Cracks continue to appear

This week's data has been a mixed bag, leaving us with a few clues about what to expect in the future. While earnings have been mostly positive, there's still a lot of caution in the air due to the high valuations and the many companies yet to report. Further, on the macro side, the first week of May contains the Fed's decision and comments, ISM manufacturing and services PMIs, and non-farm payrolls. CPI and the Senior Loan Officer Survey will follow the week after. Therefore, there will be a lot for the market to absorb.

Earnings

Large banks' earnings were good, but regionals are lowering their FY23 NII guidance due to higher deposit costs. Overall, deposits changes were manageable in the quarter. The focus is shifting from solvency/liquidity to earnings/margins, which could be a positive for the economy. However, the impact on financing conditions remains a key question, particularly whether lending to companies and commercial real estate will continue to decrease as in March.

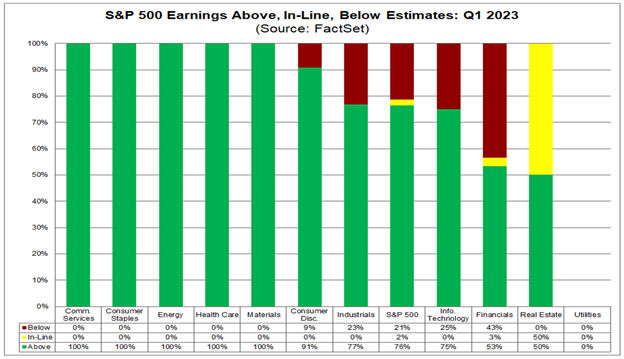

The Q1 2023 earnings season is in full swing, and so far, 18% of the companies in the S&P 500 have reported their actual results. While the majority of companies (76%) have beaten estimates for their earnings per share (EPS), this figure is slightly below the 5-year average, but still above the 10-year average. However, the surprise factor - how much they are exceeding expectations - is 5.8%, which is lower than both the 5-year and 10-year averages. It's important to note that, despite these results, Factset reports that the index is still experiencing the largest year-over-year decline in earnings since Q2 2020. It's an intriguing time for investors, as they weigh up the positives and negatives of these mixed results.

During the upcoming week, 180 S&P 500 companies (including 14 Dow 30 components) are scheduled to report results for the first quarter.

Economic data

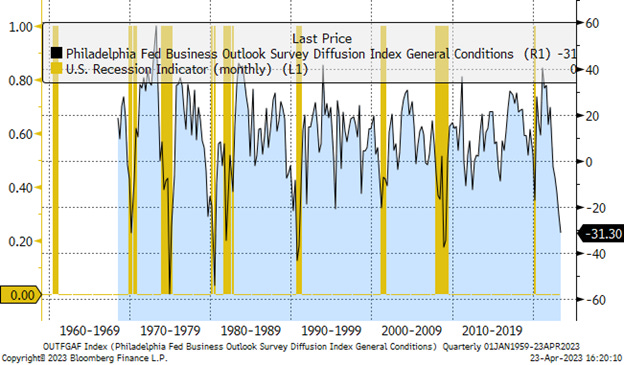

The most recent macro data continue to point to significant economic weakness, especially on the manufacturing side. The Fed's Beige Book indicated that some regional Feds are seeing banks tightening lending conditions and have concerns about liquidity and growth. Some of the regional Fed company surveys were quite negative as well. In particular, the Philly Fed, which is generally one of the better bellwethers for ISMs, indicated a recession-like level of contraction in the business outlook at -31.3 (compared with -36.6 just before the 2001 recession, -40.9 at the worst time during the GFC, and -8.9 during the 2015-16 commodities sell-off).

