Last week in the markets

Fears of imminent recession abating

What happened last week?

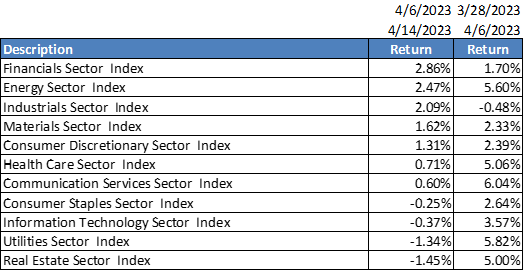

The S&P 500 index was up 0.8%, while the NASDAQ underperformed as it finished with a mere gain of 0.15%. Looking under the hood (in the S&P500), we saw that cyclicals (financials, energy, industrials) outperformed defensive sectors (Utilities and Real Estate). This was an interesting reversal in performance compared to what we saw for the last few weeks, as the Utilities and Real estate sectors gained over 5% during that period. What does that mean? I think the market is pricing away an imminent recession which equity markets have been pricing in since the regional banking crisis

Banking crisis update

Stresses in the U.S. banking sector continued to ease in the past week as lenders reduced their borrowings from the Federal Reserve's discount window and its newly opened Bank Term Funding Program, according to the central bank's balance sheet. For the week ended April 12, U.S. banks had a total of $139.5B in outstanding borrowings from the two channels, compared with balances of $148.7B in the prior week. Moreover, banks borrowed $67.6B from the Fed's traditional discount window, down from $69.7B in the previous week and a record $152.9B last month, when the failure of Silicon Valley Bank and two other regional lenders spurred liquidity constraints and contagion fears. Banks' balance at the BTFP, which was created on March 12 to support banks' liquidity after the bank failures, was $71.8B vs. $79B in the previous week, the data showed.

Bank earnings

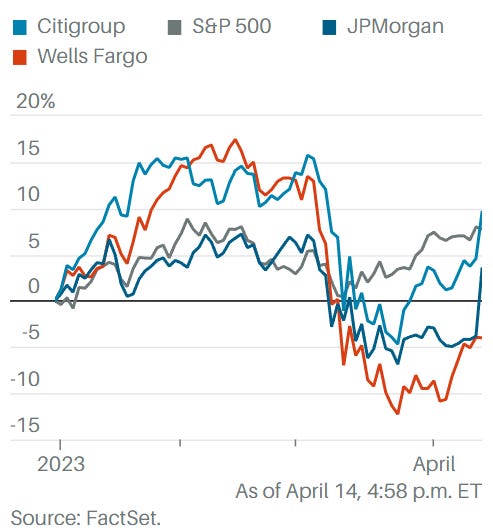

Four of the nation’s biggest banks (C, JPM, WF, PNC) reported solid earnings, demonstrating the resiliency of the industry's giants amid the challenges that tested regional lenders in March.

JP Morgan’s CEO, Jamie Dimon, who was involved in the regional banking crisis talks, did give us a hint as he expects regional banks to post “pretty good numbers” next week, but there is the risk of “additional bank failures.” He also said investors and businesses should plan for interest rates to remain higher for longer than currently expected by the market. He went further to warn us “If and when that happens, it will undress problems in the economy for those who are too exposed to floating rates.”

Fed Hiking Expectations

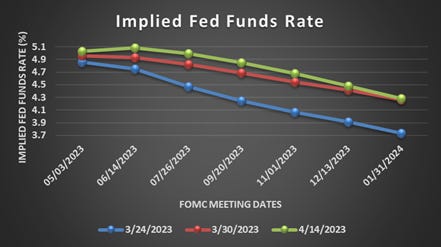

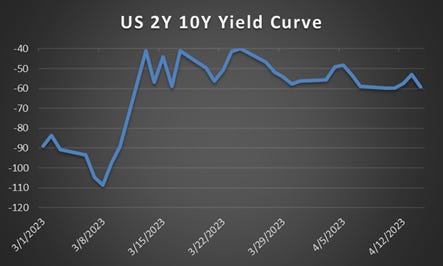

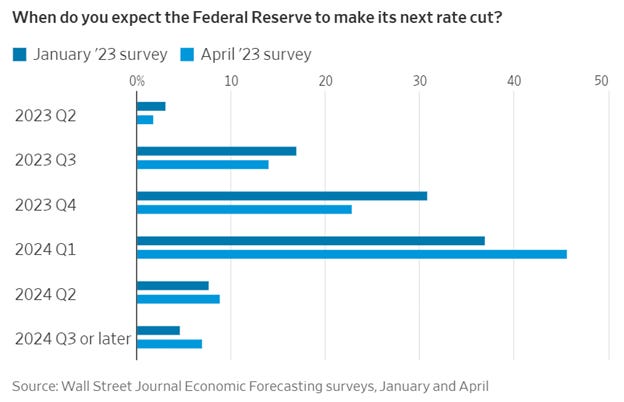

The easing of the banking crisis and elevated core inflation readings led to market pricing a higher probability of a 25bp hike in May from 71% to ~81%. The expectations of Fed cutting rates by end of 2023 also decreased – market expects Fed funds rate to be ~4.5% by end of the year compared to 3.9% which was priced on March 24th. The yield on the 2y curve moved higher and the 2y10y Treasury curve flattened once again as recession risks faded

I would also like to remind the readers that market was pricing cuts in May 2023 last year, but here we are talking about a rate hike in May, so we need to be careful to not overly rely on market pricing.

