Jan 16th Morning Note

Boeing Sinks on Concerns Max Blowout Will Slow Deliveries

Risk assets are starting the week on a weak note as major equity indices are negative, however, S&P 500 index pared most of the earlier losses at the time of print. The gains are coming from Tech stocks mainly, with NVDA and MSFT adding another 3.6% and 1% to their valuations. On the corporate front, Apple is falling nearly 1.2% after offering iPhone discounts in China. Tesla recouped earlier losses of about 2.9% after Elon Musk said unless he has roughly 25% voting control at the company, he’d prefer to build artificial intelligence and robotics products elsewhere.

On a single name front, Boeing is lower by ~7% bringing YTD losses to ~21% on lots of weekend news, including increased FAA inspections as 737-9 remains grounded increasing the risk of delays in deliveries. Meanwhile, China has also delayed all MAX deliveries. A cracked window in Boeing aircraft's cockpit forces All Nippon Airways flight to return.

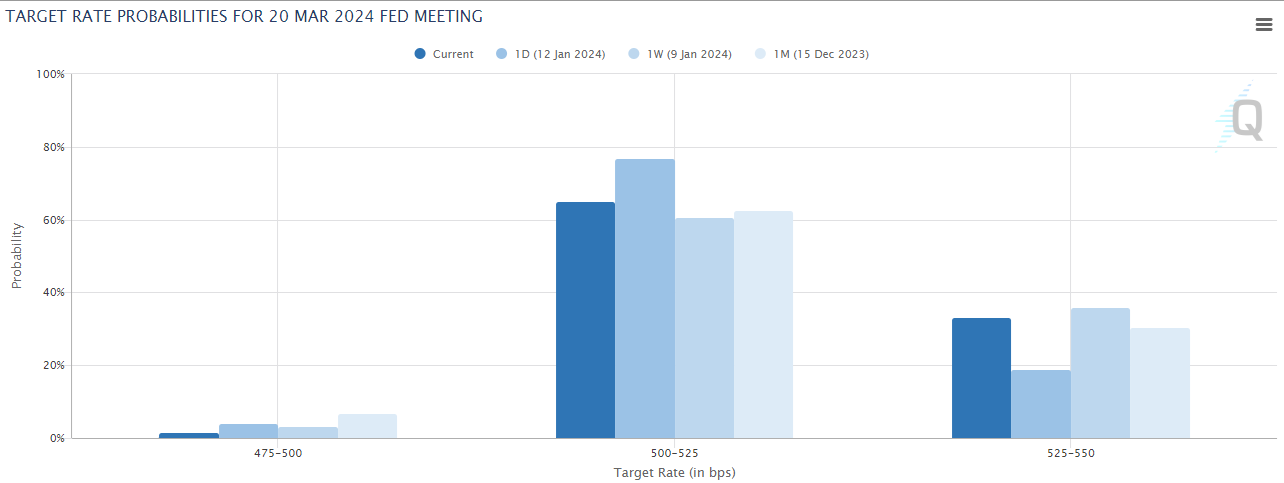

Treasury yields have been choppy this morning as markets digest fresh economic data and an ongoing interview with Fed’s Waller. The NY Empire State Manufacturing Index plunged to -43.7 in January 2024, the lowest reading since May 2020, signaling a sharp drop in manufacturing activity in the NY state. The 2Y notes are higher by 7bps, reversing the decline post-NY Empire State miss as Waller pushed back against aggressive Fed Funds pricing by the market. The current Fed funds pricing implies a 65% probability of cut vs 77% on Jan 12th. Meanwhile, the 10Y and 30Y Treasury yields are higher by 8-9bps.

Other news:

Boeing Sinks on Concerns Max Blowout Will Slow Deliveries (BBG)

Trump scores easy win in Iowa (BBG)

Forget Meme Stocks and Bitcoin. These Investors Are Hunting Quality (WSJ)

Beijing tells some institutional investors not to sell stocks (FT)

Timiraos: Fed tiptoes toward tapering QT (WSJ)

Coming flood of Treasury issuance unsettles some investors after blazing rally (RTRS)

Worries grow in Washington that a flood of Chinese products put new US investments in clean energy and high-tech factories at risk (NYT)

The unintended consequences of the Basel endgame (FT Opinion)

China weighs more stimulus with $139bn of special bonds (BBG)

Some wealthier Chinese say they can't afford marriage as economy slows (RTRS)