Fed's Dovish Stance Meets Consumer Sector Weakness

What’s next for US equities?

This week, the S&P 500 surged to a new record, reaching 5,234 points. This marked its most significant weekly increase since mid-December, with a gain of 2.3%. Simultaneously, the Nasdaq experienced its largest weekly percentage rise since mid-January, climbing by 2.9%.

The upward momentum was fueled by a combination of a dovish stance from the Federal Reserve and a series of positive developments in the AI space. Noteworthy events included Micron Technology's (MU) earnings report, NVIDIA's (NVDA) GPU Technology Conference (GTC), and an AI collaboration headlines between Apple (AAPL) and Google (GOOG). These factors collectively inspired confidence among investors, leading to substantial gains.

Despite the week's bullish trends, concerns lurked beneath the surface. Concerns in the consumer sector resurfaced, as reflected in the negative performance of several companies. Notable downturns were observed in Lululemon Athletica (LULU) with a 10% decline, Dollar Tree (DLTR) falling by 13%, and Nike (NKE) dropping by 11%, all based on one-month return figures. This divergence highlights the complex dynamics at play in the current market landscape.

Is the US Consumer Weakening?

Given the negative consumer data points, particularly from a slew of downbeat earnings reports, an examination of some macro data reveals that in the short term, consumers should be ok, but things could deteriorate if inflation picks up and the Fed is forced to change their stance.

The average refund amount as of March 15, 2024, is 6% higher than last year, which could be a tailwind for consumer spending in March. (Source: IRS)

Additionally, the Child Tax Care credit awaiting a Senate vote after its passage in the House, could provide much-needed help to the lower-end consumer.

