Assessing the Current State of the Market: Inflation, Recession Fears, and Credit Crunch

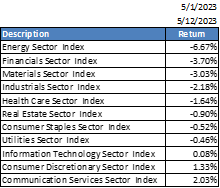

The market continues to go through an uncertain and conflicting period. The macro forces - inflation, Fed policy, recession fears, banking crisis, and debt ceiling drama are driving the price action. The S&P 500 has been range-bound. Under the hood, we see investors adding exposure to mega-cap tech while derisking in the cyclicals.

This price action suggests a possible recession is on the horizon, which would lead the Fed policy to pivot towards an easing (rate cuts). However, recent data has made me question whether we are too complacent in pricing that scenario.

Inflation

Three recent reports on inflation have been released, and two of them did show declining inflation.

CPI report

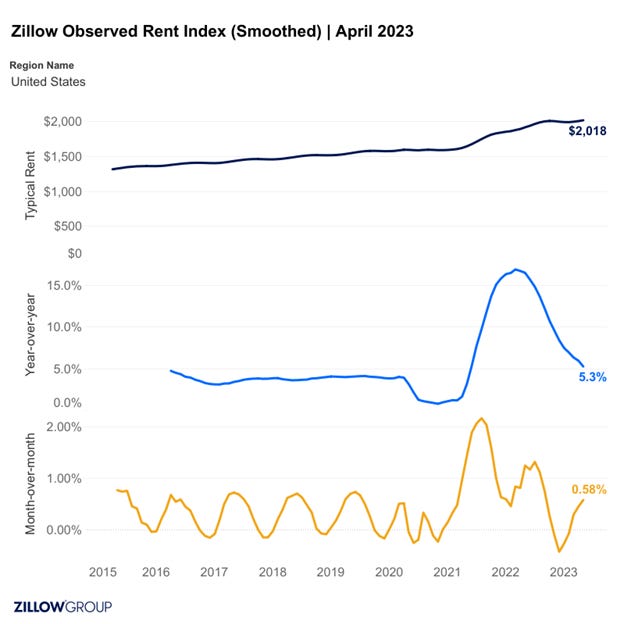

Let's start with the CPI report. The headline CPI rose 0.4% MoM and moderated to 4.9% from a year earlier, down from March's 5% increase. However, the Fed and the markets care more about the so-called core prices, which exclude volatile food and energy items, as it is more sticky and hard to stamp out. This measure rose 5.5% from a year earlier, a slightly slower increase than in March of 5.6%. Core prices remain elevated due to persistently strong shelter costs driven by mortgage and rental contracts, which are expected to slow their ascent in official inflation data (because it lags) in the coming months. So if we exclude the shelter costs, we do see a decline, which is potentially good news.

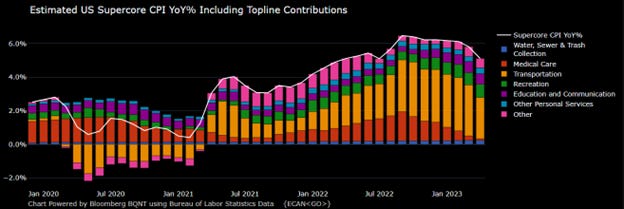

In fact, the measured rents have slowed to 0.5% from 0.6-0.8% MoM and are expected to slow further, but it is not all that comforting when we look at high-frequency data on the housing front. Zillow rents have been picking up recently, and in fact, when I check with some local friends in NY/NJ they have been telling me about bidding wars on rentals!

PPI Report

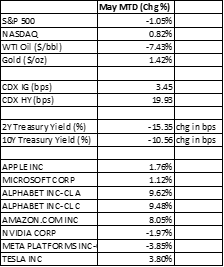

PPI (producer price index) was also released this week, and it covers a wide range of prices, not just those faced by consumers, and has been softening as supply disruptions correct and commodity prices fall. While easing in prices for input goods and various services like freight transportation can help imply moderation in consumer prices, for now we are most focused on the elements in PPI data that have immediate consequences for the Fed’s preferred core PCE inflation. Portfolio management fees and medical services were both strong, which is concerning from Fed’s perspective as these carry a material weight on the index. Note that medical services prices are sensitive to trends in wages, with substantial increases in labor costs over the last few years likely to take some time to feed through to higher prices.

