Fed done 'Hiking' rates but policy will remain 'Restrictive'

Stale September FOMC minutes showed little deviation from recent Fedspeak as most officials saw risks to goals are more two-sided, and they are in a position to “proceed carefully.”

“Participants generally judged that, with the stance of monetary policy in restrictive territory, risks to the achievement of the committee’s goals had become more two-sided”

“Participants generally noted that it was important to balance the risk of overtightening against the risk of insufficient tightening,”

Although the above statement describes that the Fed is concerned about growth slowing from their tight monetary policy, it is somewhat incongruent with data given the substantial upward revision to 2023 GDP growth projections, but it lines up with a number of statements from Chair Powell and other Fed officials positing that the US economy is on-track for softening growth and slowing inflation.

While the meeting outcome included a hawkish upward revision to Fed “dots,” minutes tempered that by emphasizing that policy rates are now restrictive.

The meeting minutes combined with recent Fedspeak now suggest that only a substantial upside surprise to CPI inflation will have the Fed hiking again in November. The Fed Fund futures market is only pricing a ~10% chance of a 25bp hike in November, though the odds of a hike in December are at ~30%.

All participants agreed that policy should remain restrictive for some time until the Committee is confident that inflation is moving down sustainably toward its objective.

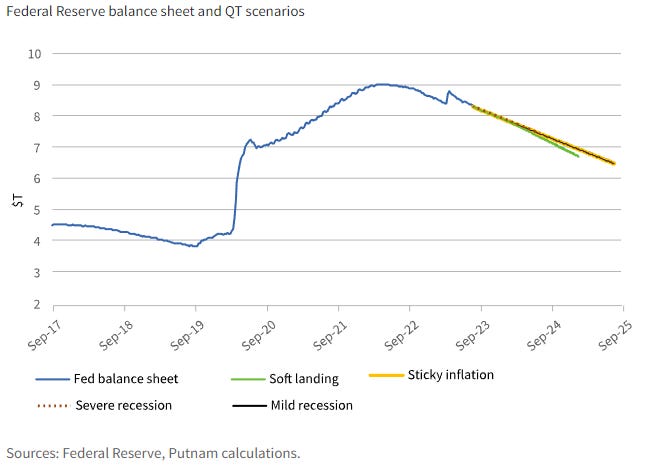

Even though the Fed maybe done with hiking, they are not thinking about cutting rates anytime soon. Also notable in otherwise not-too-surprising minutes was an explicit mention of the idea that balance sheet reduction might continue even in scenarios where the Fed is lowering policy rates.

Several participants noted that the process of balance sheet runoff could continue for some time, even after the Committee begins to reduce the target range for the federal funds rate.

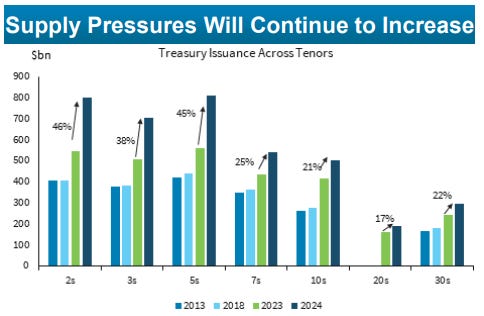

We can expect yields in the long end of the Treasury curve to stay higher as supply from the issuance will continue to increase, while the Fed will also continue to reduce its balance sheet (ie sell more treasuries.) This in turn will lead to further tightening of monetary policy, without additional hikes.