Jan 30th Morning Note

Treasury refunding announcement sends stocks to record highs

After another record high in the S&P 500 set in yesterday’s session (S&P +0.76% at 4,928pts), stock futures are modestly lower. Investors are continuing to watch earnings as we get 24% of S&P 500 earnings report over the next 48 hours. All eyes are going to be on Microsoft and Alphabet today and Apple, Amazon and Meta on Thursday. We also have the FOMC tomorrow and payrolls on Friday, with markets expecting the Fed to hint rate cuts at upcoming meetings, while labor market will continue to be resilient.

Risk assets got a boost yesterday after US Treasury’s borrowing announcement. The US Treasury lowered its quarterly borrowing estimate for Jan-Mar from $816bn to $760bn, a larger decline than expected by the market. The decrease is mainly due to higher revenue from surprisingly brisk growth and higher cash balances. It further announced a modest $202bn borrowing estimate for the Apr-Jun period. The latest refunding news - which will be followed on Wednesday with details of debt auction sizes and maturity buckets - electrified the bond market late on Monday as 10yr Treasuries rallied 8bps to 4.05%. We could see a further rally similar to the last quarterly refunding announcement on 1 November marked the start of the dramatic bond rally into year-end, if the details of auction sizes/maturity buckets are supportive. More here (RTRS)

Above announcement triggered another sharp rally in stocks near the close. Small caps outperformed with the Russell 2000 up +1.67% on the day (gaining nearly one percent after the Treasury’s announcement). Other major indices also posted solid gains, including the S&P 500 (+0.76%) and the NASDAQ (+1.12%). The Magnificent 7 (+1.59%) also outperformed, led by a +4.19% gain for Tesla.

In Europe, several ECB officials are moving towards a dovish direction, leading to increase in likelihood of rate cuts from the ECB, with a move now fully priced in by April again. This morning’s data showed that the Euro Area economy unexpectedly stalled in the last three months of 2023, following a 0.1% contraction in the previous period, and compared to forecasts of a 0.1% fall, preliminary estimates showed. The common bloc avoided a recession in the end of 2023, amid a better-than-expected growth in Spain (0.6%) and Italy (0.2%) while the French economy stalled and Germany, which is the largest one, contracted 0.3%.

Turning to commodities, Brent traded above $84.50 early on Monday (up +1.5% at the peak) amid increased concerns over Middle East tensions. But this supply risk sentiment eased during the day, also helped by an industry report suggesting that OPEC+ supply cuts this month might have been smaller than scheduled.

On the growth front, the IMF raised its 2024 global growth forecast to 3.1% from 2.9% seen in October while keeping the forecast for 2025 unchanged at 3.2%, amid greater-than-expected resilience in the US and several large emerging market and developing economies, as well as fiscal support in China. Meanwhile, global inflation is expected to fall to 5.8% in 2024 and 4.4% in 2025, compared to 6.8% in 2023, with advanced economies seeing faster disinflation. With disinflation and steady growth, the likelihood of a hard landing has receded.

Looking at earnings, shares of UPS sank over 6% in premarket trading after reporting a full-year revenue outlook below forecasts. Whirlpool was also down more than 4% after giving a downbeat sales guidance. In contrast, General Motors soared almost 8% in premarket hours after the company beat estimates for both earnings and revenue and provided an earnings guidance better than its 2023 results. Investors are continuing to face the dilemma on the growth front as economic data continues to show resiliency, while data from a micro perspective (earnings) apart from the AI exposed names look shaky.

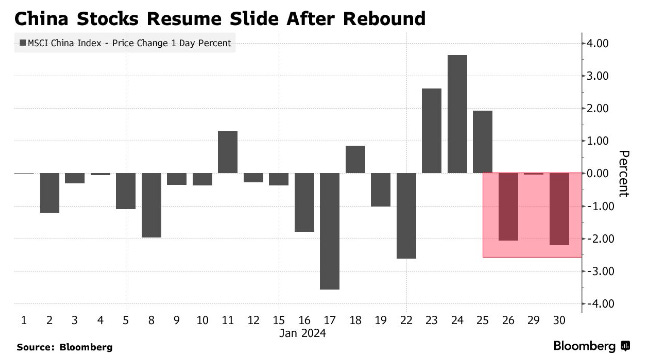

Chinese stocks declined for a third consecutive day on Tuesday, diminishing gains from the previous week's rally that was fueled by hopes for a market support package. The pessimism surrounding the world's second-largest economy grew this week with the escalating liquidation of the heavily indebted China Evergrande Group, previously the top developer in the country, heightening worries about the troubled real estate sector. Investors find little cause for optimism amid disappointing earnings from key companies and the re-emergence of geopolitical tensions ahead of the US presidential election later this year. According to media reports, Trump is considering the implementation of a uniform 60 percent tariff on all imports from China, as discussed with his advisors.

Other news:

Businesses and Consumers Are Borrowing Again, in 8 Charts WSJ

Increase in real interest rates raises pressure on Fed WSJ

Fed Rate Decision Could Be the Prelude to a March Cut BBG

Blackrock Says Raises Overall U.S. Stocks View To Overweight From Neutral Blackrock

China Developer Liquidation Is a Big Test for International Creditors BBG