Market Melt Ups

Stonks only go up 🚀

Equities melting up

Stocks continued to trade higher this week, displaying a generally positive bias towards the headline debt ceiling negotiations. However, on Friday, headlines emerged of Republicans walking out of the negotiations. Even as I write this piece over the weekend, talks between the White House and House Republican negotiators broke down, with both sides playing the blame game. Either way, President Biden and the House Speaker agreed to meet on Monday afternoon to prevent a catastrophic default. Meanwhile, as of this morning, Treasury Secretary Janet Yellen stated that the US is unlikely to reach mid-June and still be able to pay its bills. Yellen has previously warned that the US could lose its ability to pay all its bills as soon as June 1, putting the country at risk of a catastrophic default. While tax payments are expected in mid-June, the challenge lies in reaching that date, she said.

Positioning

In the last few weeks when negotiations were not progressing, stocks did not experience a significant decline. In my opinion, there is more to the rally than just the headlines. I believe positioning is playing a significant role in this melt-up episode, as speculative positioning in S&P 500 futures is near a record short position (betting on price decrease). When the net position is a record net short, it implies that speculators are holding a historically high number of short contracts relative to long contracts. As a result, any positive news leads to a rally mode as shorts are likely capitulating and closing their positions. Consequently, the price of the index goes up since there are more buyers of the index now. Additionally, sentiment in the FinTwit and trading community is clearly negative, with many speculators eagerly awaiting Treasury Bill issuance once the debt ceiling is raised. More on that later.

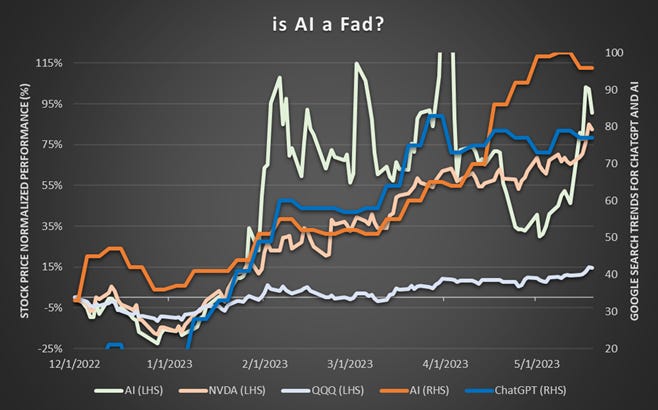

AI Hype

The hype surrounding AI is still prevalent in the market, benefiting megacap tech stocks. Most recently, Stanley Druckenmiller expressed his positive views on this technological innovation. However, 13F filings revealed that billionaire investing titans, including Stanley Druckenmiller and David Tepper, loaded up on stocks benefiting from the artificial intelligence boom during the first quarter. They could possibly be playing retail investors, as they won't disclose right away when they sell their AI stocks. Interestingly, when looking at the Google search trends, AI is still trending upward (orange line below), so it is not surprising that stock tickers 'AI' and 'NVDA' continue to rally 🚀.

Japanese equities

Another area where a bubble might be forming is in Japanese equities. The media continues to highlight how Warren Buffett helped Japanese stocks hit a 33-year high. Arguably, it is the best-performing index when comparing against major DM and EM stock indices. The Nikkei 225 index is up 18% so far this year, reaching a level last seen in 1990 when Japan had the second-largest economy after the US and appeared poised to take the top spot. However, it is still far from the epic Japanese asset bubble of the late 1980s, as the market would need to climb around 25 percent more to reach that peak.

The driving force behind this move, apart from Warren Buffett's followers adding more of Japan to their international stock portfolio, is the monetary policy divergence between Japan and the rest of the world. The Bank of Japan maintains an easy monetary policy, keeping interest rates low and continuing their quantitative easing (QE) program. This has pushed the value of the yen to its weakest levels in two decades, making it attractive for overseas investors. It is also helping boost the revenue of exporting companies, such as carmakers, which gain competitiveness from a weak yen. The Tokyo Stock Exchange has also made efforts to improve corporate governance standards, which seems to be positively impacting the stock prices of public companies. However, portfolio managers caution that foreign investors should not expect quick profits in Japan, as net buying of Japanese stocks fell in the latter half of the last decade when the US stock market became more attractive and many investors felt that Japanese corporations were not changing quickly enough.

Gold

Gold prices experienced a significant decline last week as media headlines around the debt ceiling circus became more positive, reducing the perceived risk of the US defaulting on its debt. We could potentially see further downward pressure on gold once the debt ceiling is actually raised, as investors realize that it is better to earn 5% on the USD rather than holding an asset driven by sentiment and without interest payments.

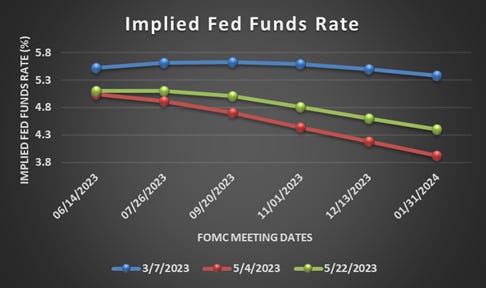

Fed speakers last week

The narrative around a potential June rate hike shifted slightly toward the hawkish side last week. However, Fed Chair Powell and Minneapolis Fed President Neel Kashkari lean toward skipping the June hike, which would constitute a hawkish pause. They justify this decision by stating the need to study the potentially lagged effects of rapid rate increases. On the other hand, hawks such as Barkin and Logan are suggesting a 25 basis points hike, arguing that inflation and economic activity are not slowing enough to justify leaving rates unchanged. A backdrop of resilient activity, confirmed by solid retail sales and a tight job market, confirmed by a drop in fraud-distorted initial jobless claims, along with persistently elevated inflation, is causing concern that the Fed's job of bringing down inflation is not yet complete. The current Fed funds pricing implies only a 9% chance of a 25 basis points hike in June, down from May 18th when it was around 38%, thanks to the impasse in debt ceiling talks and the statements from Powell that have caused the market to reduce its forecast of a June hike.

$1 Trillion Treasury Bill Issuance

The market is also paying attention to the massive fund raising the US Treasury will undertake once the US debt limit has been raised, as the Treasury would need to replenish its coffers. The Treasury will need to rapidly increase Treasury-bill sales, potentially draining liquidity from the banking sector, raising short-term funding rates, and tightening the US economy. This liquidity drop could have a negative impact on risk markets and economic growth, as there would be more people holding T-Bills and fewer available funds for other investments. While there is a possibility that investors parking their cash at the Federal Reserve's reverse repurchase agreement facility (RRP) could play a role in mitigating the reserve drain, there are concerns that reserves will become scarce, affecting funding markets and potentially leading to a risk-off environment.

The week ahead

• The debt ceiling circus will be on top of the minds of most of us.

• Fed speakers will also be on the docket, including Bullard, Daly, Collins, and Waller.

• The FOMC minutes from the last meeting will be released on Wednesday.

• The core PCE measure will be closely watched on Friday, along with personal income and consumption, the advance goods trade balance, and durable goods orders.

• The final May reading of the University of Michigan Survey (57.7 vs. 63.5) will be released on Friday as well. As a reminder, the preliminary data showed a 9% drop from April, which was attributed to "negative news about the economy, including the debt crisis standoff." Also of note will be whether the spike in long-run inflation expectations, up to 3.2% (the highest since 2011), is revised away with the final data, as that is a common occurrence.