Buckle up

ISM, FOMC, NFP and key Tech sector earnings ahead

The pain trade this week was an upside in S&P 500 index driven once again by Megacap tech stocks. The S&P 500 grinded lower till Wednesday before roaring back to close 0.9% higher, while NASDAQ outperformed with a gain of 1.9%. Tech leadership has masked the issues we are seeing in the underlying economy and the problems in the banking sector, as evidenced by a 75% fall in First Republic Bank’s stock price.

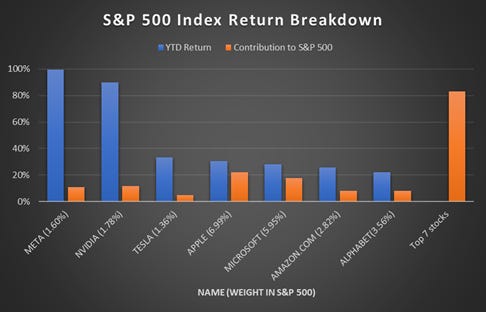

When I drilled down to see what’s holding the S&P index, it was surprising to see that SEVEN stocks are responsible for 83% of the S&P 500’s YTD 9% return. This means that the primary barometer, the “S&P 500 index” used as the health of corporate America and cited by presidents as a measure of their handling of the economy — often comes down to just seven companies.

Yes, we did see better-than-expected or “feared” earnings from most of the tech companies, but I would say the earnings quality was not something to get too excited about.

Facebook parent company, Meta Platforms Inc., reported a 3% increase in revenue for the first quarter of 2023, amounting to $28.6 billion, exceeding analysts' expectations. This is the first increase in sales in almost a year, and it's attributed to the company's efforts to improve its advertising business while cutting down spending. The company's investment in artificial intelligence tools to enhance its ad-targeting systems seems to be working but ad prices have also declined by an average of 17% last quarter, compared to an 8% decrease in the same quarter last year. The company also reported a net profit of $5.7 billion, a 24% decline from last year but an improvement from the previous quarter.

Other tech companies (AMZN, Google parent Alphabet and Intel) signaled to investors in recent days that the brutal slowdown in sales growth that began as people emerged from the pandemic and re-engaged with daily routines was coming to an end. On the other hand, we are continuing to see a slowdown in cloud computing growth. Microsoft Corp. on Tuesday reported 27% growth for its cloud business, down from about 50% during the pandemic. Amazon also posted record-low sales growth for the cloud business in the first quarter at 16%, though managed to do better than what Wall Street had been bracing for. Google eked out an operating profit for its cloud business for the first time, after shifting some costs elsewhere in the company.

“There’s uncertainty in the economic environment,” said Ruth Porat, Alphabet’s chief financial officer. “We saw some headwind from slower growth of consumption with customers really looking to optimize their costs.”

Intel posted a record quarterly loss after sales fell to 2010 levels. But the stock price jumped after the company issued an outlook slightly ahead of Wall Street forecasts. Chief Executive Pat Gelsinger said the company is “seeing some green shoots in the marketplace” and spoke of a sales recovery in the second half of the year.

We will get more data on tech earnings next week from Apple, AMD, and Qualcomm.

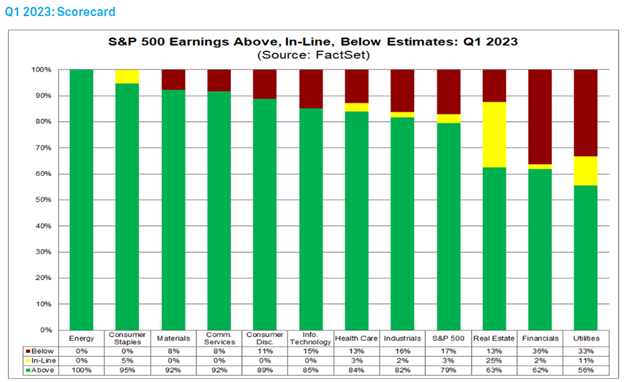

Overall, as per FactSet, at the mid-point of the Q1 2023 earnings season, companies are beating analyst expectations, however, the S&P 500 index is still reporting a year-over-year decline in earnings for the second straight quarter.

