Good news ≠ Bad news for stocks anymore?

Are stocks still at the mercy of good news and bad news? It seems like the market has a mind of its own these days. Despite the recent hawkish remarks from Fed officials, the market rallied and oversold conditions, positioning, and technicals have taken center stage. Even Treasuries rallied in the face of a strong services ISM print (ie inflationary), with yields across the curve retracing on oversold conditions.

This impressive rally was fueled by the rejection of a low point in the S&P 500 futures, which climbed from 3,925pts to 4,052pts in just two sessions. As the US 10Y yield failed to end the week above the 4% mark, many investors are anticipating more bullish action in the coming weeks.

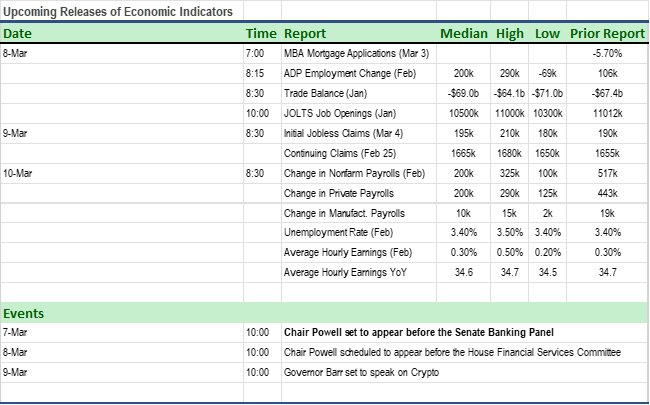

Next week, all eyes will be on Powell and his remarks. Will he leave the door open for reaccelerating the pace of hikes to 50bp? Many believe the bar is high, but not insurmountable. In addition to Powell's remarks, the JOLTS and NFP reports will be watched closely, as well as any indications of a strong core CPI reading following week. Officials might be reluctant to provide a dovish impetus to markets by hiking by less, so it remains to be seen how this will all play out.

In short, it seems like the market is becoming less predictable, and good news and bad news no longer have the same impact on stocks. Investors are focusing more on technicals and other factors, which could make for a very interesting and exciting market in the coming weeks.