Jan 25th Market Note

Tesla set to erase $70 billion in valuation after Musk's sales warning

Equities are continuing to extend their gains setting new record highs (again), as supportive macroeconomic data along with optimism around Tech earnings continues to drive the S&P 500 index higher for a 4th consecutive session.

Although Year-to-Date, the index is higher by ~2.8%, most of the gains are driven by Magnificent 7 stocks (ex-TSLA).

h/t: finviz.com

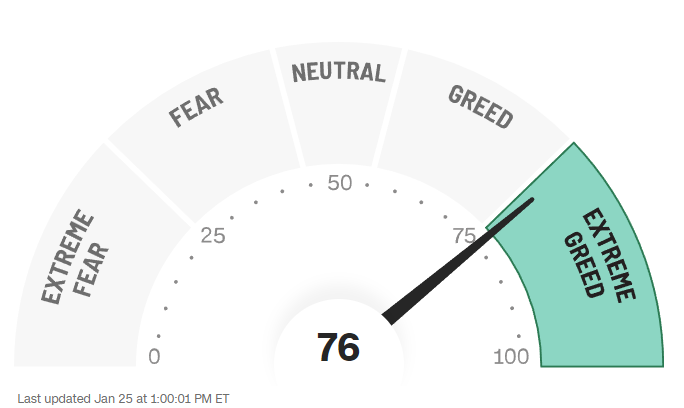

When looking at the RSP ETF to see the YTD performance of the S&P 500 equal weighted index, it is slightly down (-0.15%). This shows that the market is struggling to find direction and if the rally in remaining Mag7 stocks falter, we could see a correction. In fact, CNN’s Fear and Greed index is also in the Extreme Greed territory, which has historically been a decent indicator of frothiness in the market.

Speaking of Mag 7 stocks, TSLA is down 13% after company reported a miss on Q4 EPS due to weak margins, and mgmt. warns that vehicle volume growth in ’24 may be “notably lower” than ’23. Reuters

Meanwhile, NFLX has continued to trade higher (up 13% since Jan 24th) after posting stronger-than-expected subscriber growth for 4Q. WSJ

On the macroeconomic data front, the U.S. economy grew 3.1% from a year earlier in the fourth quarter, as a resilient labor market supported strong consumer spending and brushed aside a feared downturn. A year ago economists saw a recession as very likely and projected anemic 0.2% growth for the year.

Across the pond, the European Central Bank held its key interest rate at a record high but kept open the door to rate cuts as soon as the spring, sending the euro lower. At a news conference on Thursday, ECB President Christine Lagarde didn’t push back strongly against market expectations of rate cuts starting in April. She said ECB officials had decided that it was premature to discuss interest-rate cuts this week. But she also pointed to indications of a slowdown in wage growth in the 20-nation eurozone, a critical metric for the ECB, suggesting steady progress in the bank’s fight against high inflation.

Overnight in Asia, equities have got some fresh momentum after fresh stimulus announcements from China. That included the news that the reserve requirement ratio will be lowered by 50bps on February 5, along with other measures. In turn, that’s supported substantial gains this morning, with the Shanghai Composite up by +2.59% currently, which leaves it on track for its best daily performance since November 2022.

Other news:

The Fed Risks Getting Caught Up in Politics, Whatever It Does WSJ

Insurers Rake In Profits as Customers Pay Soaring Premiums WSJ

Lithium prices plunge on slowing Chinese demand for EVs FT

China adds support for developer funding by easing loan uses BBG

Boeing's MAX production issues ripple across aerospace industry Reuters

IBM shares soar to more than 10-year high on rosy AI outlook Reuters