'Here for Longer' Regime

FOMC minutes, S&P PMIs, NVDA Earnings highlights, and Key Events for next week

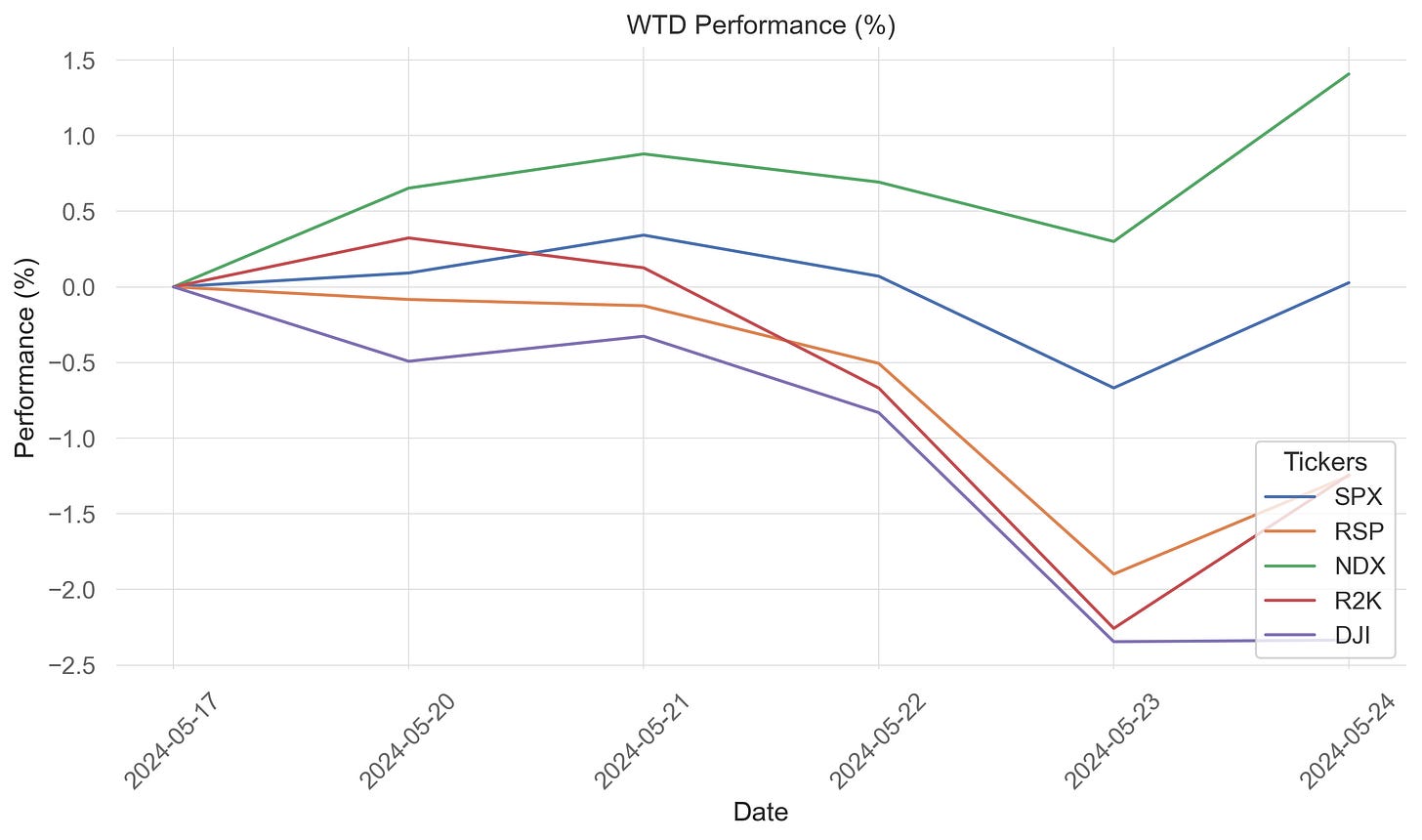

Market Performance

Equity markets pulled back from all-time highs despite NVDA meeting or slightly beating extremely elevated expectations. On the other hand, hawkish data and Fed minutes spooked the market again, sending treasury yields higher and taking stocks lower (especially the Russell 2000 index), with investors cautious after the recent rally. However, by Friday, the S&P 500 ended 17 points shy of its ATH level of 5,321 points.

