Jan 9th Morning Update

Markets pare back rate cuts odds

Markets continue the choppy price action as the S&P 500 (+1.41%) recorded its largest gain since mid-November yesterday, driven by tech optimism and supported by falling commodity prices (WT oil -4%). This morning we are seeing a reversal though, with the S&P 500 down 0.4% as Tech stocks pull back. So we are seeing a tug-of-war between two narratives “aggressive pricing for US interest rate cuts” and “soft landing driven by disinflation and moderating growth”. HSBC’s Max Kettner sees a “reverse goldilocks” scenario if economic data continues to be resilient.

The disinflationary data came primarily from the New York Fed’s latest Survey of Consumer Expectations. This showed another decline in inflation expectations across several horizons, and 1yr expectations were down to 3.0%, which is the lowest since January 2021. In addition, 3yr expectations were down to 2.6%, which was the lowest since June 2020, and 5yr expectations came down to 2.5%, which is the lowest since March 2023.

A decline in oil prices yesterday, following Saudi Arabia’s decision to cut their oil prices for buyers in all regions was also another positive tailwind on the inflation side. This morning we are seeing a retracement of price action as WTI is up 1.6%, trading at $72/bbl.

The tech rally was led by chipmaker Nvidia, which gained +6.43% after announcing new products aimed at making better use of AI on personal computers.

Elsewhere, Boeing and Spirit AeroSystems (a supplier for Boeing) remain under pressure as the risk of a wider investigation beyond the Max 9 variant after multiple airlines found loose parts could be a major setback for the aircraft manufacturer and its parts supplier (Bloomberg).

Fed speakers: Atlanta Fed President Bostic(FOMC voter) commented that inflation had come down by more than he expected, and reiterated that he expected rate cuts to come only in Q3. We also heard from Fed Governor Bowman, one of the most hawkish FOMC voices, who said that policy appeared sufficiently restrictive to hit the 2% inflation target but that “we are not yet” at the point of rate cuts becoming appropriate, and noted “the risk that the recent easing in financial conditions” could stall the progress on inflation. The chances of a Fed cut by March are down to 61% at the close, their lowest since the December FOMC, from 73% the day before (and an intra-day high of 76% shortly after the NY Fed’s consumer survey).

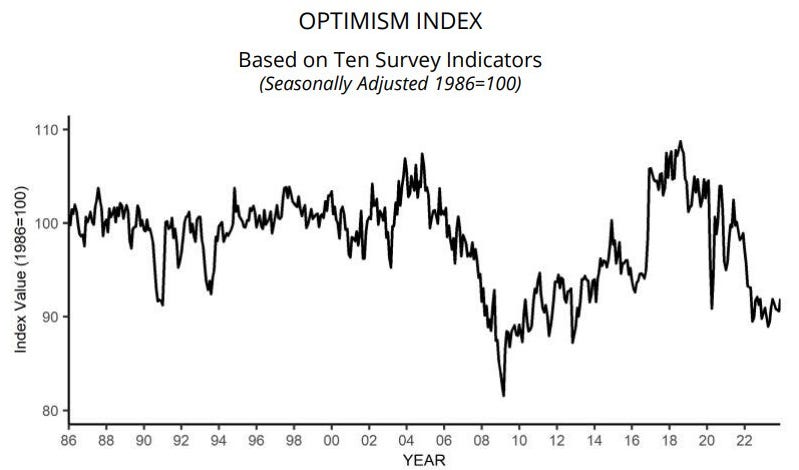

This morning’s NFIB Small Business index showed confidence among US small businesses improved slightly in December, albeit remaining subdued as inflation concerns rose again. The index rose to 91.9 in December from 90.6 in November, better than expectations for a slight rise to 90.8. However, this is the 24th straight month that the index remains below the 50-year moving average of 98. NFIB notes that small businesses remain very pessimistic about the outlook coming into this year, with 23% of firms reporting inflation to be their single most important problem in business operations - up 1% from November. Adding that while 2023 is now "in the rearview mirror, it will weigh heavily on the 2024 economy".

Other news:

Nvidia Rolls Out New Chips, Claims Leadership of AI PC Race (BBG)

Used car prices are still high, but they’re expected to stabilize in 2024 (CNBC)

U.S. crude oil falls more than 4% as Saudi price cut heightens global demand worries (CNBC)

US consumers see smaller inflation gains ahead, New York Fed says (RTRS)

Buying Home and Auto Insurance Is Becoming Impossible (WSJ)

Why Buffalo will be 2024’s Hottest Market (Zillow)

Fed Governor Bowman(V) tempered her once-hawkish policy outlook: "My view has evolved to consider the possibility that the rate of inflation could decline further with the policy rate held at the current level for some time..." (RTRS)

the Fed announced that US consumer borrowing surged in November as household credit card balances surged by the most since March 2022 (BBG)