Is Soft-Landing still the base case?

"Sell-in-May" investors are probably disappointed

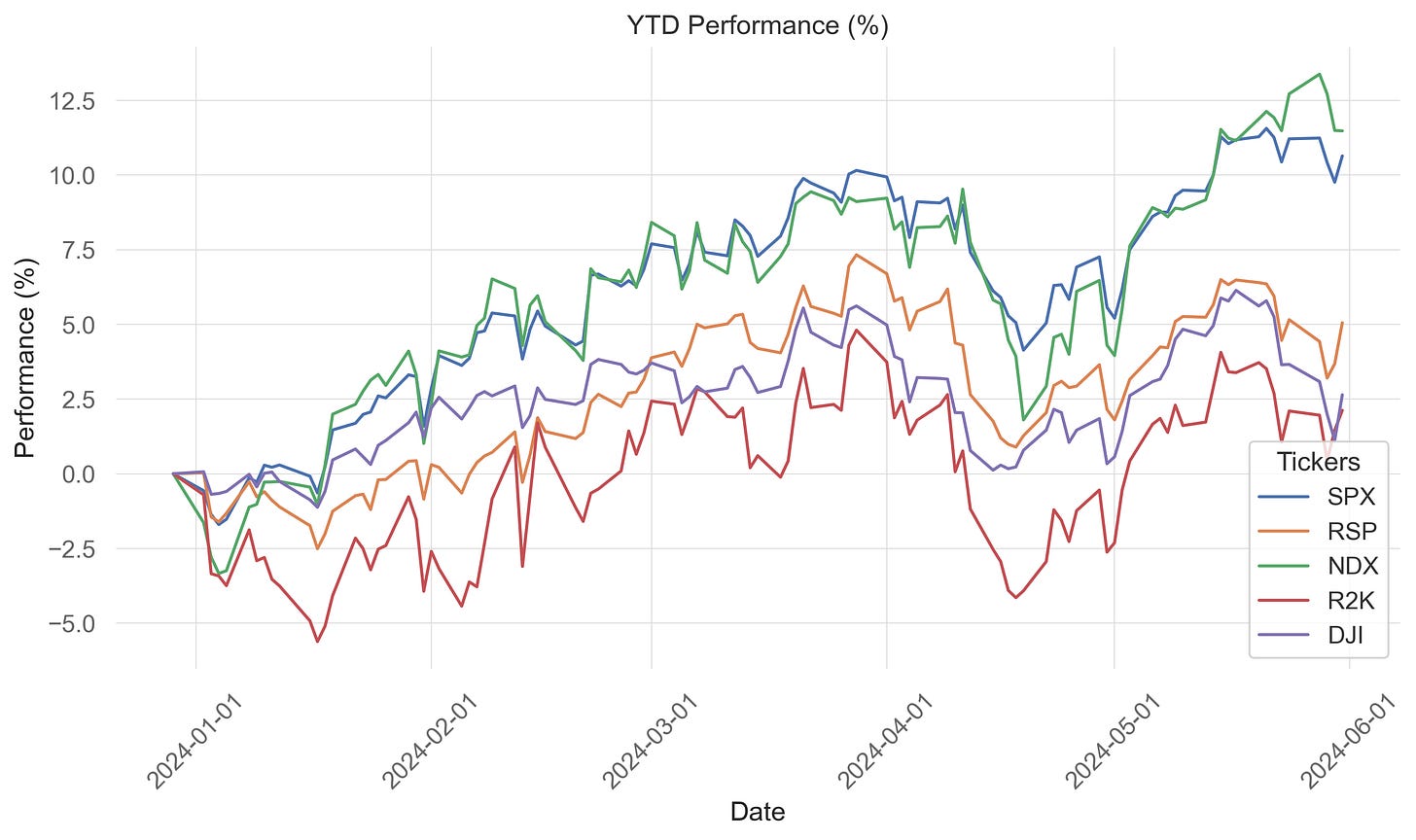

Despite a challenging week for risk assets, overall performance for the month of May remained robust following April's pullback. The S&P 500 is now just 1% below its all-time high. However, the renewed sell-off in Treasuries, with yields rising again, continues to keep investors on edge, reminiscent of the market conditions in April.

Why did Treasury yields move higher last week?

The 10Y Treasury yields have been steadily climbing higher since middle of the month, and the first half of last week was no different. Here are the reasons why the yields shot up:

The Conference Board's confidence report for May, released Tuesday morning, showed a notable uptick compared to April, indicating that the domestic economy might be running hotter than the Federal Reserve prefers.

Europe’s inflation data released this week showed a notable increase, with May CPIs from France, Germany, Spain, and the entire Eurozone exceeding expectations. The EU CPI rose by 2.9% on a core basis, up 20 basis points from April and 20 basis points above expectations.

Australia's CPI for April also came in higher than anticipated at 3.6%, compared to the market expectation of 3.4%.

However, there was a mini-reversal in yields starting May 30th due to softer Q1 US GDP, in-line US PCE data, and downward revisions in consumption and spending data. Additionally, New York Fed President Williams struck a dovish tone in his Thursday remarks: "With the economy coming into better balance over time and the disinflation taking place in other economies reducing global inflationary pressures, I expect inflation to resume moderating in the second half of this year."

Is Soft-Landing still the base case?