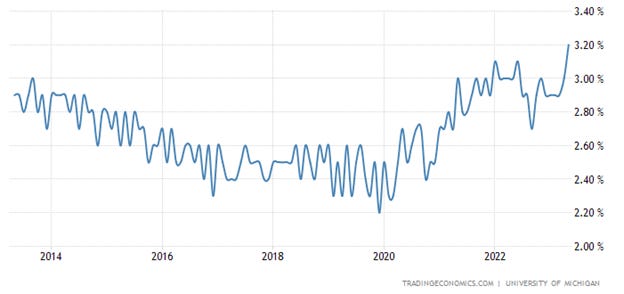

Preliminary University of Michigan survey

Although the preliminary data from this survey is known to be volatile, and we should wait for the final survey results on May 26th, the survey was bad news for the Fed. Inflation expectations were extremely strong in May, with 5-10y expectations now the highest in 12 years at 3.2% vs consensus forecasts of a 2.9% print. This wouldn't be so worrying if consumer sentiment wasn't dropping too. Expectations have dropped from 60.5 to 53.4 vs consensus forecasts for 60.8. The index has become quite volatile, but we are surprised by the scale of the decline.

It's worth noting that Fed Chair Powell, specifically called this survey out in June 2022 when the FOMC decided to raise rates by 75bps, even though the central bank was planning a 50bp hike just a week earlier than the data release. The preliminary release for May 2022 — came out just five days before the June 2022 Fed decision and showed that respondents expected prices to increase 3.3% over the next five to 10 years, the most since 2008. At his post-decision press conference, Powell said it was critical that inflation expectations remain anchored. As he put it:

“If we even see a couple of indicators [of inflation expectations] that bring that into question, we take that very seriously. We do not take this for granted. We take it very seriously. So the preliminary Michigan reading, it’s a preliminary reading, it might be revised. Nevertheless, it was quite eye catching and we noticed that.”

Inflation expectations are self-fulfilling prophecies, and Powell is understandably concerned about them. If they rise further, workers could theoretically demand raises to offset inflationary concerns; companies could raise the prices of manufactured goods to offset higher labor costs; and the entire economy could enter a self-perpetuating inflationary spiral that may be hard to break.

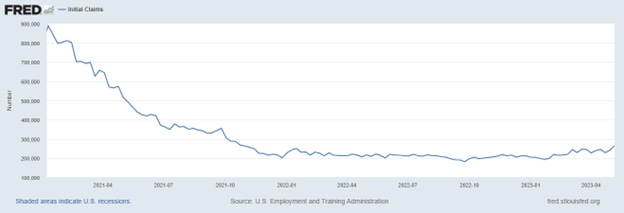

Recession fears

Market participants are actively watching the US labor markets as it is extremely tight and Fed’s policies are engineered to slow the growth of the economy, which in turn will lead to a weaker job market. To that end, most economists monitor the weekly jobless claims to see if its trending higher. After averaging around 211k from Feb 2022 to Feb 2023, we have seen an average of 245k from March till May. This is concerning from a growth perspective, especially after we printed 264k last week. This concern was somewhat alleviated after it was revealed that the increase was due to fraud. Much of the increase in non-seasonally adjusted initial claims during the week of May 6th (+14k) was due to a pickup in initial claims in Massachusetts (+6.4k). Assuming these fraudulent claims are cleaned from the data, we expect initial claims to stay within the 200k-230k range for at least a few more months during the strong summer hiring season.