Key events for next week:

1. What happens with First Republic bank?

As we go to print, various news outlets have reported that JPM and PNC have submitted bids for First Republic bank to the FDIC, which is preparing to seize and sell the troubled lender. With some $233 billion in assets at the end of the first quarter, it would be the second-largest bank to fail in U.S. history. As per its latest earnings report, First Republic lost over $100B of deposits excluding the $30B it received from large banks. The high cost of its borrowings relative to its earning assets puts it under-water and is unable to offer high deposit rates to its clients.

Bank’s strategy is in question as First Republic became a go-to bank for high-net-worth individuals and their related businesses due to high-quality customer service, but also low-rate loans to get the depositors in the door. The primary strategy was to provide below market rate jumbo non-conforming mortgages with a request to the borrower that they bring in and maintain a portion of the loan value in the form of deposits. This created a higher-than-normal level of uninsured deposits and with no real agreement to maintain the deposits, which led to the bank run (spurred on by failed competitors). Going forward, we see the strategy as unclear and the execution risk of bringing in more insured depositors as tricky and expensive (typically online banks are raising deposits by paying high rates).

2. ISM Manufacturing, New Orders on May 1st and ISM Services on May 3rd

I suggest reading Brent Donnelly’s Friday speedrun to learn more about these surveys. In a nutshell these surveys tell us about outlook on manufacturing and service industries. These surveys typically precede the hard data (such as GDP and jobs reports) which give us a clear indication of a slowdown and/or a recession.

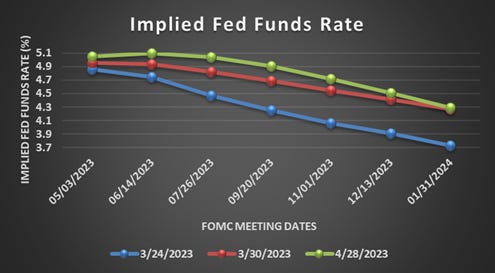

3. Fed decision on May 3rd

A 25bp hike is priced in the market for the May meeting, but the market is pricing just 21% odds of a June hike and 23% of a cut in July. Pausing on fears of credit driven slowdown is likely to elicit a positive response from the market. However, if the Fed tries to keep a hike in play for June (data dependent) it would read negative for stocks. Since there will be no SEP (summary of economic projections) this meeting, FOMC commentary on credit contraction, growth risks, and Powell’s presser will be key.

4. RBA on May 2nd, ECB on May 4th and BOJ minutes on May 7th

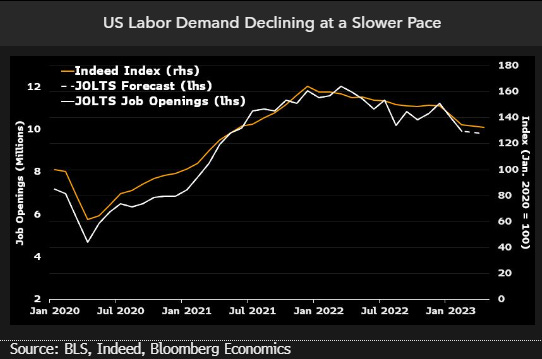

5. JOLTS Job Openings on May 2nd, ADP employment change on May 3rd, Jobless claims on May 4th and Non-farm payrolls (NFP) on May 5th

JOLTS would tell us more about the tightness of labor market as we will get data on number of job openings. If the job market remains hot, the Fed must pour more cold water on it to cool it down. This is accomplished by hiking interest rates that burden businesses financially. In response, companies cut costs and lay off employees. This is why there have been unrelenting layoff announcements since the Fed implemented this strategy.

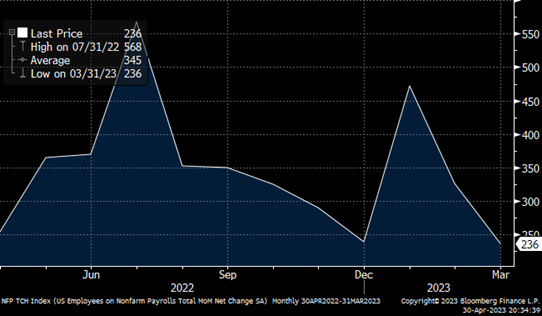

NFP is expected to print 180k, but a read below 100k would be negative for the market. Average Hourly Earnings is expected at 0.3%, while headline UE rate is expected at 3.6%.

6. Earnings - 23% of S&P 500 market reporting including 40% of Tech