Market Note (Feb 23)

Fed officials' hawkish stance; NVIDIA profit taking

The macro backdrop continues to remain supportive, thanks to NVIDIA. More on this later.

Federal Reserve officials expressed caution about rate cuts. Vice Chair Jefferson warned against overly easing policies in response to fluctuating inflation, suggesting potential cuts later in the year, reflecting a somewhat hawkish stance. Philadelphia Fed President Harker's remarks were mixed, advising patience with rate easing, yet hinting at possible cuts in the near future. Governors Waller and Kashkari emphasized a patient approach to policy easing, focusing on ongoing inflation challenges.

Market reacted by cutting rate cut expectations further, for 2024 we are pricing in 81.5bps in cuts, which is less than half what priced at the peak on January 12. As a result, 2yr Treasury yields rose +4.6bps to 4.71%, their highest since the December Fed meeting. Meanwhile, the 10Y yields have hovered around 4.30% amid softer PMI data.

So far equities have decoupled from the rates market as enthusiasm about AI has sent valuations higher, ignoring the higher for longer rates narrative which is building in the background. The biggest risk in my opinion is that the Fed has to stay put for all of 2024, without delivering any rate cuts.

Across the pond in Europe, preliminary February PMIs indicated modest growth, influenced by services sector performance. European Central Bank officials prioritized rate stability over early cuts, amidst signs of inflation aligning with targets.

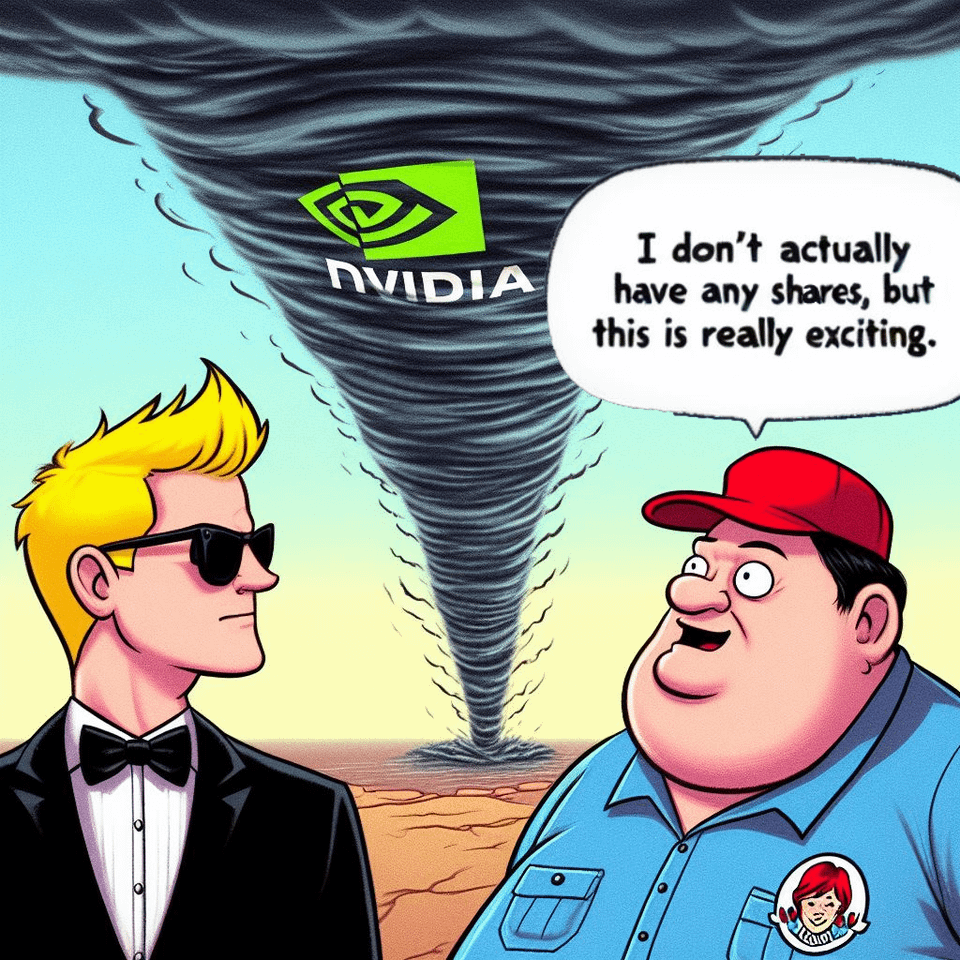

NVDA Profit Taking

This morning the stock printed a high of $823 but has since then reversed all the gains and is trading at $777 (1% lower). There isn’t much new news, so the only way to explain what is happening in this market pre and post-NVDIA earnings is through memes at this point.