On Thursday, the tensions between the overall market and NVDA were reflected in the market performance, as the AI leader added roughly the GDP of a country to its market cap but the S&P 500 saw its largest daily decline in a month.

Treasuries

The 10Y Treasury yield tested the 4.5% level twice this week as the FOMC minutes and economic data had hawkish implications for the monetary policy.

There were two main reasons for the renewed sell-off (yields going higher) in Treasuries:

FOMC Minutes - Headlines from the Minutes noted that “various participants” would hike rates, only if “such an action became appropriate”. This was a surprise to the markets, given Powell set a very high bar for another rate hike. However, the minutes would have been considered much more hawkish if the hard data in April was hotter, but the jobs and CPI reports had dovish implications for the monetary policy. A few other highlights included:

“Participants discussed maintaining the current restrictive policy stance for longer should inflation not show signs of moving sustainably toward 2 percent or reducing policy restraint in the event of an unexpected weakening in labor market conditions.”

“Many participants noted signs that the finances of low- and moderate-income households were increasingly coming under pressure, which these participants saw as a downside risk to the outlook for consumption. They pointed to increased usage of credit cards and buy-now-pay-later services, as well as increased delinquency rates for some types of consumer loans.”

"The economy now seems to be evolving closer to what the Committee expected."

On the other hand, the central bankers are trying their best to signal a “here for longer” narrative to keep inflation expectations anchored despite their confidence that rates at current levels are ‘restrictive’ and they are seeing labor market ‘rebalance.’

Even the Reserve Bank of New Zealand’s Orr noted, similarly, “We are confident [in inflation trends]…, we’d just like to make sure we get there without risking another blowout in expectations.”

S&P PMIs - Market participants were surprised to see manufacturing and services PMIs increase as “hard” activity data point to a slowdown in economic growth. The services PMI increased from 51.3 to 54.8 while the manufacturing PMI rose to 50.9 from 50.0. However, the S&P PMI series has more noise/volatility than the ISM series, which has been around for longer. Brent Donnelly has written more about this in his latest Friday Speedrun.

Fed Fund Rates Expectations

The odds of a 25bp cut by the September 18th meeting are about 55% compared to ~80-90% last week. The market is pricing in ~34bp of aggregate reductions for the year, compared to 45bps priced in last week.

NVDA Earnings highlights

FQ1 saw a 262% Y/Y sales increase to $26B (buy-side expectations $25B), with Data Center sales surging 427% to $22.6B ($21.1B street forecast), driven by diverse customer adoption. Nvidia expects strong demand for its H200/Blackwell GPUs to exceed supply well into next year, driven by a profound industry shift. For FQ2, Nvidia targets ~$28B (in line with elevated buy-side expectations) in sales with 75.5% gross margins. Other announcements include a 10:1 stock split (exciting for retail investors) and a 150% dividend increase (barely matters as it will be 10c). Bulls emphasize Nvidia's market dominance, while bears note high inventory levels and revenue concentration concerns.

Key Events for the Week of Monday 5/27

Tuesday, 5/28

ECB inflation expectations (morning)

Australia's CPI for April (night)

Closing arguments in Trump trial; jury deliberations commence

Wednesday, 5/29

Germany’s regional CPIs for May (morning)

Fed’s Beige Book (afternoon)

Thursday, 5/30

Japan’s Tokyo CPI for May (night)

China’s NBS PMIs for May (night)

Friday, 5/31

Eurozone CPI for May (morning)

US PCE for April (morning)