Feb 2nd Morning Note

Tech Earnings Fuel Market Rebound Amid Banking Concerns and Hawkish Jobs Report

Risk assets experienced a significant rebound (NDX +1.21%, SPX +1.25%) following impressive tech earnings from META and AMZN, which reignited investor interest after a notable decline post-FOMC (NDX -1.94%, SPX -1.61%). This downturn on Wednesday was primarily due to two main factors:

New York Community Bancorp (a New York-based regional bank) provoked renewed concern about small/regional bank balance sheets

Fed’s Powell indicated a rate cut at the March meeting may be unlikely

On the former, questions about systemic risk to the banking system resurfaced after banks in the U.S., Japan and Switzerland announced losses tied to troubled real-estate lending. Although most analysts believe that NYCB’s issues were mostly idiosyncratic- outsized exposure to commercial real estate (especially New York City multifamily), weaker liquidity, and lighter regulatory capital - spillover concerns remain. The risks are particularly acute for small and regional lenders, which have far higher chunks of their loan portfolios in commercial real estate than big banks. As a result KBW Regional Banking Index (-6.00%) saw its largest decline since the regional banking turmoil last March. More here - WSJ

On FOMC, the committee altered their statement, moving from a tightening bias to a more neutral stance on federal funds rate adjustments. However, they remain cautious about reducing rates until confident about controlling inflation towards 2%. Powell, in his press conference, emphasized this need for confidence in disinflation, deeming a March rate cut unlikely. This stance, along with upcoming CPI reports, suggests a higher threshold for a March reduction. He also indicated upcoming discussions on balance sheet issues in March.

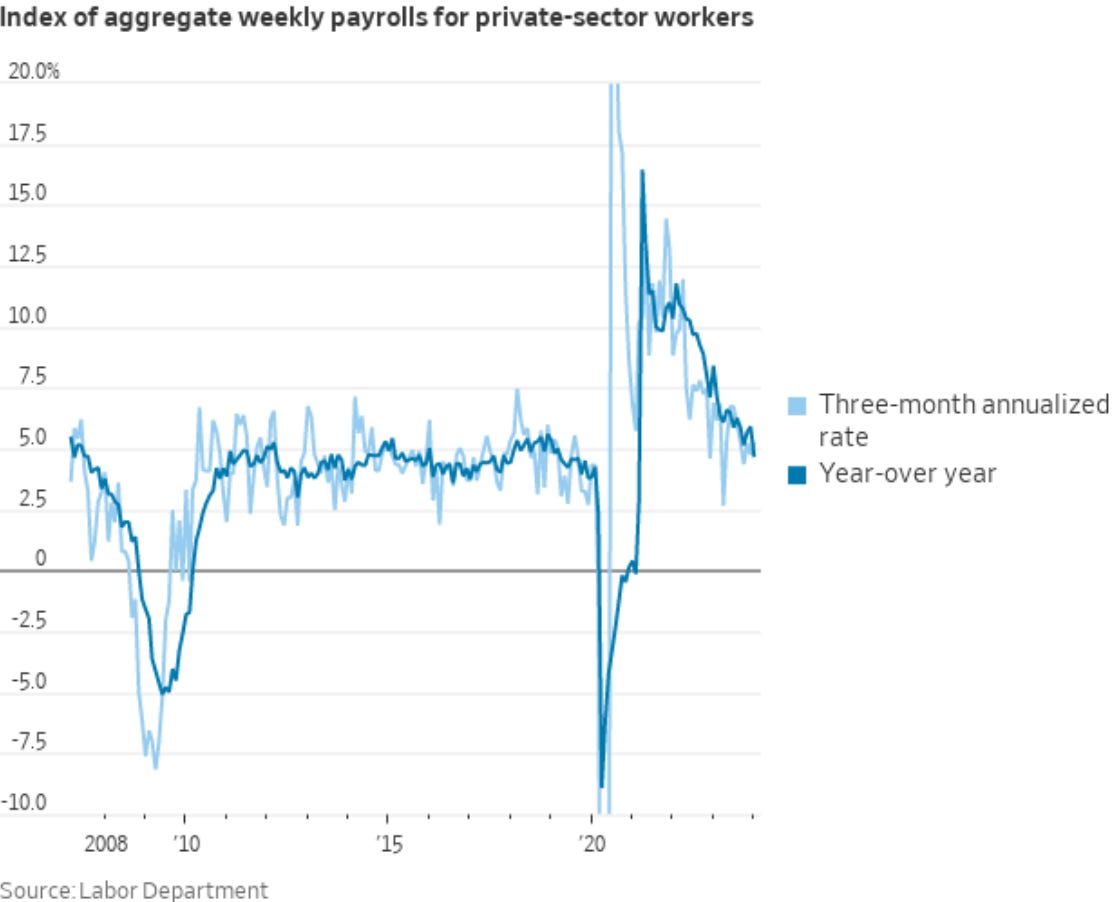

At the time of print, the likelihood of a March rate cut fell to 20%, from 35% post-FOMC as the US jobs report surprised to the upside. Market expectations for year-end rate cuts have also reduced to 121bps (4.9 cuts) compared to 145bps (5.8 cuts) on Jan 4th. Treasury yields are also sharply higher - 2Y = 4.37% +16bps; 10Y = 4.0% +12bps and 30Y = 4.20% +9bps. Equities also erased their pre-open gains with S&P 500 slightly lower after the NFP (non-farm payrolls) report.

