, its crude production has recovered to above 3.1mbpd, a five-year-high, with exports running at around 1.5mbpd. In an already undersupplied oil market, disruptions to Iranian exports either through broadening conflict or tougher sanctions could have a significant impact on oil prices in the near term. This WSJ article has gotten a lot of attention over the weekend, it says that Iranian security officials helped plan Hamas’s Saturday surprise attack on Israel and gave the green light for the assault at a meeting in Beirut last Monday, according to senior members of Hamas and Hezbollah, another Iran-backed militant group. For a deeper dive into the conflict, here are two opinion pieces from Bloomberg:

Gaza Won't Hamper Markets — Unless Israel Strikes Iran

For Oil, It’s Not 1973 Again – But It Could Still Turn Ugly

US equities – it is contained so far, the market has bounced off the lows seen in the overnight session. S&P 500 futures are trading 28bps lower compared to an overnight loss of 90bps.

US bond markets are closed today, but the Treasury futures (10-year notes) are trading higher. The USD and Gold as proxies of safe haven assets are trading higher but off the overnight session highs.