FAQs on FOMC

Created using ChatGPT

What is the FOMC and why does it matter?

The FOMC (Federal Open Market Committee) is the monetary policy-making body of the Federal Reserve System, the central banking system of the United States. The FOMC is responsible for setting the direction of monetary policy by determining the appropriate level of interest rates and the size and composition of the Fed's balance sheet.

The FOMC consists of 12 voting members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Reserve Bank presidents. The chair of the Board of Governors serves as the chair of the FOMC.

The FOMC matters because its decisions have a significant impact on the U.S. economy and financial markets. The FOMC's decisions on interest rates and monetary policy affect the cost and availability of credit, which in turn influence consumer and business spending, investment, and employment. The FOMC also plays a key role in maintaining price stability and controlling inflation.

Financial markets closely monitor the FOMC's statements and actions, as they can signal changes in the direction of monetary policy and influence market expectations about future economic conditions. Therefore, the decisions made by the FOMC have broad implications for investors, businesses, and households, both in the United States and globally.

Why does the FOMC decision matter for the US and global economy?

The decisions made by the FOMC can have significant impacts on both the US and global economy. Here are a few key reasons why:

1. Interest rates: One of the primary tools the FOMC uses to implement monetary policy is by setting the federal funds rate, which is the interest rate that banks charge each other for overnight loans. The federal funds rate is a key benchmark that influences other interest rates throughout the economy, including rates on mortgages, auto loans, credit cards, and other forms of borrowing. Changes in interest rates can have a significant impact on borrowing costs, which in turn can affect consumer and business spending, investment, and ultimately economic growth.

2. Inflation: The FOMC has a dual mandate to promote maximum employment and stable prices, which means it seeks to keep inflation at a moderate level. Inflation can erode the purchasing power of money, so the FOMC carefully monitors inflation and adjusts monetary policy as needed to keep it under control. If the FOMC raises interest rates to combat inflation, it can slow economic growth, while if it keeps rates too low for too long, it can fuel inflation.

3. Financial stability: The FOMC also plays a key role in promoting financial stability by monitoring risks to the financial system and taking action to mitigate them. For example, during the financial crisis of 2008, the FOMC took a number of unconventional steps, including buying large amounts of government bonds and mortgage-backed securities, to help stabilize financial markets and prevent a deeper economic downturn.

4. Global impacts: As the world's largest economy and issuer of the world's primary reserve currency, US monetary policy has a significant impact on global financial markets and economies. Changes in US interest rates can cause capital to flow in or out of other countries, affecting exchange rates and financial conditions. The FOMC also works closely with other central banks around the world to coordinate monetary policy and promote global financial stability.

Overall, the decisions made by the FOMC can have far-reaching impacts on the US and global economy, making it an important institution for policymakers, investors, and businesses to watch closely.

What is the meaning of hawkish and dovish with respect to FOMC decisions? and why does it matter for the financial markets especially stocks?

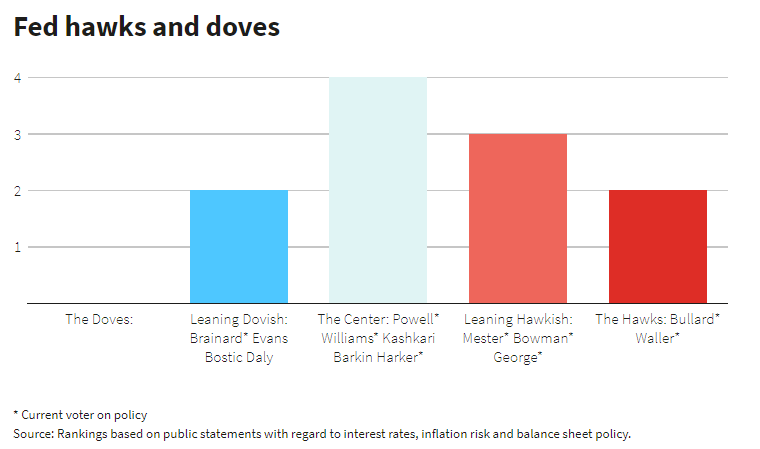

Above chart is created by Reuters

In the context of the FOMC, the terms "hawkish" and "dovish" refer to different policy stances regarding interest rates and monetary policy.

A hawkish stance implies a more aggressive approach to monetary policy, with a focus on controlling inflation and maintaining financial stability, even if that means raising interest rates. Hawkish policymakers tend to favor tighter monetary policy, with higher interest rates, to prevent the economy from overheating and to prevent inflation from rising too much.

On the other hand, a dovish stance implies a more accommodative approach to monetary policy, with a focus on promoting economic growth and employment, even if that means tolerating higher inflation. Dovish policymakers tend to favor looser monetary policy, with lower interest rates, to encourage borrowing and spending and to stimulate economic activity.

The stance of the FOMC, whether hawkish or dovish, can have a significant impact on financial markets, especially stocks. When the FOMC signals a hawkish stance, investors may become concerned that higher interest rates could slow economic growth and reduce corporate earnings, leading to a sell-off in stocks. Conversely, when the FOMC signals a dovish stance, investors may become more optimistic about the economic outlook and bid up stock prices in anticipation of higher growth and earnings.

In addition, the FOMC's policy decisions can also affect the cost of borrowing and the availability of credit, which can impact the profitability of companies and the willingness of consumers to spend. Therefore, the stance of the FOMC and its decisions on interest rates and monetary policy can have significant implications for the financial markets, particularly for stocks, and investors closely monitor its statements and actions.