Jan 10th Morning Update

JPM Outlines Key Scenarios for Tomorrow's CPI Impact on the Market

Markets continue to be range-bound as we didn't receive any incremental news over the last 24 hours. The S&P 500 finished 0.1% lower yesterday, while the Nasdaq added 0.2%. The small-cap index, Russell 2000, was the primary laggard, finishing 1.1% lower. In the technology sector, MegaCap Tech outperformed the broader market, with NVDA adding another 1.6%, thus continuing its positive momentum.

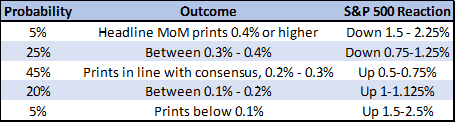

Looking ahead, CPI data tomorrow, along with the kickoff of the earnings season and PPI data on Friday, will provide additional insights into the market's direction. JP Morgan’s strategists have come up with a few different scenarios regarding the CPI outcome and the associated market reaction. So if consensus is right, we could see SPX rise 50-75bps.

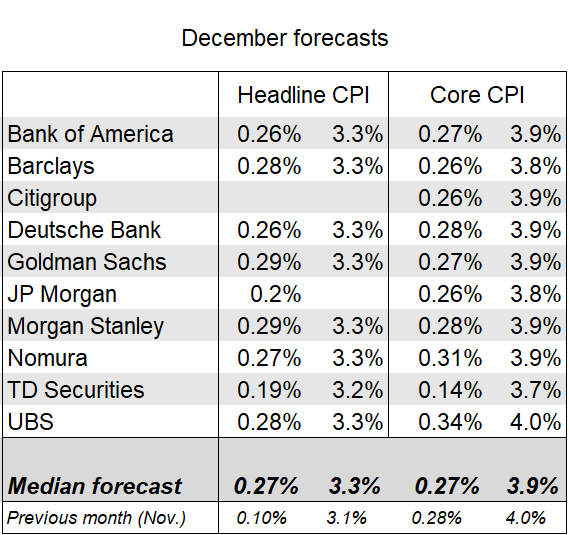

The consensus of Wall Street Forecasters expects the core index to rise 0.3% from November, lowering the 12-month rate slightly to 3.9%.

They see the headline index up 0.3% from November, pushing the 12-month rate up to 3.3%.

WTI finished 2% higher at $72/bbl, following a 4% decline on Monday. In terms of economic data, as mentioned yesterday, the NFIB’s small business optimism index rose to a 5-month high of 91.9 (versus 91.0 expected). Additionally, the November trade deficit came in smaller than expected at $63.2bn (versus $64.9bn expected). This has led the Atlanta Fed’s GDPNow estimate for Q4 2023 to point to an annualized growth rate of 2.2%, indicating solid growth despite a deceleration from Q3.

Yesterday also marked the year's first Treasury note auction, with 3-year notes issued at a yield of 4.105%—the lowest for 3-year issues since last May, and 1.1 basis points below the when-issued yield. I will watch the more significant 10-year and 30-year auctions today and tomorrow closely.

Moving to the Federal Reserve, today we will hear from NY Fed President, John Williams. Officials have been sounding more hawkish, although they have not been discussing rate hikes. They are gradually shifting towards downplaying market expectations for a rate cut in March. Comments on Quantitative Tightening (QT) will be significant as the Fed prepares the market for an eventual slowdown in the QT program.

In international markets, the Japanese equity index, Nikkei, added 2.06%, reaching a fresh 34-year high amid a weaker yen and dovish economic data releases. Japanese labor cash earnings only rose by +0.2% year-over-year in November (versus +1.5% expected), the slowest in nearly two years, after a +1.5% increase in October. This is encouraging the notion that the Bank of Japan won't tighten this month or perhaps in the foreseeable future, thus supporting Japanese equities.

Elsewhere, Australia’s consumer price inflation fell further to a near two-year low of +4.3% y/y in November (v/s +4.4% expected) and down from +4.9% in October mainly as a result of base effects thus reinforcing expectations that RBA rates have peaked.

Other news:

Bond investors may be ignoring the cloud of rising deficits around the world (BBG)

Boeing Probe Focuses on Bolts as Airlines Find Loose Parts (BBG)

China Hints at More Easing With Possible Reserve Ratio Cut (BBG)

Global economy set for its worst half decade of growth in 30 years, World Bank says (CNBC)

Meta says it will restrict content for teens, as complaints mount about harmful effects on youth (CNBC)

Markets tweak Fed balance sheet views after comments from Dallas Fed chief (RTRS)

Banks should increase use of 'discount window' to prevent crises -expert group (RTRS)

Who’s Getting Big and Small Raises in 2024 (WSJ)

An A/I spin-off aims to halve drug discovery times (FT)

US used EV prices fell almost a third in 2023 (FT)

China's policy dilemma: Is boosting credit deflationary? (RTRS)

Emerging market debt issuance hits record as borrowing costs fall (FT)