Bad news on data = Bad news for Markets

Perhaps a recession is "6 months away" as always

Tuesday’s price action reflected US growth concerns after US JOLTS and other data disappointed. The US equities sold off, as clients rotated into US Treasuries, gold, and other safe-havens, like CHF, JPY. USD correctively underperformed G10 FX.

US equity weakness was broad Tuesday, with SPX and Nasdaq Composite equally down -0.5% to -0.6% by NY close. US 2y yield approached 3.80%, driving similar downside across the nominal curve, while real yield downside was fueled by 10y real yield's break through 200d MA. Gold spot broke the $2,000 mark Tuesday in NY, with supportive flows and levels fueling upside. Few strategists on the street think that further upside is possible on broader sentiment, even at current levels.

As this note goes to print, the 2y has dropped to 3.76% this morning after ADP jobs miss.

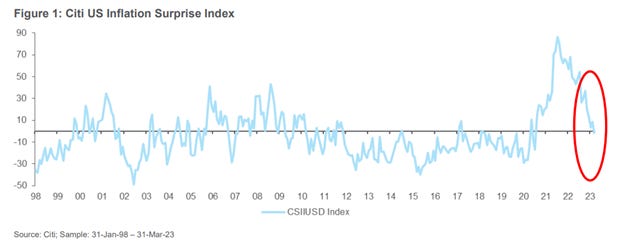

Interestingly, for the first time since August 2020, Citi’s US Inflation Surprise Index has gone into negative territory, meaning that inflation prints in the US are coming in below expectations on average. This follows the index reaching an all-time high in July 2021 and ends the longest period of upside inflation surprises, as measured by Citi’s index going back to 1998.

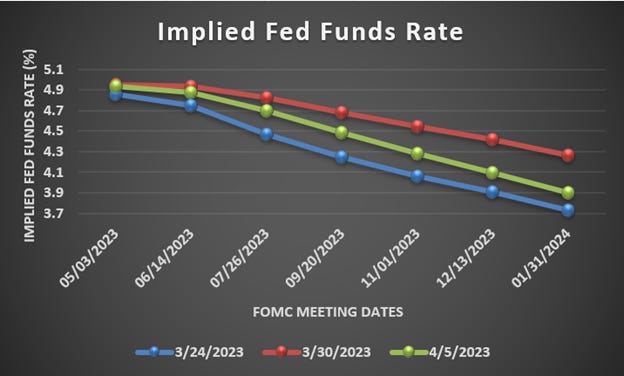

Perhaps, market is right in pricing rate cuts despite Fed pushing its message that they intend to keep Fed fund rates in restrictive territory for a long time. Fed’s Mester was the latest speaker to reiterate this message. Fed's Mester(NV): Despite cooling economy, the Fed needs to get policy rates above 5% and the real fed funds rate needs to stay positive "for some time."

Focus on incoming US data to gage US recession risk, which will be a significant driver of US equities ahead. US ISM services on Wednesday and US payrolls on Friday are top of mind. Visit Tradeconomics for a more detailed calendar

Interesting articles:

After taking in a flood of capital during the pandemic, the warehouse sector is showing signs of trouble MSN

Traders rush to cover options exposures amid 'peak' Fed uncertainty BBG

New Zealand's RBNZ hiked by 50bp (25bp expected) to 5.25% to fight 'stubborn' inflation despite signs the economy could be on the cusp of a recession NIKKEI

RBA's Lowe said yesterday's announced policy pause doesn't imply that hikes are over Reuters

Risky AT1 bonds rebound from plunge after Credit Suisse wipeout: FT