Double Whammy Sent Risk Assets Lower

Hot CPI report and Poor 30Y Treasury Auction

Equities (S&P 500 -0.62% Nasdaq -0.37%) ended the day lower, reversing earlier gains after a hotter-than-expected CPI report and a poor 30-year Treasury auction which sent yields on longer-dated Treasuries sharply higher.

Takeaways from the CPI report

While the Fed officials most recently indicated that they were comfortable with keeping Fed Fund rates at current levels, today’s inflation report was a fresh reminder that the fight against inflation is not over. Concern is that inflation might settle around 3%, above the Fed’s 2% inflation target Perhaps it gave further fuel to the ‘higher for longer’ narrative, as futures prices continued to show a small chance of a further hike, but also somewhat diminished expectations for the scale of reductions in 2024. The 2Y Treasury bond also climbed back above 5% to 5.07%

CPI report details

The headline reading was stronger than expected at 0.4%MoM (month-over-month) due to higher energy costs.

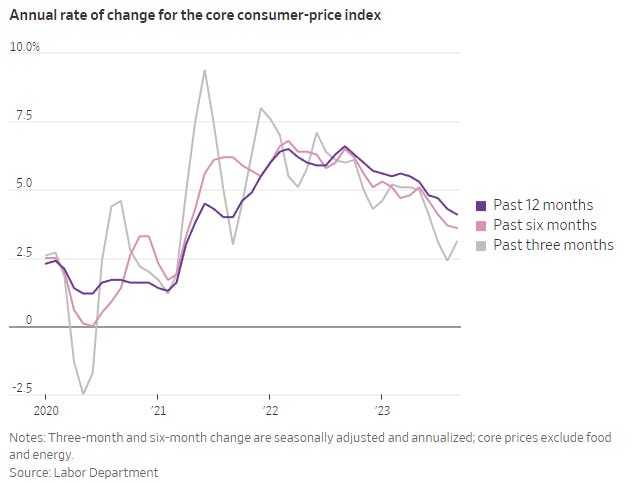

Core CPI inflation (excludes volatile food and energy prices) registered 0.323%MoM in September, above consensus that rounded up to 0.3 %MoM. The bad news is that after a sharp slowdown in core inflation earlier in the summer, those prices rose modestly faster last month.

The biggest surprise in the core was an unexpected acceleration in shelter prices. Direct rents held steady at 0.49%MoM but owner’s equivalent rent (OER) accelerated to 0.56%MoM. The acceleration in owner’s equivalent rent to the strongest monthly reading since February is contrary to Fed and consensus expectations for a steady slowing. House prices that had been declining are now rising at a roughly 10% monthly annualized rate, creating further upside for the category in 2024.

Core goods prices declined 0.39%MoM in part due to a 2.5%MoM decline in used auto prices and a 0.8%MoM decline in apparel prices.

30Y Treasury Bond Auction

Concerns about the supply of Treasuries were back after demand for safe-haven assets receded. The US sold $20 billion of 30-year bonds, but dealers had to take up 18% of the supply, more than the typical share of about 11%, after investors balked. The auction tail, or the gap between the lowest bid price versus the average, was the narrowest since November 2021, according to the Financial Times, representing another sign of waning demand.

The yield on the 30-year Treasury jumped 12 basis points to 4.856% (compared to the pre-Hamas attack of 4.97%), and the 10-year yield surged 10 basis points to 4.7% (compared to the pre-Hamas attack of 4.80%).