US CPI Data

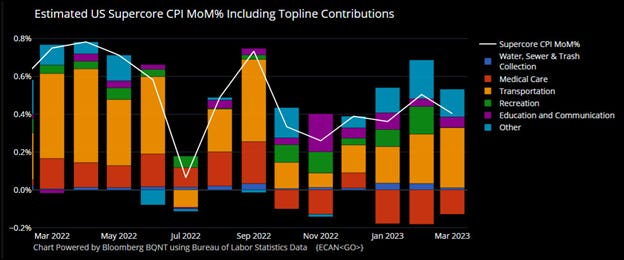

The CPI data showed hints of moderating in March, core CPI — which excludes food and energy and is closely watched by the Fed — rose 0.4% from the prior month following a 0.5% gain, in line with economists’ estimates. Services inflation excluding rent of shelter was unchanged on the month, and the core version of that index was up 0.25%. Overall, the core inflation measures remain elevated despite some moderation.

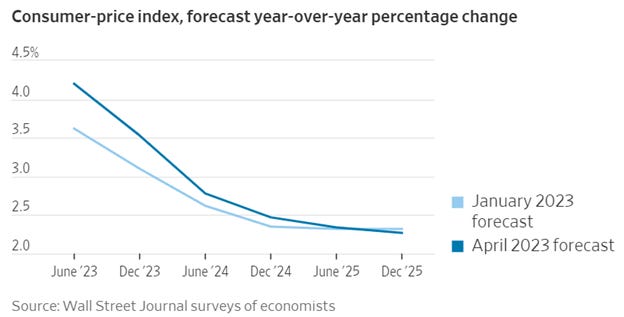

According to the WSJ latest survey of economists, the economy is proving more resilient and inflation more stubborn than economists expected a few months ago, and as a result the Federal Reserve will keep interest rates high for longer.

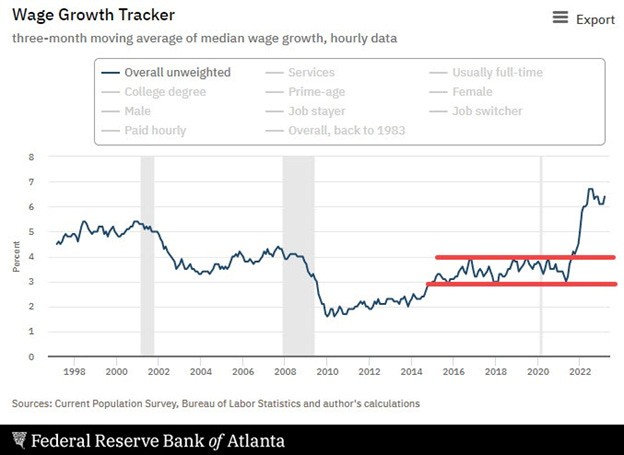

Wages continue to move higher

The Atlanta Fed Wage growth tracker moved up to +6.4% in March versus 6.1% in February. The tracker is a three month moving average of the median wage growth. This report is not good news for future inflation as stronger wage growth could lead to higher demand for goods and services, which could in turn drive up prices and contribute to higher CPI. Looking at the chart below, the wage growth pre-September 2021 was centered between 3% and 4% going back to 2015. The high monthly gain reached 6.7% in June and July 2022. The most recent low bottomed at 6.1%. Needless to say wages continue to be a problem for inflation going forward.

On the other hand, the NFIB survey of small businesses is not looking great for labor market, and is pointing towards weakness in the coming quarters.

Fed Official Backs Higher Interest Rates as Banking Stresses Fade (WSJ)

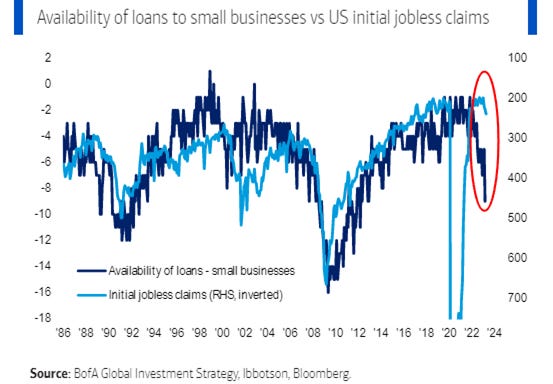

Lastly, I would like to point out that the Fed officials, especially the voting members are also once again getting hawkish. Fed’s Waller said he was prepared to approve another interest-rate increase because recent banking-system stresses haven’t produced a significant pullback in lending while high inflation remains supported by strong growth. Some central-bank officials earlier this week signaled support for pausing rate rises after one more increase at their next meeting, May 2-3. But Mr. Waller pointed to stronger-than-anticipated economic activity so far this year and stubbornly high inflation in concluding that the outlook currently supported tighter monetary policy.