Yes, a soft-landing remains the base case. Pullbacks as seen last week or in April are normal, but overall we don’t see a fundamental change in the economy’s outlook. We are still seeing a solid GDP growth, positive EPS performance from corporate America, and cooling inflation. Although recent economic data has supported a paused Fed, the bar for further hikes is too high. Further, micro data from Q1 earnings season is pointing towards a deteriorating demand landscape, which will inevitably lead to disinflationary pressure and cooler growth. At this juncture, the key question is will the market price in lower rates and Fed easing before we see negative EPS from corporate America?

As it stands, the odds of a cut by September 18th meeting are at 60% while 37bps of cuts are priced in for 2024.

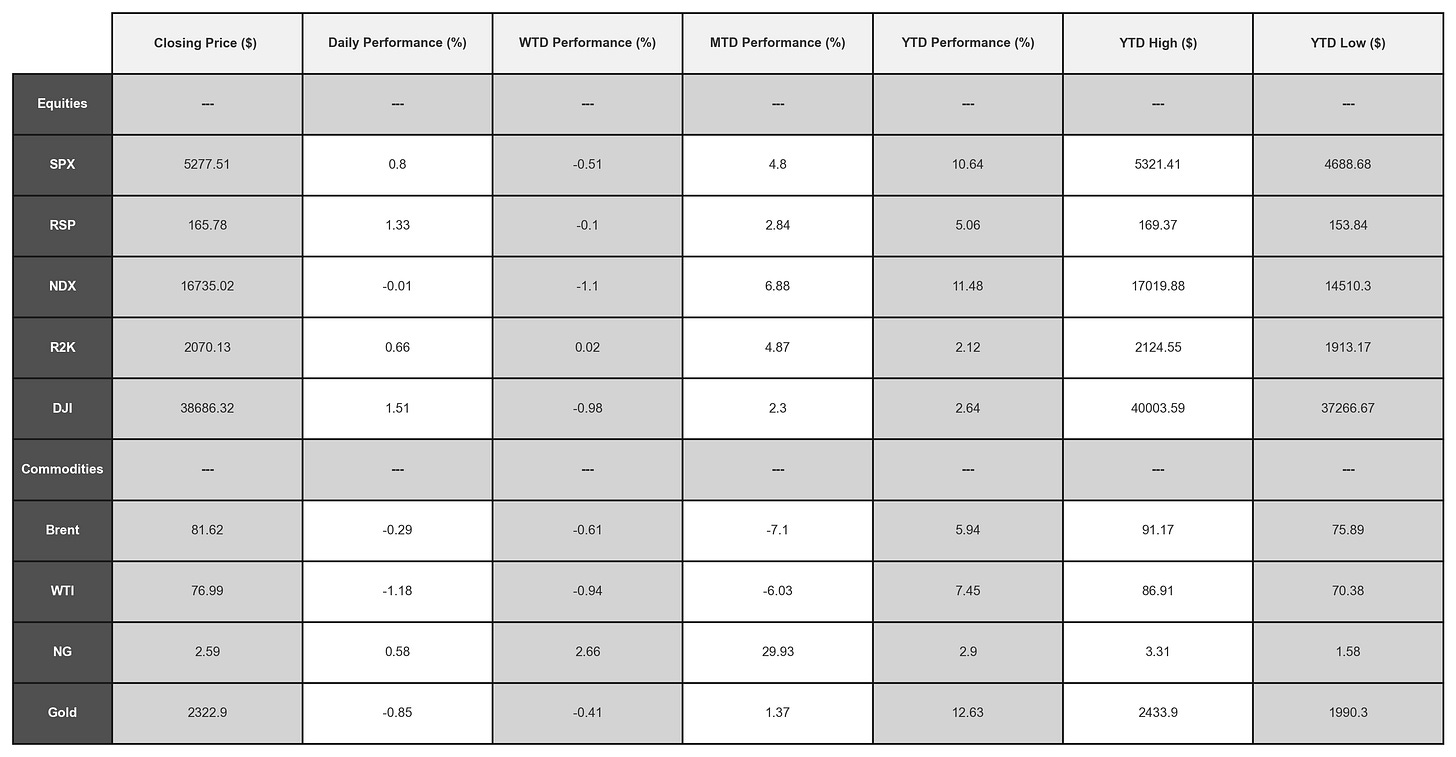

Market Performance

Key Events for the Week of June 3rd

Monday, 6/3

US manufacturing ISM for May (10am ET): The Street expects a modest uptick to 49.6 from 49.2 in April.

Tuesday, 6/4

JOLTs report for April (10am ET): The Street anticipates a downtick in job openings to 8.3M from 8.48M in March.

Wednesday, 6/5

US services ISM for May (10am ET): The Street expects an uptick to 50.7 from 49.4 in April.

Bank of Canada decision (9:45am ET): Market anticipates a rate cut, although odds are lower compared to the ECB's decision on 6/6.

Thursday, 6/6

ECB decision (8:15am ET): Expected to lower rates with forward guidance suggesting patience; no further easing likely until at least 9/12. Market assumes 55-60bp of aggregate reductions for the year.

Jobless Claims (8.30am ET): The Street expects 220k, modest uptick compared to last week.

Friday, 6/7

US jobs report for May (8:30am ET): The Street expects a modest downtick in job creation to +170K from +175K in April, with private job creation forecast at +155K. The workweek and unemployment rate are expected to hold steady at 34.3 hours and 3.9%, respectively, with wages estimated at +0.3%