Jan 4th Morning Update

Skepticism about the chance of a Q1 rate cut

Another weak session for risk assets on the back of softer data and ongoing skepticism about the chance of a Q1 rate cut. The S&P 500 index fell by 0.8%, while Nasdaq ended 1% lower. The primary laggard was the small-cap Russell 2000 index which fell by 2.7%.

Federal Reserve Meeting Minutes: The December Fed meeting minutes did not indicate imminent easing, with little discussion on rate cuts. There was a note of caution against easing financial conditions too much, which could hamper inflation goals. However, there were dovish elements, acknowledging uncertainties in maintaining a restrictive monetary policy and the downside risks of being overly restrictive.

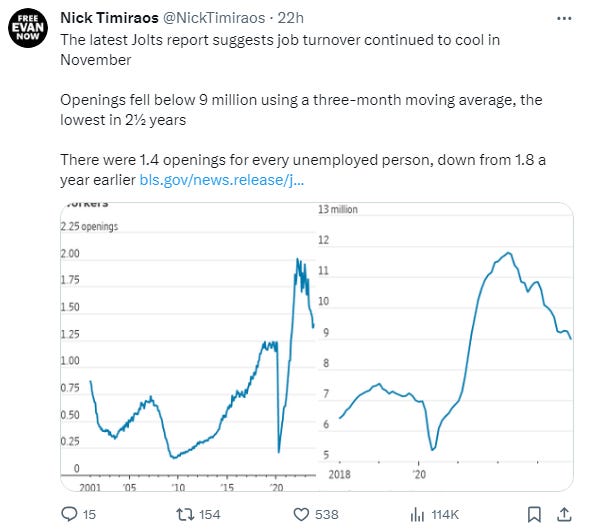

US Economic Data: The ISM manufacturing index remained in contraction, and the JOLTS report indicated a decrease in job openings and hires rate, raising concerns about a weakening labor market. The same data a couple of months ago was seen as soft landing friendly, but with the market already pricing in 6 cuts for 2024, there is a bit more caution about that view.

As noted above, the market is reversing its earlier stance on rate cuts, as the probability of a rate cut by March was down to 76% yesterday, having been at 87% the previous day, and 96% the day before that.