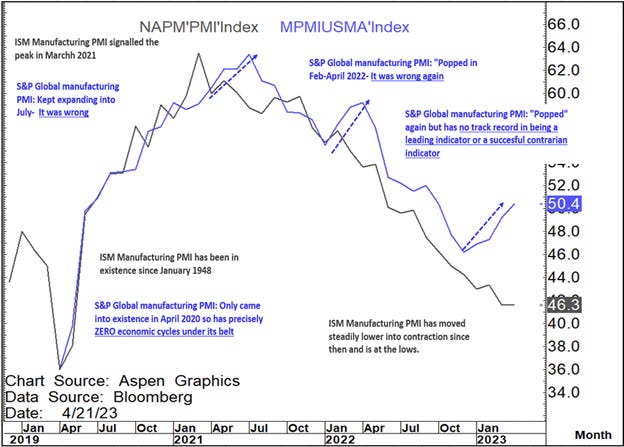

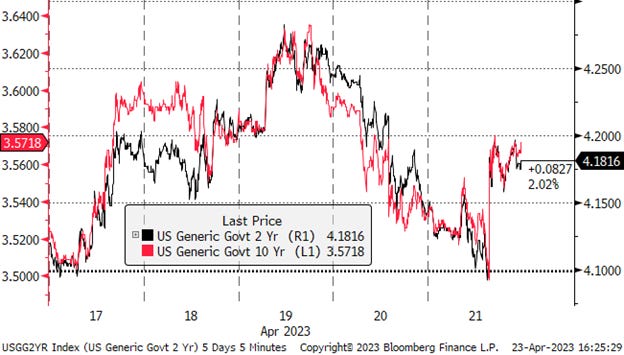

On the other hand, the S&P Global US Manufacturing PMI surprised the market as Manufacturing is back in expansion territory, printing 50.4 vs 49.0 consensus forecasts. The details of the report point to broad-based growth and momentum, dispelling recessionary concerns following Philly on Thursday. However, most economists don’t consider S&P PMIs as a good gauge as it doesn’t do a good job of tracking more respected ISM gauge. See the below chart for a few examples where S&P PMIs were wrong. Nevertheless, the yields on the 2y and 10y bonds spiked higher in response to this data, possibly due to lower market participation on Friday and/or trades by machines (dare I say AI).

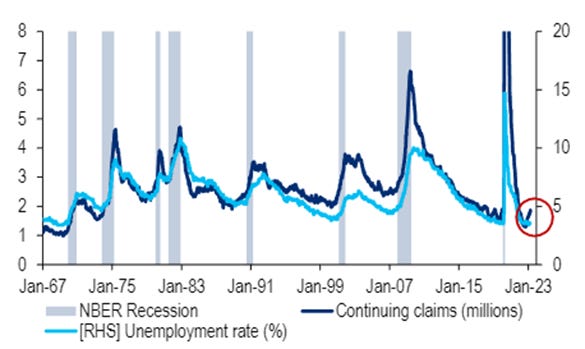

This week's biggest market move was on Thursday, driven by higher jobless claims and continuing claims, causing a rally in the 2-year and 10-year rates by 10bp and 6bp, respectively. The Philly Fed's Business Outlook also came in lower than expected. The market is sensitive to labor market signals in predicting when the economic cycle will change. Unemployment insurance claims are a key macro variable in determining the probability of a recession. In recent months, continuing claims have increased, but unemployment has remained steady, which is worth keeping an eye on.

Finally, the Leading Economic Indicator (LEI) contracted 1.2% m/m and 7.8% y/y; such large drops have occurred only during recessions in the past sixty years.

Fed speak

The Fed officials have taken solace that the banking sector concerns have faded. Attention is rapidly returning to macroeconomic data that shows underlying inflation well-above target. A Fed rate hike May 3rd is very likely and priced by markets. However, the Fed officials and investors will now look for signs that tighter credit conditions will lead to a slowdown in growth, which could lead the Fed to pause their rate hiking cycle. Interestingly, Fed mouthpiece, Nick Timiraos of the WSJ, just released an article on the banking mess, which is worth a read. Why the Banking Mess Isn’t Over

This week, New York Fed President John Williams said that “Inflation is still too high, and we will use our monetary policy tools to restore price stability.” Mr. Williams, a close ally of Fed Chair Jerome Powell, said stresses in the banking system had stabilized, but he said he anticipated they would lead to tighter lending standards for households and businesses, which would in turn reduce consumer spending. He said it was too soon to judge the magnitude and duration of any such tightening.

Turning to the debt ceiling, most investors now expect a temporary deal given increasing risks for a mid-June X-date. A temporary deal would give Treasury funding through September/October.

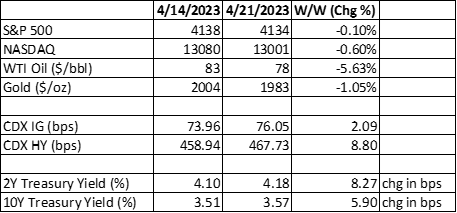

Market reaction

Risk assets are discounting the negative macro updates. Credit and equities are not particularly worried about the negative macro data. However, the drop in oil prices clearly reflect the growth concerns despite recent OPEC+ production cuts.

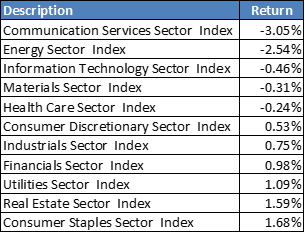

Breakdown of S&P 500 sector performance

Earnings next week