Credit crunch

After the regional banking failures in the US, most market participants and the Fed were worried about the credit crunch which would accelerate the slowdown in the economy. As mentioned in my previous post, a one standard deviation tightening of Commercial & Industrial bank lending conditions was approximately equal to two to three 25bp rate hikes after accounting for spillovers to broader financial conditions. FWIW, to our relief the Senior Loan Officer Opinion Survey (SLOOS) as well as the NFIB small business survey data showed lending standards and credit availability continued to tighten in April, but at rates relatively similar to those that prevailed before the recent round of bank stress. The absence of a sharp “credit crunch” probably gives the Fed a go ahead to keep monetary policy tight.

Banking crisis

Post First Republic failure, the market seems to be focused on the PacWest as the stock continued to selloff, most recently after the company said its deposits dropped 9.5% during the week ended May 5. The lender said most of the decline occurred in the wake of news reports that PacWest was exploring a range of options, including a sale.

The administration and the Fed continue to push the narrative that the US banking system is sound and resilient. Perhaps the only way to contain this issue is for Congress to raise the FDIC’s deposit-insurance limits or even fully insure all deposits. The FDIC cited one option in a May 1 report—significantly increasing deposit insurance coverage to business payment accounts—as “the most promising option to improve financial stability.” Such a move would include the possibility that some account types receive unlimited coverage, while others don’t.

The FDIC said unlimited coverage for all accounts provides the clearest solution to bank runs, but “would remove depositor discipline and may induce excessive risk-taking by banks.”

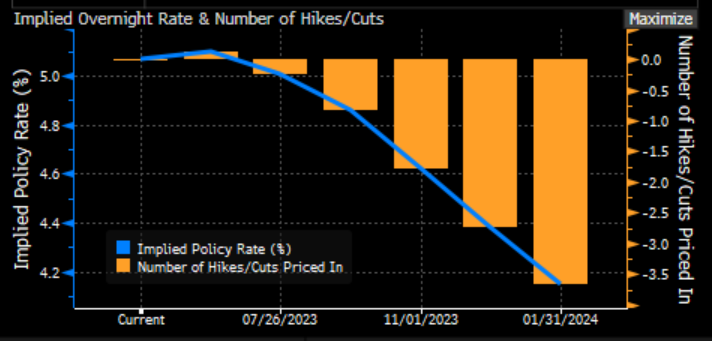

Fed pricing

Taking all of the above into consideration, where does this leave us with Fed funds pricing? Well the market is pricing a 13% chance of a 25bp hike during their next meeting on June 14th. However, it still expects the Fed to cut rates to ~4.38% from current upper bound of 5.25% by end of the year.

Debt ceiling crisis

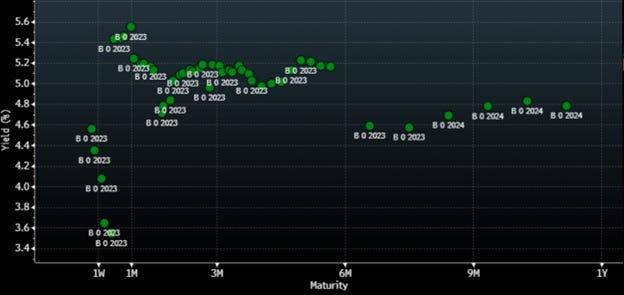

The Congressional Budget Office said Friday that the U.S. government faces a significant risk that it will be unable to pay all of its bills in the first two weeks of June unless the debt ceiling is increased, a projection largely in line with the latest estimate from Treasury Secretary Janet Yellen.

Equity markets seem to be unfazed by the above, as it probably expects the situation to be resolved as it has always in the past. However, looking at the US 1Year CDS contract there is a non-zero chance that the US might default on its debt obligations.

The Treasury bill market is also reflecting this risk with Treasury bills maturing in middle of June yielding higher than the ones in May.

The day the United States runs out of cash is known as the X-date. Note that the volatility could keep increasing in the markets as we get closer to the X date without a resolution. The uncertainty and heightened market concerns around the negotiations could also raise credit risks. This could possibly mean a non-zero chance of another downgrade of America’s credit rating. More on this in another post, but at the time of writing, media reports indicate that President Joe Biden, House Speaker Kevin McCarthy and other congressional leaders are planning to meet Tuesday to discuss budget negotiations to avoid a default.