Jan 12th Morning Update

Inflation Edged Up in December After Rapid Cooling Most of 2023

Risk markets overlooked a stronger-than-expected headline US CPI print and escalation in the Middle East as the S&P 500 closed roughly flat yesterday and is trading higher by 20bps at the time of writing.

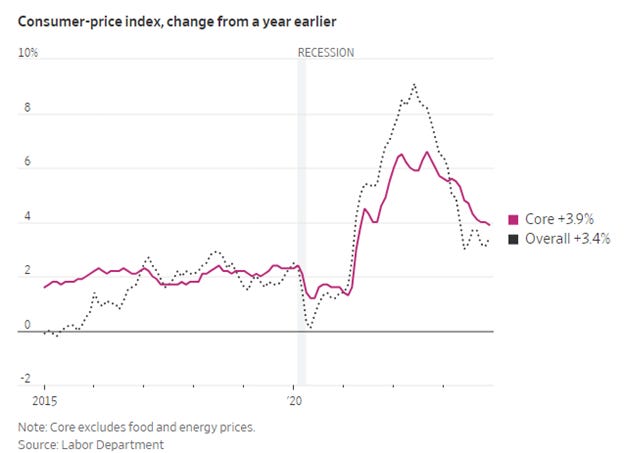

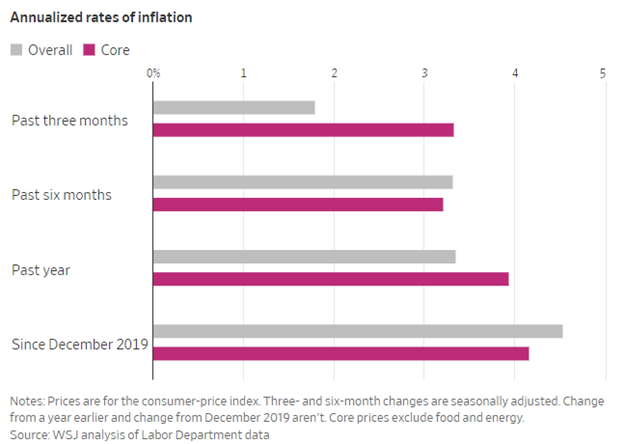

In terms of details on the CPI print, monthly headline CPI was 0.10% stronger than expected at +0.3%, which in turn pushed the year-on-year number up to +3.4%. Meanwhile core CPI, also came at +0.3% for the month, which was in line with expectations, but meant the year-on-year number only slowed by a tenth to +3.9% (vs. +3.8% expected). So, the progress on disinflation is proving slower than hoped, and that’s also evident by just focusing on the last 6 months of data. For instance, on a 6-month annualized basis, core CPI was up from +2.9% to +3.2%, and headline CPI was up from +3.1% to +3.3%.

Despite the upside surprise on US CPI, the expectations for the Fed Funds rate cut for the March meeting increased to 76% from 68% the day before. Similarly, the amount of cuts priced in by the December meeting went up by +14.0bps to 155bps, so that’s still a reasonably rapid pace of cuts for the year as a whole and one that tends to be more consistent with what happens in a recession rather than continued growth. The gap between market expectations and Fed speak continues to drift wider as Cleveland Fed President Mester said that “I think March is probably too early in my estimate for a rate decline because I think we need to see some more evidence”. Meanwhile, Chicago Fed President Goolsbee said “I don’t like tying our hands,” while Richmond Fed President Barkin said he didn’t wish to “prejudge” a decision about March.

Treasuries sold-off on the initial CPI release but quickly rebounded, trading range-bound, however went bid on Red Sea developments. The UK and US attacked Houthi targets in Yemen after they seized a tanker in the Gulf of Oman. This was not completely unexpected, but oil prices traded higher (WTI ~73.8 +4%) on this. The strikes—and fresh promises of retaliation—threaten to escalate monthslong violence in the Middle East into a broader conflict and turn the Red Sea into a new flashpoint between Washington and the various Iran-backed groups arrayed across the region. The market response is mostly contained to commodities, suggesting this is a one-off.

Overnight in Asia, we saw a mixed performance for equity markets, which comes as China’s inflation data remained in deflationary territory. The latest CPI print showed prices fell by -0.3% year-on-year (vs. -0.4% expected), while the PPI reading came in at -2.7% (vs. -2.6% expected). On the back of that Hang Seng (-0.03%), CSI 300 (-0.04%), and Shanghai Comp (+0.09%) all closed broadly flat, whereas the Nikkei (+1.39%) is on track for its highest closing level since 1990.