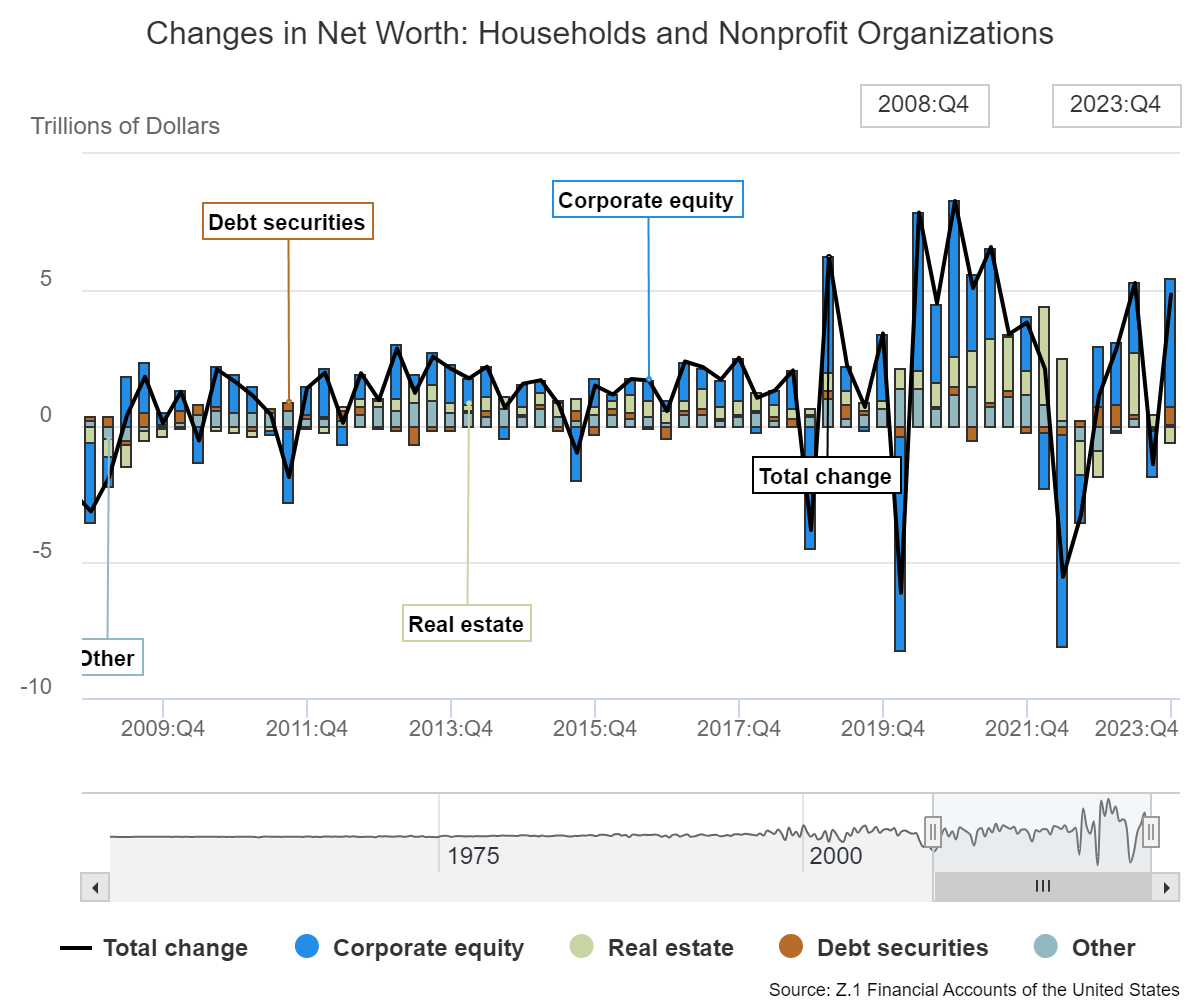

The balance sheet (first graph below) of households and non-profit organizations shows that their net worth has increased to $156T in 4Q 2023 from $152T in Q1 2022 (last peak). Despite most of the change being attributed to the gains in stock markets (second graph), the checking account balance (third graph) is at $3.9T (compared to $980B pre-covid). These elevated cash balances could still support consumer spending.

FOMC Recap

Going into the FOMC, the market was prepared for a hawkish stance, instead, it was surprised by an unchanged dot plot indicating 3 cuts (~75bps) and a dovish press conference by Powell. Key highlights include:

GDP growth has been revised up by the Fed to 2.1% this year, from 1.4% in the December forecast. The GDP forecasts for 2025 and 2026 were also raised, pointing to upside risks for growth.

The dot plot indicates a 75bp easing for each of 2024, 2025, and 2026 — this is one fewer easing than previously forecast for 2025 and 2026 — and raised the longer-term rate by 10bps to 2.60%.

On inflation, the core PCE forecast for 2024 was raised from +2.4% to +2.6%. Powell also reminded us that getting inflation back to target is expected to be a gradual process - not something that happens overnight. Although he said that the Fed is not going to dismiss any data, but also commented that they are not going to overreact to ‘bad inflation.’ When asked by the WSJ’s Nick Timiraos (aka Fed whisprer) how much calendar effects were imputed into the Fed’s view on inflation, Powell suggested that there is reason to expect there were seasonal effects at play in January, while February’s core PCE below 30bps “was not terribly high”.

When queried whether labor market strength might deter Fed cuts, Powell provided a dovish "not necessarily" in response.

This line from Powell stuck out in particular: “things like the low hiring rate, people have made the argument that if layoffs were to increase, that that would mean that there would be fairly quick increase in unemployment. That is something we're watching [but we're not seeing].”

On QT (Quantitative Tightening), Powell said that it would be appropriate to slow the pace of runoff “fairly soon”.

Bottom line: The Fed is prepared to cut possibly by June, but May can’t be ruled out. They still think that inflation has eased substantially and Powell didn’t seem to be too bothered by recent hot inflation data. Instead, the Fed is more worried about unexpected weakness in the labor market.

Treasury Market Reaction to FOMC

The yields on the 2Y and 10Y bonds fell by 12-14bps over the week.

The market is pricing in a 75% chance that the Fed will cut by June. For 2024, the market is pricing in 85bps of cuts vs. 72bps pre-FOMC.

What’s next for US equities?

The bulls are saying that Powell’s dovishness, along with the lack of “sell-the-news” price action in AI-related names is a net positive for stocks. The prospect that not even higher growth or a strong labor market will deter the Fed from making cuts is seen as a bonus by the bulls. Meanwhile, Powell dismissing the Jan/Feb hotter inflation print leads me to believe that the next major catalyst for the Fed is the March CPI report to be released on April 10th.

Conversely, the bears are arguing the market's current valuation (S&P 500 ~5,300pts), the market looks less appealing due to its overbought condition and crowded sentiment. On AI, the spending on data centers and chips is propelling the sector, but there is a big question mark on returns from all this spending. The recent underperformance in consumer-related retail stocks underscores the potential volatility; a miss in growth expectations or earnings could trigger a selloff.

This interplay of views underscores the nuanced and uncertain path ahead for U.S. stock markets.