Cautious Optimism Going into CPI

Heading into the crucial CPI release, the market is cautiously optimistic (as stocks are back to highs) about the potential return of disinflationary data, which could support the "Goldilocks" narrative and push stocks even higher. Meanwhile, the resurgence of meme stocks ahead of the upcoming data, with GME 0.00%↑ soaring 60% in 2 days following the return of RoaringKitty to Twitter (now X) is a sign that froth is approaching dangerous levels.

Quick Check on Markets

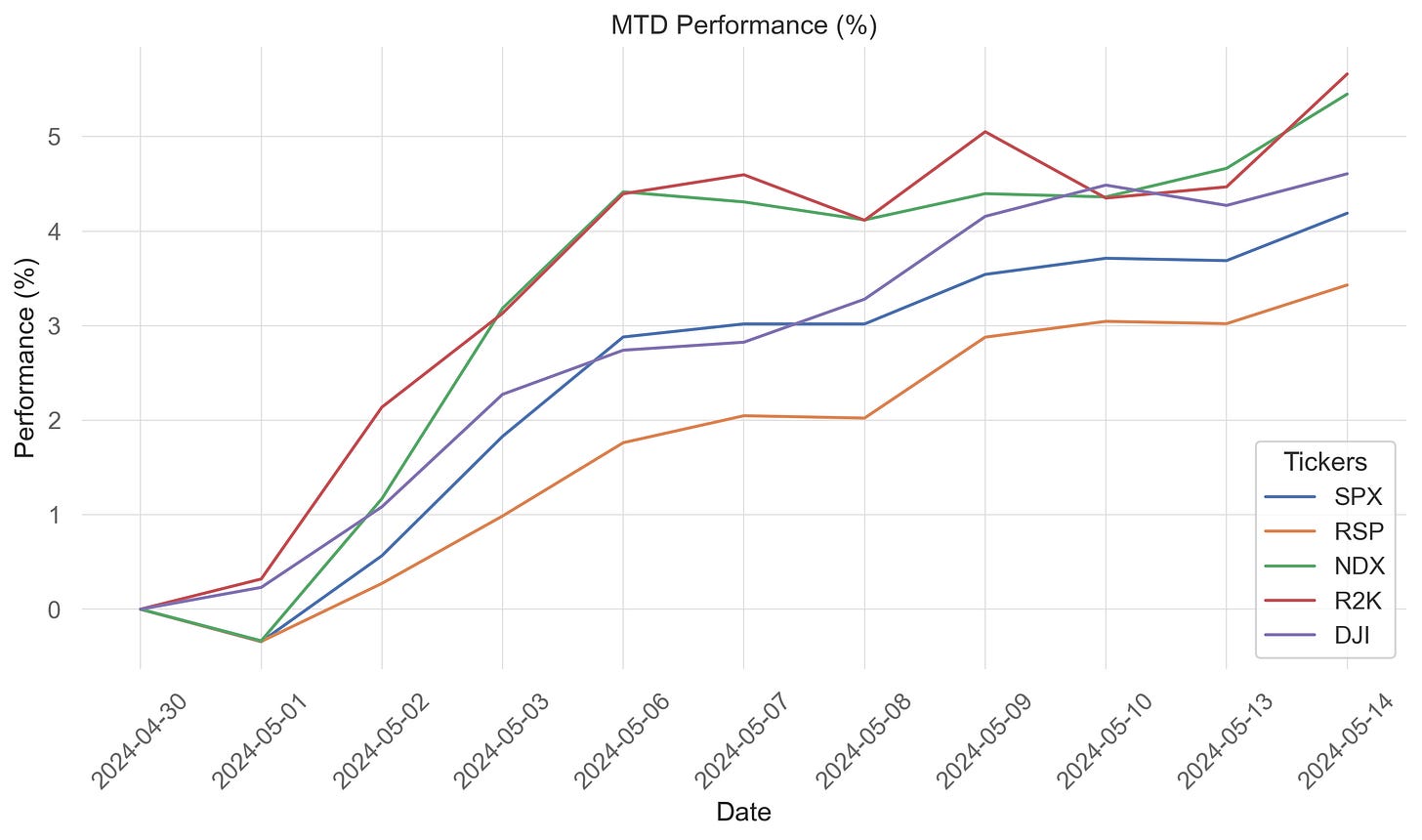

As of May 14th close, the Russell 2000 continued its recent outperformance, gaining 1.2% today. It is the best performing index this month, up 5.7% so far.

Sector performance

The utilities sector, usually considered as a defensive sector, has outperformed over the past 30 days amid volatility in the broader market. This strong performance is also bolstered by the increasing power demands from AI applications. It remains to be seen if a rally in Treasuries, prompted by a potential softer CPI print, will lead to further outperformance in utilities or if investors will shift their focus to cyclical sectors.

For the year, the NASDAQ index is back at the highs, while the S&P 500 index is within 10pts of its all-time high close.

Treasury yields have been range bound since the post-NFP rally, however, they digested today’s PPI data well as yields were lower by 3-4.5bps.

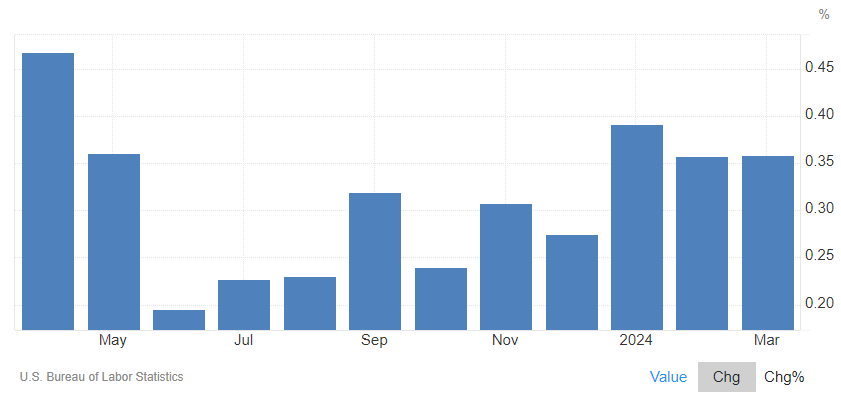

Dissecting PPI

Although the PPI came in hotter than expected, with the Core print at 0.4%, investors were relieved after digging into the components. Given the Fed cares about the Core PCE, the specific components which are picked from PPI include:

Portfolio management fees surged by 3.9%, partly catching up from previous lows and likely to reverse in May.

Physician services showed a modest increase of 0.2% with upward revisions for the previous month.

Airfares were revised lower and fell further in April.

Note that Fed Chair, Powell, spoke today after the PPI release and his comments were perceived dovish – his personal forecast is that the disinflationary process will resume (due in large part to the fact that rent as calculated in the CPI/PCE is artificially inflated) while the odds of another rate hike are low. On labor, Powell noted that demand for workers is cooling off “pretty substantially” while wage growth eases.

CPI Preview

After three months of stronger core-CPI increases, rounding to 0.4%, the street is forecasting a modest slowing to 0.3% increase in April. From a markets perspective, the odds for a cut in September stand at 80%, so an inline or a softer CPI print can further increase the odds. Given April is essentially the last inflation data before the June FOMC meeting, the modest slowing in April alone will not increase the chance of a cut in June FOMC, but the Fed might be able to push back on keeping policy rates restrictive for longer given the softness in growth.