Main highlights from the US Jobs report include:

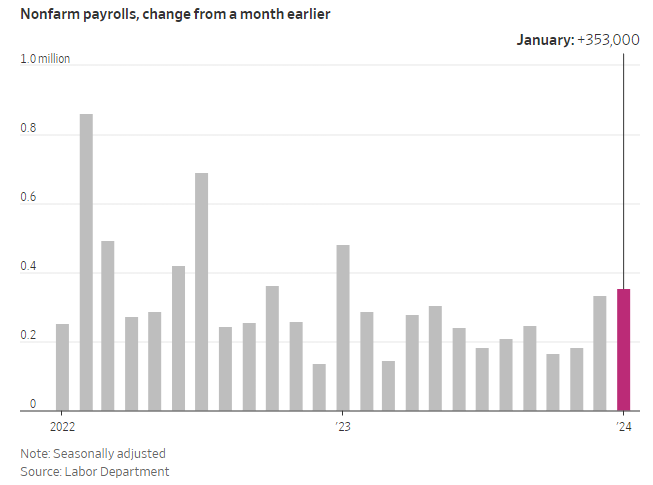

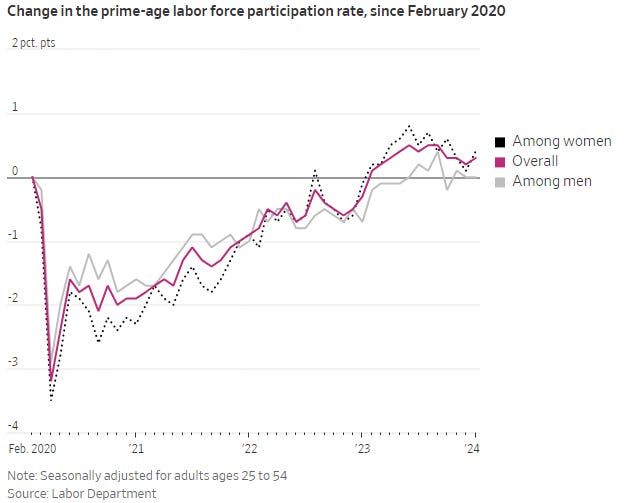

Headline numbers - US economy added 353k jobs in Jan, compared to an upwardly revised 333K in December, and way above market forecasts of 180K. It is the biggest rise in employment in a year, signaling the labor market remains tight.

Revisions added 359K jobs to 2023’s total gains, with employment in November and December revised 126K higher. With the revisions, the US economy added an average of 255K jobs per month in 2023, higher than the monthly average of 225K earlier.

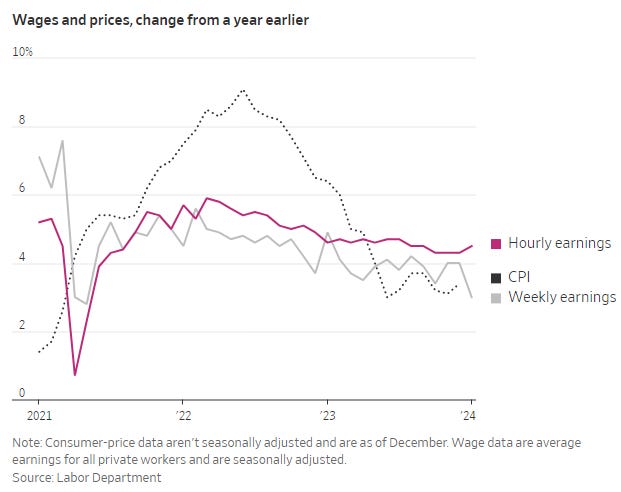

Average hourly earnings for all employees on US private nonfarm payrolls rose by 0.6 percent in January 2024, above market expectations of 0.3 percent. It was the biggest rise since March 2022. Over the past 12 months, average hourly earnings have increased by 4.5 percent.

On the other hand, hours worked dropped a lot. The 12-month rate slowed to 4.7% in Jan from 5.9% in Dec

The unemployment rate held steady at 3.7%

Tech earnings highlights:

Meta’s stock traded 15% higher post earnings as its revenue guidance for Q1 came in clearly above analysts’ expectations, and the company announced additional share buybacks and its first ever dividend.

Amazon gained 7%, also posting a strong profit outlook for Q1. This is despite its sales guidance for Q1 actually coming in a touch below estimates, and investors appeared to reward both companies for their cost control efforts.

Apple’s shares were down close to 3% in after-hours trading, with a deepening sales slump in China taking the shine off what was otherwise a modest beat.

Other news:

US job growth surges in January; wages rise (RTRS)

The way you search the internet may soon change, thanks to AI (NYT)

US auto safety agency upgrades probe into Tesla power steering loss (RTRS)

$560Bn Property Warning Hits Banks From NY to Tokyo (BBG)

Bank of England Keeps Rates Steady Just Like the Fed (MSN)

US Plans for strikes on Iranian facilities in Iraq, Syria approved (CBS)

Tags of the times in CRE? (NYP)

Eurozone inflation slows to 2.8% in January (FT)

Risky Borrowers Storm Loan Market for Once ‘Unthinkable’ Savings (BBG)

Red Sea crisis pushes up delivery times for European manufacturers (FT)

One of America’s Hottest Commodities Is Probably in Your Trash (WSJ)

Fed Chair Powell just taped a 60 Minutes segment on inflation and monetary policy that will air on Sunday (BBG)

US crude oil production jumps to a record high 13.3mln/bpd (Yahoo)

Could Japan's lost decades happen in the US? (WSJ)

The Fed won’t be rushed (FT)