Jan 11th Morning Update

All eyes on US CPI

Stocks (SPX +0.6%, NDX 0.7%, RTY +0.1%) closed higher yesterday, once again led by MegaCap tech (avg 1.2% return). Overall there was no incremental new news to justify the price action, however, equities are back to multi-year highs (SPX ~4800).

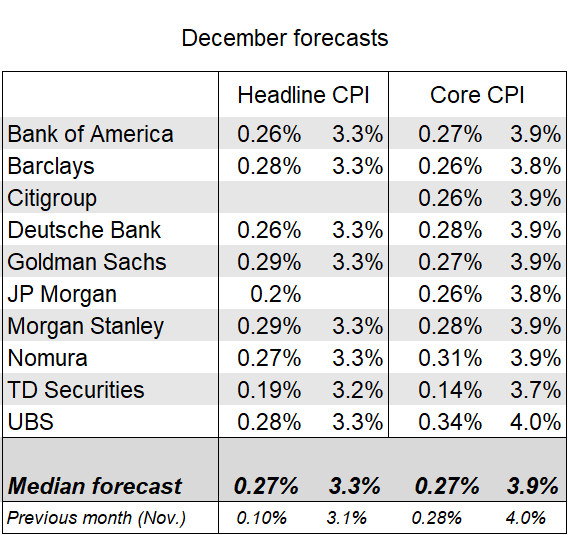

In terms of the most anticipated number of the week – CPI - the consensus of Wall Street Forecasters expects the core index to rise 0.3% from November, lowering the 12-month rate slightly to 3.9%. They see the headline index up 0.3% from November, pushing the 12-month rate up to 3.3%.

For Fed cuts pricing, markets continue to price a pivot soon, with futures still pricing in a 69% likelihood of a cut by March. But so far, officials have generally been talking about later moves. Talking of officials, NY Fed’s Williams said that rates were restrictive enough to reach the 2% inflation target while reiterating the need for the Fed to maintain a restrictive stance “from some time”. While noting the meaningful progress on inflation, he added that it was still far from 2%. He was also hawkish than expected on the Balance Sheet, though the market didn’t see a strong reaction. Equity futures were just a touch softer after his speech. “The FOMC said that it intends to slow and then stop the decline in the size of the balance sheet when reserve balances are somewhat above the level it judges to be consistent with ample reserves... So far, we don’t seem to be close to that point.”

The 10-year Treasury auction tailed by 0.5bp but the stats were decent. The auction priced at a high yield of 4.024%, which was a sharp drop from December's 4.2960 and was the lowest yield since the 3.999% August auction. More notably, the high yield tailed the When Issued 4.019 by 0.5bps. This was the 4th consecutive tailing 10Y auction, and the 11th non-stop through auction in a row (September was on the screws). More remarkably, there have been only 3 stop-through 10Y auctions in the past 27 months!

Treasury yields are 3-4bps lower across the curve at the time of print (2Y = 4.33%; 10Y = 3.99%; 30Y = 4.17%)

Yesterday, the SEC finally approved the first-ever spot Bitcoin ETF (key takeaways), set to enhance the accessibility of Bitcoin for both retail and institutional investors. It is trading over $47k - a 21-month high - over the last 36 hours as the decision has been anticipated. Here is what to expect on Day One.

Elsewhere in commodities, WTI is trading $1.4 higher at $72.7 , reversing losses from yesterday. Meanwhile, NatGas prices have dipped below $3 after yesterday’s 5% dip on forecasts for the weather to turn warmer than normal in late January after next week's expected freeze when demand is projected to reach record highs.

In US political news, Former New Jersey Governor Chris Christie has withdrawn from the 2024 Republican presidential race due to low poll numbers and a lack of a viable path to victory. His campaign focused on criticizing Donald Trump and calling for a new direction in the Republican Party. Christie's exit potentially benefits other candidates like Nikki Haley, although his impact on the overall race remains uncertain.

Other news:

Why 2024 may be a very good year to be a renter (WSJ)

Wall Street Quants Grapple With New Era Where Cash Actually Pays (Yahoo)

Searching for rift in Transatlantic easing (Rtrs)

Red Sea Diversions Pile Up (WSJ)

Is US Inflation Set to Fade Alongside Goods Prices? (BBG)

Will inflation's rapid downturn stabilize? (WSJ)

The Fed's QE comeback could be dangerous (FT)

The EU’s new fiscal rules are not fit for purpose (FT)

Eurozone heading for another downturn, warns ECB vice-president (FT)

Bond Sales Reach €108 Billion in a Record Week for Europe (BBG)

This Inflation Measure Is Running Hot. It’s Probably Wrong. (WSJ)

"Germany is stuck in an economic dead end" (RTRS)

China is set to lose crown as top US exporter after 17 years (Nikkei)

South Korea's BOK is the latest central bank to essentially call it a day on tightening (BBG)

Remittances to Mexico have almost doubled since 2018 (FT)

A large ratings agency looks ahead for the US economy and sees 1995 (RTRS)